Lowe's (LOW) Home Depot is trading ~3% lower today after […]

Is HD Overbought?

Last quarter Home Depot (HD) cleared a low bar, besting the Street expectations even though sales dropped -3%.

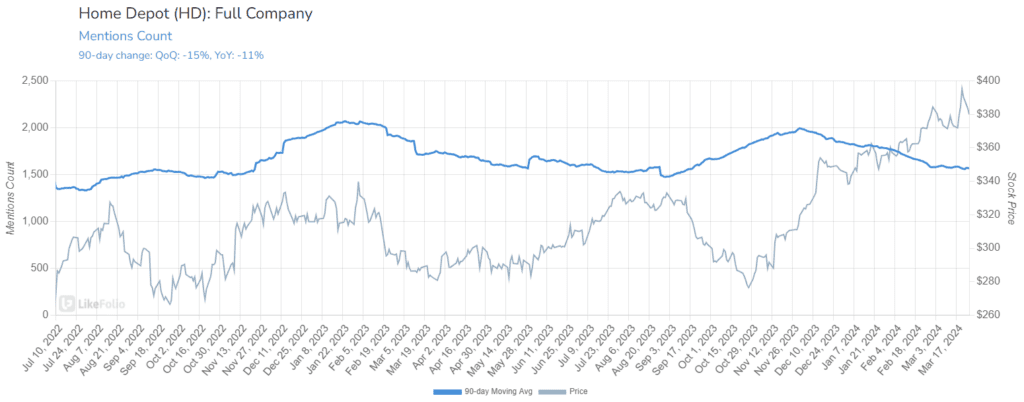

Since then, shares have marched higher. LikeFolio data suggests it may be time for caution...

HD mention buzz is heading in the opposite direction of the stock price.

What's going on? Here's what we know:

On its last earnings call, Home Depot said it was "neutral on housing in the short term" and called for a 1% increase in sales for the fiscal year as consumer spending moderates due to inflation, higher interest rates, and a preference for experiences over goods.

Bottom line: lower housing turnover and consumers less willing to take on large projects weighed on HD shares in 2023.

But boy are things heating up. HD shares have traded nearly +40% higher since October and are inching their way closer to post-pandemic highs.

This seems like a bit of a mismatch, especially considering last quarter same-store sales fell -3.5%, transactions fell -2.1% in the quarter, and average ticket decreased -1.3%. Big-ticket transactions dropped at an even higher rate, down -6.9% with softness in categories like flooring, countertops, and cabinets.

Does LikeFolio data support the recent stock action? No.

- HD mention volume is down -11% YoY and continuing to lose momentum (down -13% on a 30day MA).

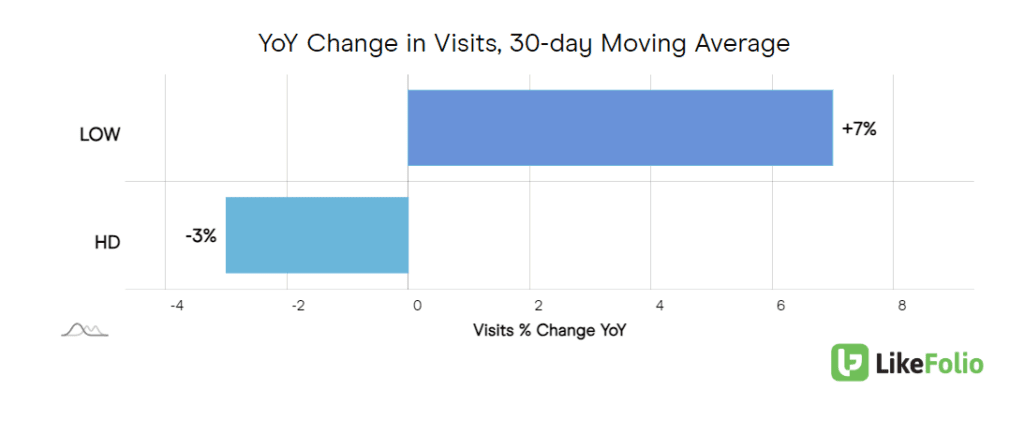

- HD digital traffic looks weak, down -3% YoY and underperforming peer, LOW (up +7% YoY). Part of this could be due to the DIY/Pro mix for both companies. HD has a higher exposure to the pro consumer (comprising about half of its revenue) and is clearly susceptible to pull backs in large projects. LOW on the other hand, caters more to DIY and appears to be capturing more of the small projects consumers are taking on themselves.

- Home Depot has a slight edge vs. Lowe's when it comes to consumer happiness (1 point higher) but it's not enough to generate significant "switching" action for consumers.

Bottom line: Signs indicate the economy is moving toward normalization, yet the home improvement market anticipates continued challenges in fiscal 2024. HD has already benefitted from the idea that certain pressures from 2023 are unlike to continue this year, like 4 fed rate hikes, lumber deflation, and a sharp decline in existing home sales.

The bleeding is slowing...but it hasn't stopped.

Earnings aren't due for some time (end of May), but unless we see a turnaround in consumer spending activity and engagement with HD specifically, the new, higher bar may prove tough to clear.