Travel Update: Airline Earnings It's time for the airline industry to report […]

Delta Bets on Premium Travel

Delta is the first airliner to report Q1 earnings, setting the tone for the segment heading into peak travel season.

What are we watching ahead of the company's first quarter release?

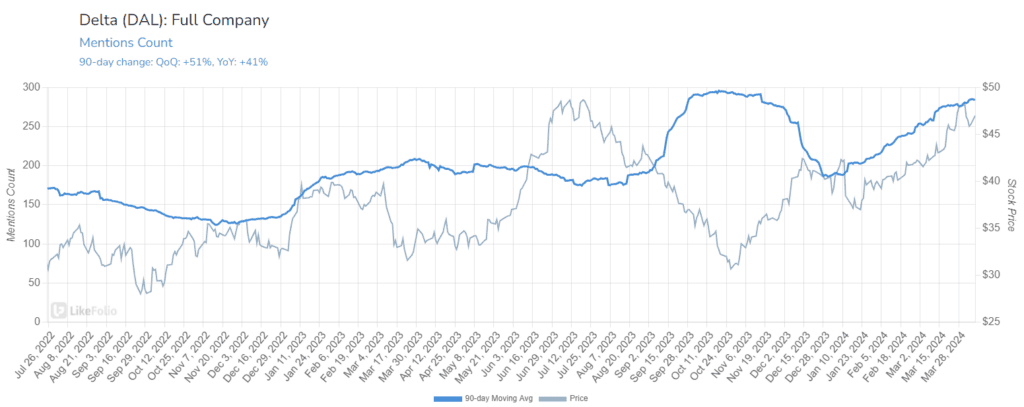

- Delta's mention buzz looks healthy, up by +41% YoY. However, this growth is flattening out, dipping a bit when you look at a 30-day Moving Average. This could translate to another guidance warning.

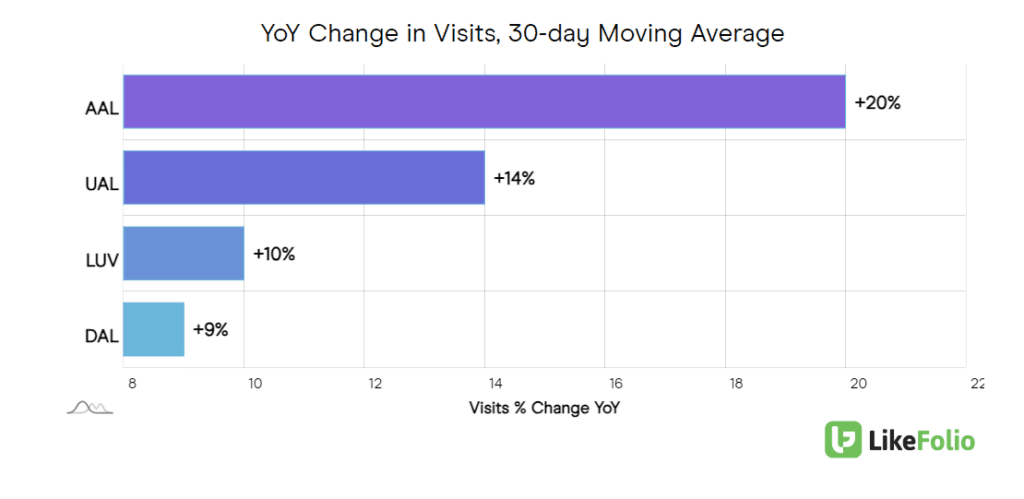

- Delta is underperforming when it comes to total web traffic -- up +9% YoY but in the back of the pack when it comes to growth vs. all other major competitors.

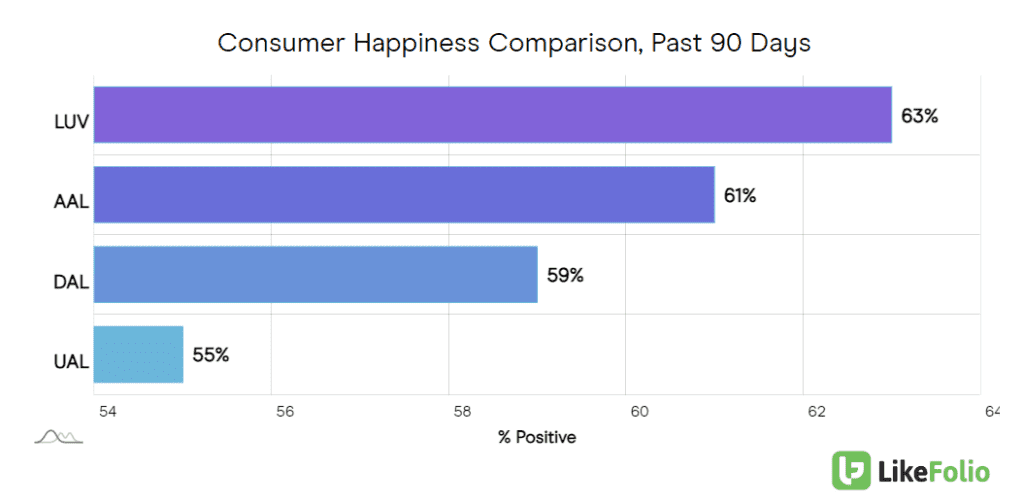

- Delta sentiment is being impacted by deal-seeking leisure travelers, who are touting AAL and LUV comparative affordability (from seating to fees). The good news: higher ticket prices and catering to a higher income flyer is likely to cushion Delta margins. But it could also translate to slower bookings in the meantime.

Delta Air Lines' strategy to focus on premium travel paid off significantly in 2023. The company logged a +26% YoY increase in premium seating revenue, amounting to $19.1 billion. This growth outpaced the 20% gain in main cabin seating revenue.

The company doubled down on the premium flyer last quarter, announcing an order for 20 airbus 350-1000 aircraft (for delivery starting 2026) to cater to international travelers with more premium seats and customer amenities, alongside improved fuel efficiency.

It also benefited from improving business travel, noting on its last call: "corporate travel continues to improve, with demand accelerating into year-end...Technology and financial services led this momentum for the December quarter, with media and auto sectors seeing notable traction following the strike resolutions."

Despite these notes of positivity, Delta did acknowledge potential headwinds brewing, including higher international mix, the normalization of travel credit utilization, and lapping its competitors' operational challenges. Overly cautious guidance sent shares down -9% following its report, and lowered the bar...which brings us to now.

At a high level, travel demand is expected to exceed pre-pandemic levels this year, with an estimated 4.7 billion people traveling in 2024 compared to 4.5 billion in 2019.

But macro tailwinds, included production shortfalls at Boeing and Airbus and high repair costs (repair costs at United, Delta and American were up 40% in 2024 vs. 2019) could translate to slowed capacity growth.

Bottom line: the company is reporting on a period featuring tough comps and muddying waters due to persistent inflation. It is well insulated from many headwinds thanks to its focus on premium travelers, corporate travel, and its lack of exposure to Boeing 737 MAX issues (it doesn't have any in its fleet). This could be enough to help Delta clear a low bar -- but any warnings related to guidance could send shares lower. Long-term, this name is perhaps the best of breed in the LikeFolio universe, so we view significant pullbacks as buying opportunities.