Modelo, Corona Hard Seltzer driving $STZ Demand Last quarter, Constellation […]

Can Mexican Beer Keep Constellation Brands (STZ) Afloat?

Constellation Brands (STZ) is slated to report earnings this week.

Here's what LikeFolio data says, and how we are approaching…

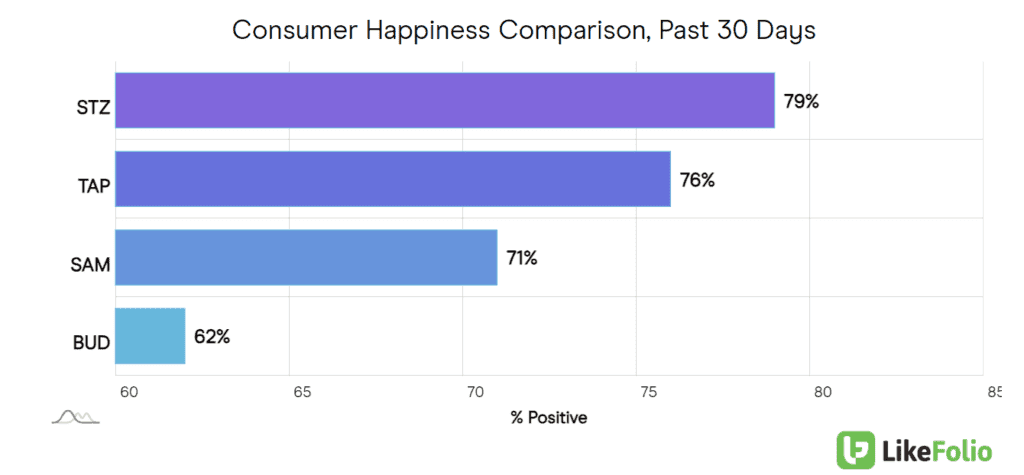

- STZ Happiness remains highest vs. peers at 79% positive, +10% YoY and our best long-term lens for future growth.

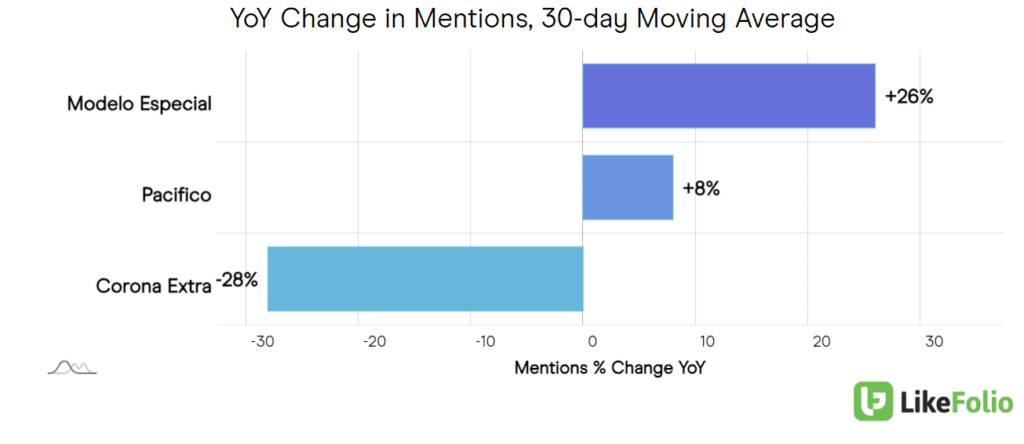

- It's dark horse is still the fastest: Modelo buzz up +26% YoY even though it already secured the top spot in the US last year. Mexican beers are on the rise as the Hispanic population grows and companies target a wider demographic who have realized, they are very easy to drink.

- Wild card effect: don't forget the company has a large stake in Canopy Growth (35%), which we featured in a deep dive showcasing the top cannabis stock for investors to watch. This is a nice tertiary play for investors who want to place a more conservative bet on cannabis legalization and ripple effects.

In Q3, the company's strong performance in beers helped to offset weakness in other segments...just like we predicted. The Beer segment at large posted a 4% sales growth, driven by strong demand and notable performance in the Modelo Especial, Corona Extra, Pacifico, and Modelo Chelada brands, leading to an increased fiscal year outlook for sales and operating income. Conversely, the Wine and Spirits segment faced an 8% net sales decline and a downturn in shipments and depletions, despite growth in specific brands and the DTC channel, prompting a downward revision of its fiscal year forecasts due to marketplace challenges.

This quarter we will be watching to see if continued Modelo strength is enough to offset continued near-term weakness in wine and spirits…