As we are kicking off the Q1 2022 Earnings Season, […]

Dave & Busters (PLAY) Earnings Deep Dive

One analyst said an “experiences” oriented company was in the running to be the next Starbucks.

You probably wouldn’t guess Dave & Buster’s (PLAY) was a contender in question – but investors and the market at large are betting on this name.

Its shares are up almost +90% YoY as the company makes strategic moves to improve profitability and bolster sales, tapping into the recent wave of consumers opting for fun instead of things.

The owner of food-drink-and-entertainment venues Dave & Buster’s and Main Event is set to report Q4 earnings April 2 after the bell.

So – is the stock set to make new highs?

LikeFolio data says probably not. Here’s why:

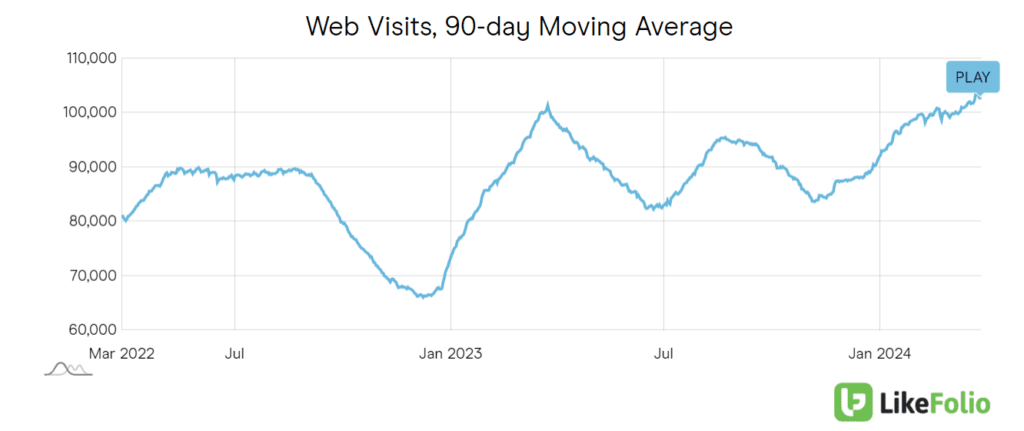

- We do see web visit growth, but it is slowing down. Collective web visits are up +4% YoY on a 90-day Moving Average and flat on a 30-day Moving average, which could be a warning sign for guidance.

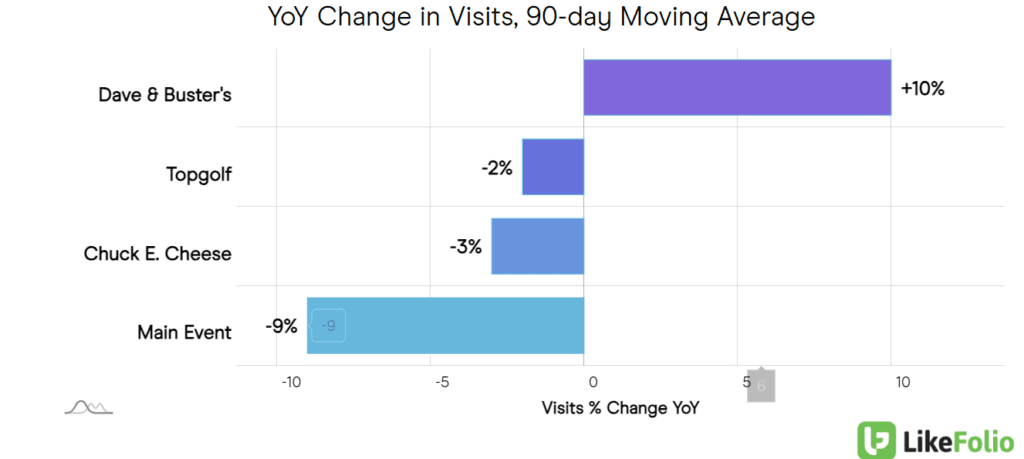

- We also note relative weakness in the Main Event banner vs. PLAY’s namesake venue and other entertainment options, like Topgolf and Chuck E. Cheese for the littles:

