“You know it's time to sell when shoeshine boys give […]

Cryptos are at a New All-Time High...Don't Say We Didn't Warn You! ($BTC)

Cryptos are at a New All-Time High...Don't Say We Didn't Warn You! ($BTC)

The total cryptocurrency market cap is at an all-time high today, nearing $3T in total investment -- Bitcoin ($BTC), the market leader, looks poised for a breakout to new highs as well.

This comes as no surprise to LikeFolio...Thanks to the unique advantage provided by our social data, we’ve maintained a confident bullish outlook throughout 2021. The crypto market suffered a hefty correction in May, falling nearly -50% from a euphoric all-time high. Many analysts saw the rapid decline and assumed the worst, but we remained steadfast. Why?

We didn’t see an equivalent downturn in investor interest.

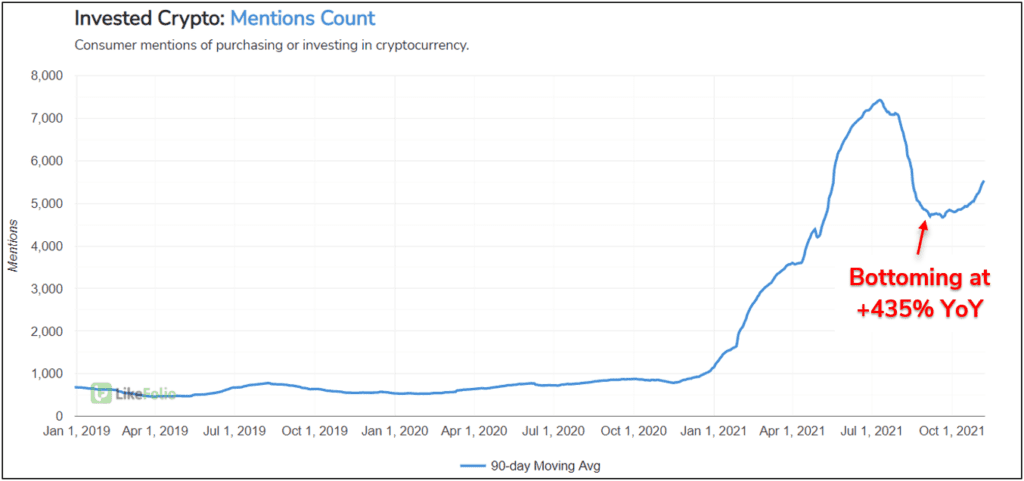

In the months following the May sell-off, consumer Mentions of buying and investing in cryptocurrency bottomed out on a 90-day moving average up +435% vs. the prior year.

The relative strength seen in this Trend directly contradicted the bearish outlook being adopted by many analysts. Demand for Bitcoin showed even more impressive resilience.

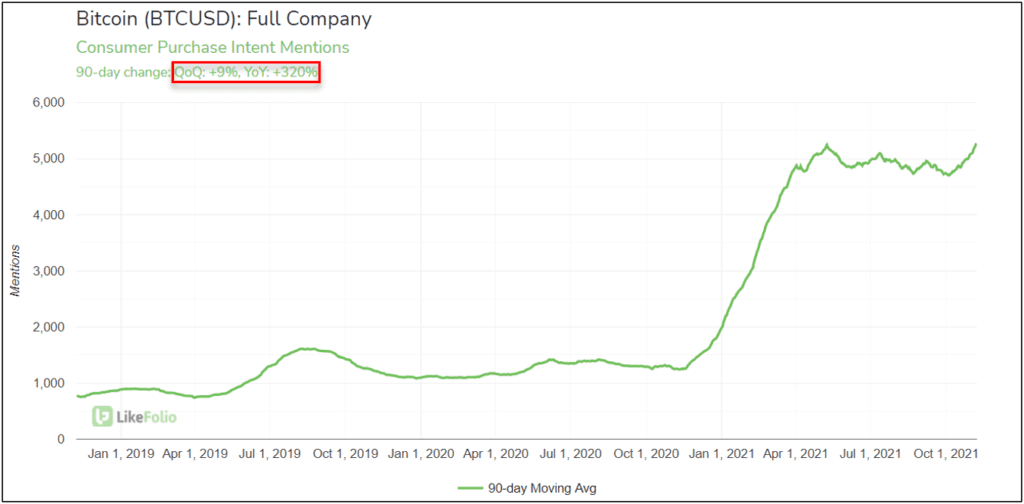

BTC lead the market lower in May, Correcting by more than -50%...However, underlying investor demand for the cryptocurrency barely flinched in that timeframe, currently trending towards a new high: +9% QoQ and +320% YoY (90d MA).

The above chart made the decision to buy at $30K an easy one, and our social data has proven incredibly effective for cryptocurrencies across the board.

We're expecting to see cryptocurrencies continue higher into the end of the year, so stay tuned for more features and insights!