Black Friday Weekend (leading into Cyber Monday) can make or […]

Ulta is Making Strategic Moves

March 11, 2021

Ulta is Making Strategic Moves

ULTA is gaining momentum in 2020. Shares are trading more than 24% higher from its post-earnings close in December. As investors look to spot re-opening winners, Ulta is a natural beneficiary.

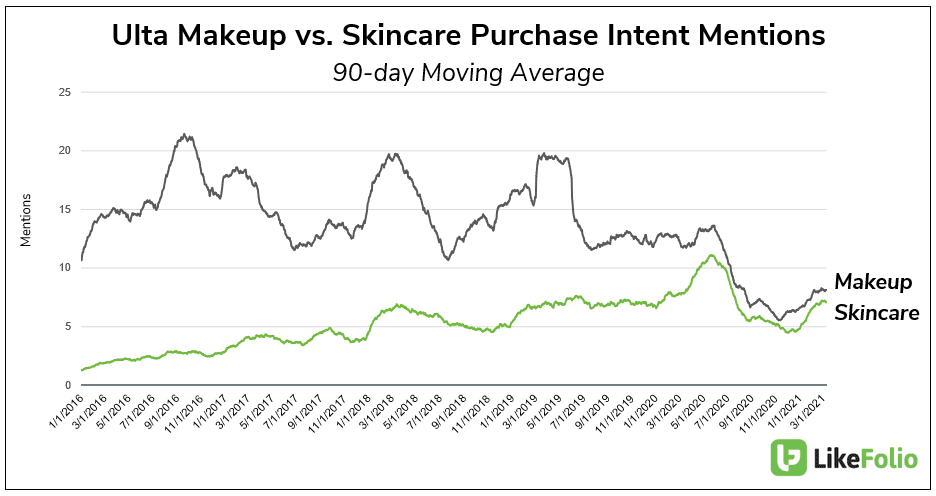

- Research suggests many women stopped wearing makeup during the pandemic (17%). As activities resume and stores remain open, makeup demand is beginning to pick up.

- Ulta utilized lockdown protocols to leverage its digital platform. LikeFolio digital Purchase Intent mentions (+8% YoY) significantly outperformed in-store purchasing mentions in Q4.

- Self-care is more important than ever to consumers, and it is driving skincare demand. LikeFolio data shows that consumer mentions of practicing a self-care routine have increased +54% YoY. Ulta is well positioned to grow in the skincare market, and reported positive comp growth in this segment last quarter. This is evident on the chart below.

Make no mistake, Ulta Purchase Intent is capping off another quarter of significant YoY decline. The market is expecting a decline in revenue. On the flip side, the Street may focus on signs of optimism surrounding reopening. Ulta's strategic Target partnership is a major bright spot looking ahead. Long-term, we'll be watching to see if consumer demand for cosmetics returns in 2021, and if Ulta can continue to position its product mix in-line with consumer trends.