Drinker’s tastes and priorities are shifting in a major way. […]

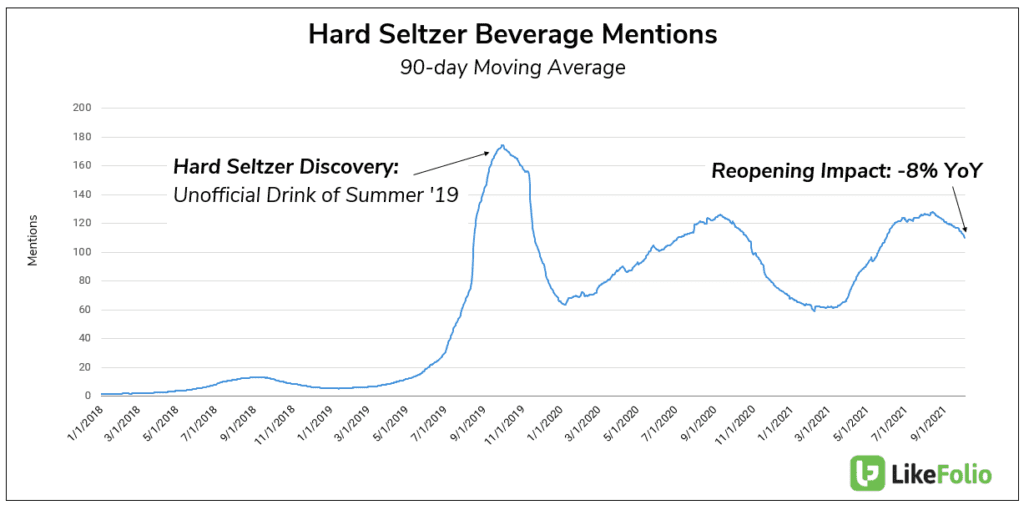

Hard Seltzer Demand is Cooling as Bars Reopen

Hard Seltzer Demand is Cooling as Bars Reopen

An interesting scenario is playing out in the alcoholic beverage industry... As bars stay open, demand for hard seltzer continues to cool.

Demand mentions for "hard seltzers" generically are pacing -8% YoY.

Boston Beer Company (SAM) CEO acknowledged this phenomenon during the company's July release.

Digging into the data, we noticed 2 themes:

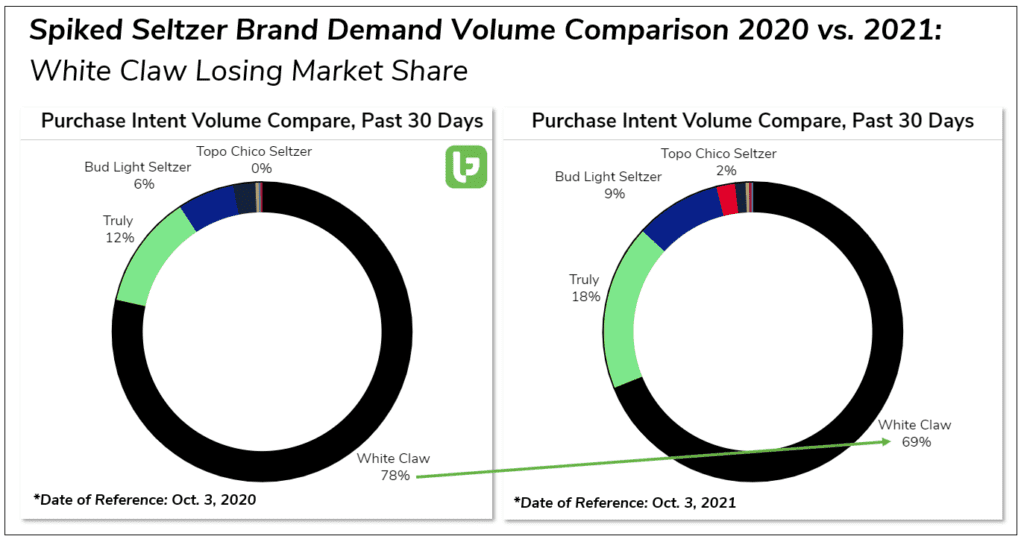

1. The Hard seltzer market is getting crowded. White Claw, the giant in the seltzer segment, is losing market share -- mostly to Truly (SAM) and Bud Light Seltzer (BUD). It's a good sign for both companies to be taking a larger piece of the pie. But the pie's overall growth is stalling significantly.