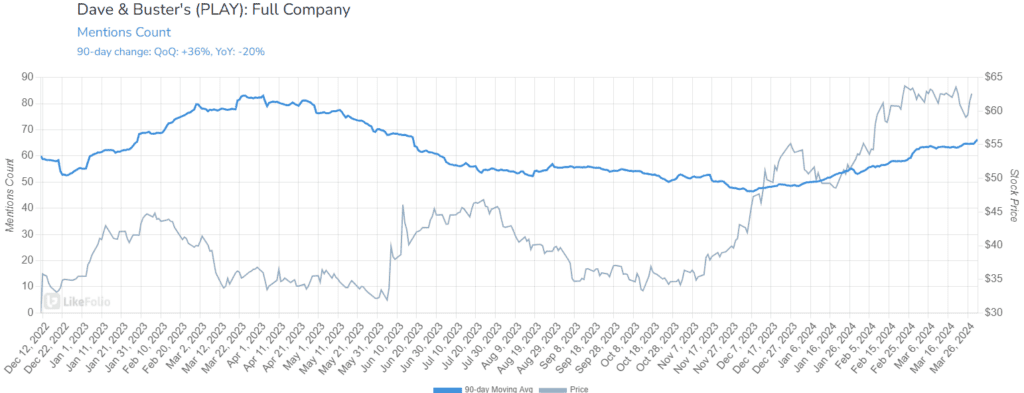

- Mention buzz is tapering off, down -20% on a YoY basis (with Main Event, once again, trailing Dave & Buster’s).

With shares trading near multi-year highs and LikeFolio data turning lukewarm, PLAY may be teetering in overbought territory.

What is the Bullish thesis? These are the strategic initiatives the company touted on its last earnings call:

- Enhanced Marketing and Digital Engagement: Investing in marketing technology infrastructure to build a digital marketing engine signifies a strategic move towards data-driven decision-making. Launching pilots across owned and paid channels for targeted communication suggests a proactive approach to increasing guest engagement and loyalty, potentially driving more frequent visits and higher spending.

- Strategic Game Pricing: The initiative to strategically adjust game pricing based on extensive testing and market feedback indicates an adaptive and innovative pricing strategy. This approach not only aims to grow same-store sales but also ensures the value proposition remains strong, suggesting a positive impact on revenue without deterring customers.

- Food and Beverage Innovation: The successful systemwide launch of the Phase 2 menu and its immediate positive impact on revenue per check and cost of goods sold (COGS) improvement demonstrate the company's ability to enhance its food and beverage offerings. Improving speed of service and food quality aligns with consumer expectations for better dining experiences, contributing to increased guest satisfaction and spend.

- Store Remodel Success: The remodel program has already shown promising results with significant sales uplifts. This indicates that refreshed and modernized stores could attract more customers and enhance their overall experience, leading to sustained revenue growth. The remodels reflect a strategic investment in the physical brand presentation and guest experience, which could further differentiate Dave & Buster's in the competitive entertainment and dining landscape.

- Operational Efficiency Through Technology: The rollout of OneDine Server Tablets and the adoption of a new ERP system for streamlined back-office operations underscore a commitment to leveraging technology for efficiency gains. These improvements are likely to enhance guest service, reduce operational complexities, and provide actionable insights for further optimization, contributing to better margins and customer satisfaction.

- International Expansion Opportunities: Announced franchise partnerships for expansion into the Middle East, India, and Australia demonstrate the brand's appeal and growth potential beyond its domestic market. This strategic move into international markets opens new revenue streams and diversifies market exposure, which is crucial for long-term growth and resilience against regional market fluctuations.

While these moves ARE positive, data suggests consumer spending headwinds may be mounting for the company, hampering it’s positive growth engine.

LikeFolio data has us worried about guidance, and see greater risk to the downside for this name.