Ulta is Making Strategic Moves ULTA is gaining momentum in […]

Can ULTA do it Again?

What do Target (TGT), Dick’s Sporting Goods (DKS) and Ulta Beauty (ULTA) all have in common?

They’re gaining consumer momentum.

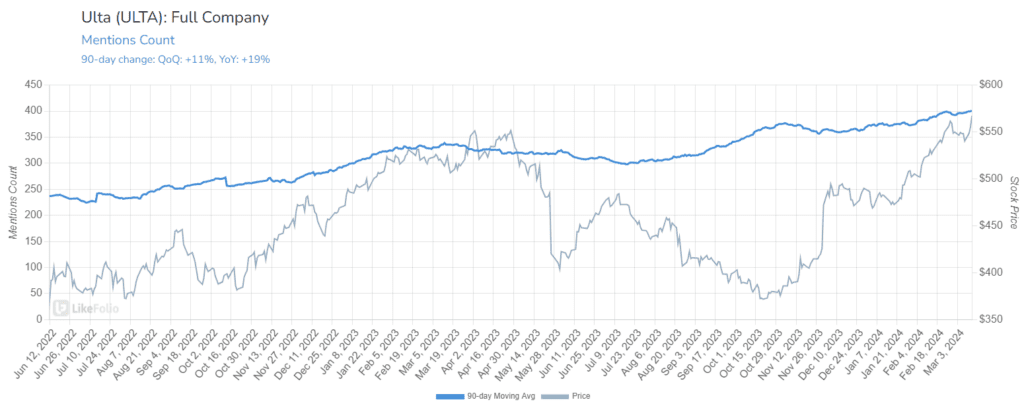

Ulta Beauty Mention Volume is up +19% YoY, boosted by a strong holiday season and spring special event.

More impressive: consumer happiness levels are up +10% YoY in the same time frame, near 70% positive.

Mentions are filled with consumers socking up on facial products and high-end cosmetics brands, including Charlotte Tilbury and Fenty.

Last quarter we correctly predicted a major post-earnings move to the upside, as the beauty retailer's audience expands to a younger audience and overtakes Sephora, thanks in part to its wide range of offerings, from drug store brands to prestige.

This allows the retailer to capitalize on splurges of high dollar products while also capturing any trade-down shoppers.

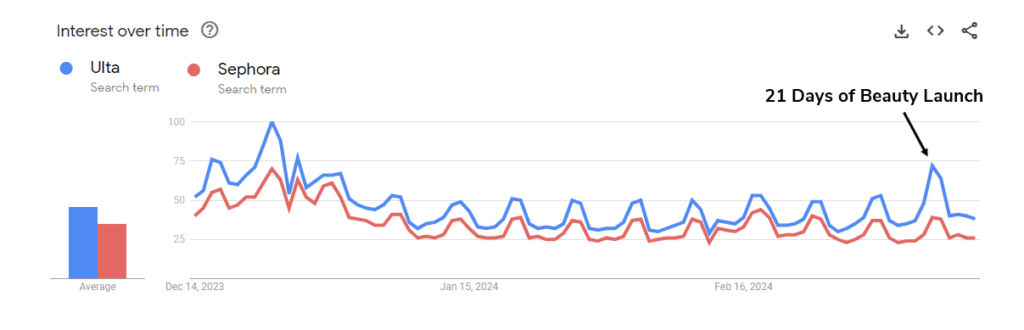

GoogleTrends suggests the gap between Ulta and Sephora is widening in Ulta's favor, with Ulta mentions spiking last week thanks to its semi-annual 21 days of beauty event that launched on March 8.

Sephora launched its own competitive event but doesn't appear to be garnering the same consumer response.

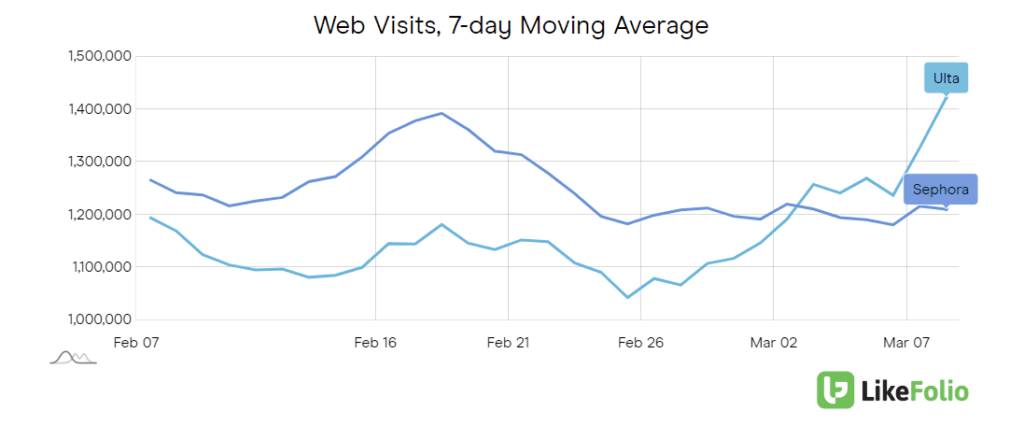

Web visits concur, with Ulta traffic pacing +17% higher YoY to Sephora's +8% YoY.

We've seen consumer favorites Target (TGT) and Dick's Sporting Goods (DKS) surprise to the upside, and we wouldn't be surprised to see Ulta do the same. Ulta is also likely to benefit from increased foot traffic at partner-store, Target. Our score falls on the bullish side of neutral, only because the bar is high and this name is susceptible to shrink.