Carvana Demand Approaching All-Time Highs LikeFolio published a Bullish alert for Carvana […]

CVNA: The Good, The Bad, and The Wildcard

Carvana was born as a spinoff from DriveTime Automotive, a used car retailer and finance company.

The brainchild of Ernest Garcia III, Carvana was his innovative solution to bring the used car buying process entirely online.

The Good News

Carvana shares are surging higher today, following the company's announcement of an improved financial outlook. Carvana expects its second-quarter earnings to be quite impressive, with a total gross profit per car above $6,000.

This optimism is driven by a couple of factors.

First, Carvana's unique business model, which eliminates the middleman in used car sales, allowing for potentially higher profit margins.

Second, the company's continuous efforts to improve operational efficiency and customer experience have started to pay off, as reflected in their expected Q2 earnings.

But Not So Fast… The Bad News

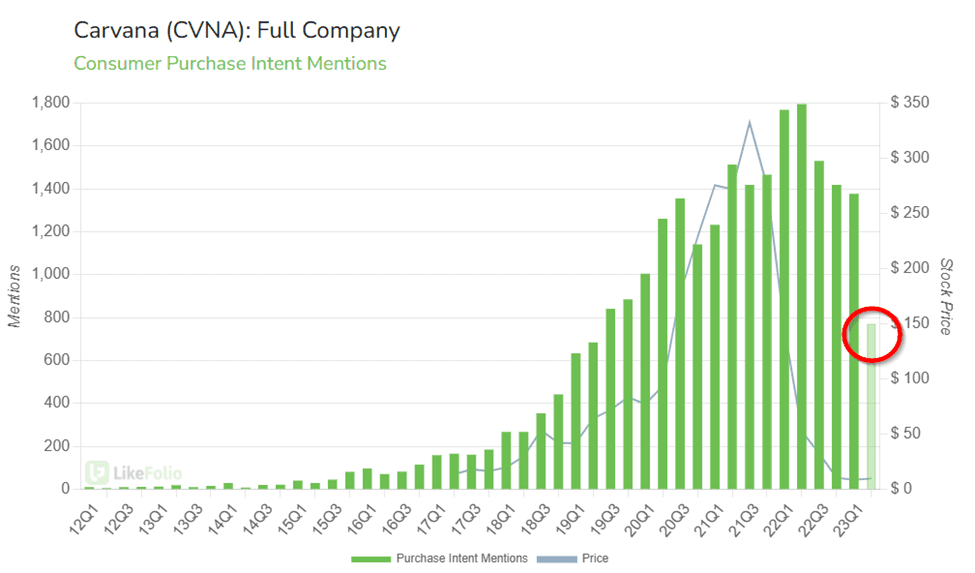

Despite the recent surge in share prices, our data at LikeFolio suggests a more cautious outlook.

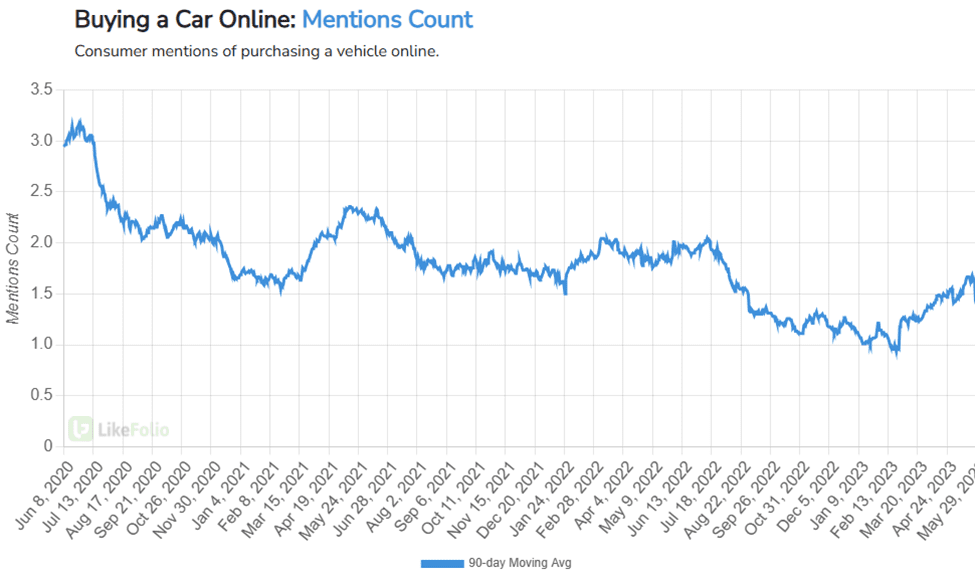

While there's been a resurgence in online car buying since February, the numbers are still not matching up to the levels we saw in 2021.

Furthermore, our data shows that LikeFolio's purchase intent mentions for Carvana are pacing lower by over -50% in the current quarter vs one year ago.

On top of all of that, consumer happiness levels for Carvana have fallen -5% year over year to just 54% happiness. Not great.

The Wildcard: A Potential Short Squeeze

Now, let's talk about the wildcard in this scenario: the potential for a short squeeze.

A short squeeze is a situation where a stock's price skyrockets due to high demand and limited supply… a positive feedback loop where higher prices force short-sellers to cover their position by buying shares… sending the price even higher.

A classic example of this was the GameStop saga of 2021.

Interestingly, Bloomberg data shows that 50% of Carvana's float is short. Could we be in for another wild ride?

In conclusion, while Carvana's recent financial report has stirred up some excitement, and a short squeeze is in the cards, it's important to look at the data. And so far, we’re not seeing any reason to jump onto the “comeback story” bandwagon just yet.

Here at LikeFolio, we'll keep our eyes on the data and keep you updated on any future profit opportunities in Carvana's stock.