Carnival Cruise Lines is starting to show some weakness in […]

Will CCL sail higher on earnings?

Is CCL deserving of a second look from long-term investors?

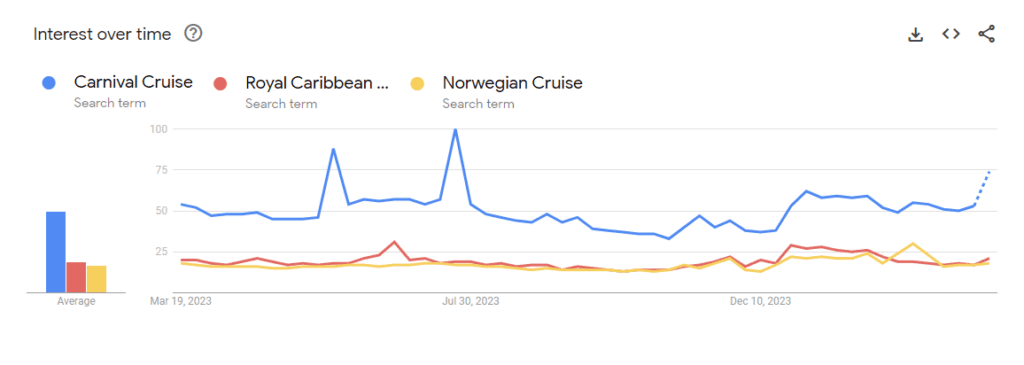

GoogleTrends suggests some traction heading into Summer, with web searches lifting higher vs. peers.

Last quarter, CCL shares traded higher on the back of a strong report, featuring a lower-than-expected loss (7 cents per share vs. 13 cent loss expected -- greatly improved vs. an 85-cent loss in 22Q4) and record-breaking booking volumes on Black Friday and Cyber Monday.

Most importantly, the company predicted a hot summer: "For our peak summer period, all major products are better booked at higher prices, benefiting from an improving trend in both occupancy and price during the fourth quarter."

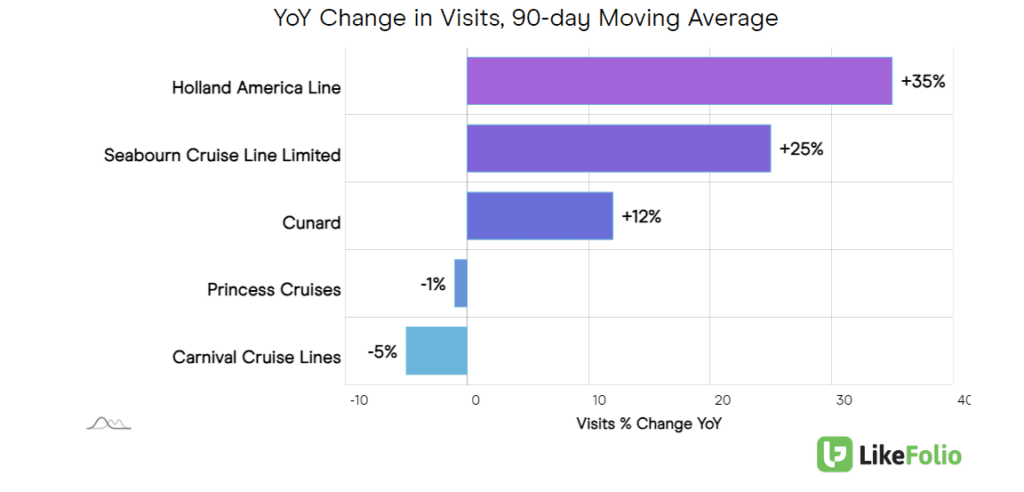

Web visits show momentum notably in its Holland America, Cunard, and Seabourn Lines and underperformance in its Carnival namesake line, with collective web traffic up +2% YoY. (Princess is flat).

CCL sentiment is high at 75% positive, and notably above RCL by +2 points thanks to its perceived savings and casual atmosphere vs. RCL with a more upscale vibe.

But overall mentions are a bit flat (-2% YoY) – giving us room for pause.

We're technically neutral ahead of earnings, especially as we wait to see how expenses and pricing shake out -- but have this name on our watchlist long-term, thanks to high levels of happiness and consistent overperformance in its European brands.