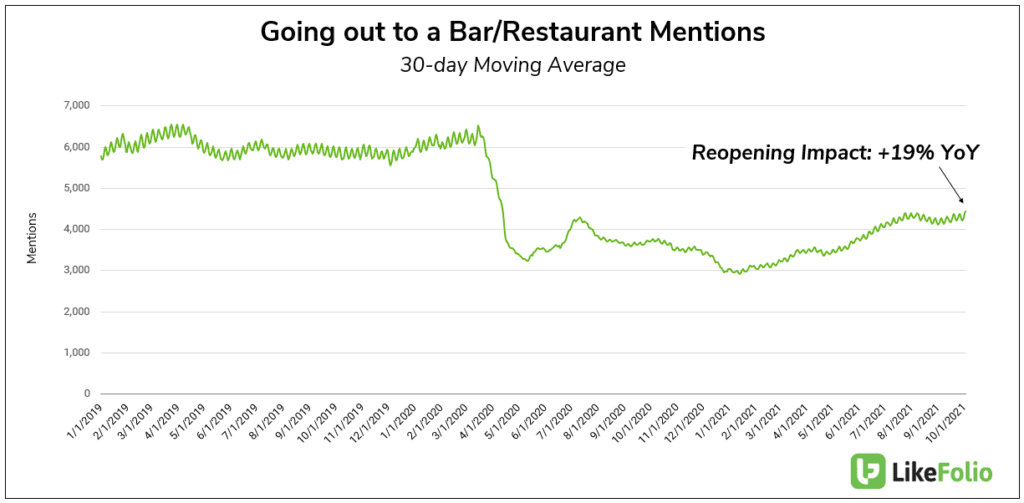

2. Hard seltzer’s weakness is a positive sign of reopening: Fewer people shopping in grocery stores for at-home alcohol consumption is translating to more people in bars ordering draft beer. Great news for beer. Not so great for Seltzers.

LikeFolio data shows the flip-side of this reopening effect in action.

Draft Beer, and "beers on tap" mentions have increased +33% YoY on a 30 day Moving Average.

And consumer mentions of going out to a bar or restaurant have increased +19% YoY in the same time frame.

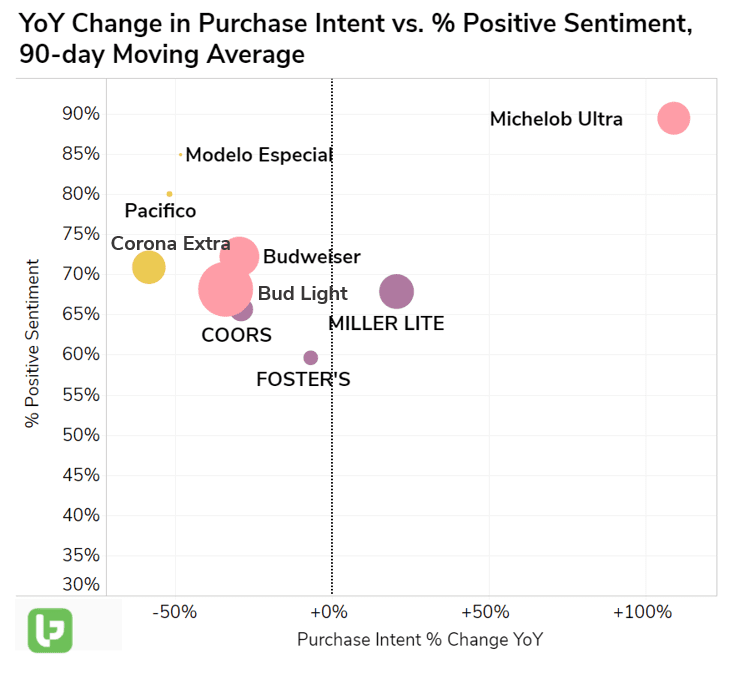

So how do the major names stack up?

While BUD commands mention volume, STZ Happiness remains high, led by strength in its Modelo, Pacifico and Corona Brands.

STZ owns 2/top 3 imported beers in U.S. (Modelo Especial, Corona Extra).

STZ reports 22Q2 Earnings October 6 before the bell.