Lululemon (LULU) As we prepped this chart for send today […]

Can GameStop Regain Its Social Media Buzz?

GameStop was the darling of the meme stock rally, hitting a high of $483 per share in January 2021…

But with the meme frenzy under the spotlight of the U.S. Department of Justice (DOJ), which is investigating short-selling practices, is GME still the talk of the town…or social media, more specifically?

Well, according to a recent article from TheStreet, they seem to think so.

But what does LikeFolio data tell us?

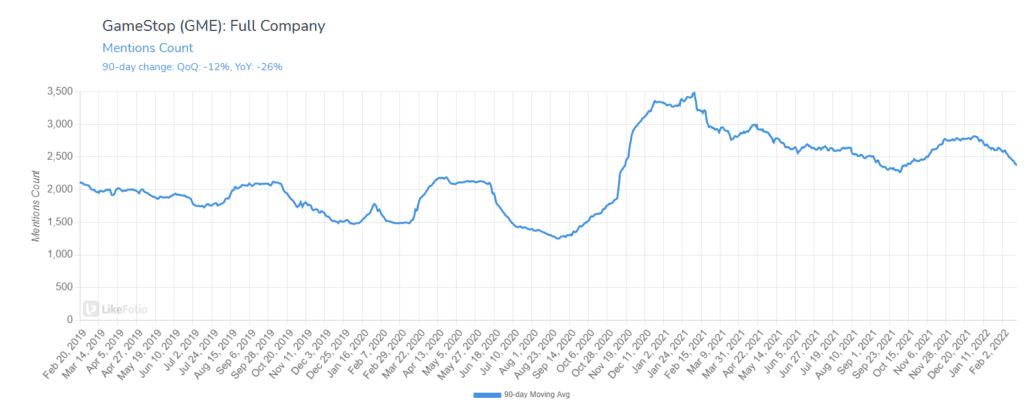

Firstly, the number of GameStop mentions has consistently fallen since the rally in late 2020/early 2021.

As you can see, despite another move slightly higher in Q4 last year, mentions for GameStop are back on the slide, trending -12% QoQ and -26% YoY.

The company has been trying hard to capitalize on the meme stock rally…

Reports emerged in early January that GameStop is launching a division to develop a marketplace for non-fungible tokens and establish cryptocurrency partnerships. Soon after, GME confirmed a partnership with Immutable X for an NFT marketplace.

But that didn’t result in a mentions spike...

However, its shares initially rose on the news before quickly turning around. However, it quickly got back in tune with mentions data and is now down 18% in 2022.

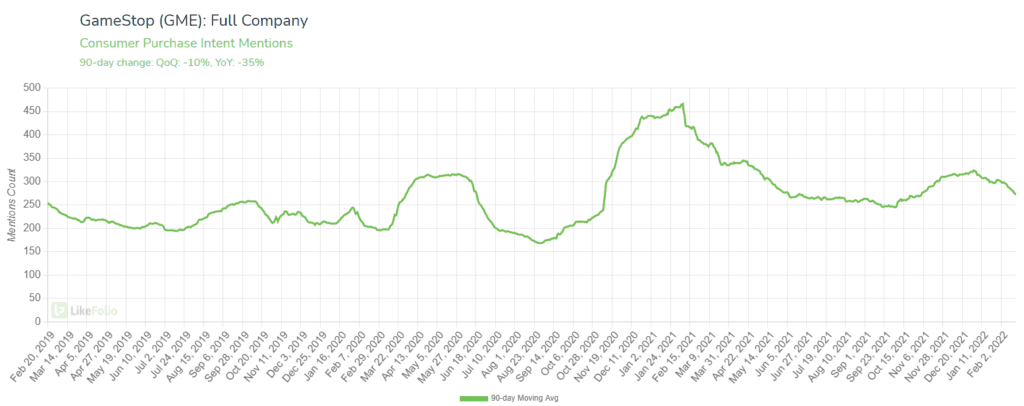

So what about GME Purchase Intent mentions?

They too have declined, trending -10% QoQ and -24% YoY.

While moving into the NFT space may make sense for the company in the long term, GameStop is currently struggling to attract anything like the previous buzz it had.

However, while it may never reach those same heights again, it is still one to keep an eye on be over the course of this year.