Can Darden Restaurants Continue on its Recovery Trajectory? ($DRI) Since […]

DRI: "Value Brands Steal the Show?"

Growing up in a small town, getting to eat at THE Olive Garden was like a fancy treat.

Every August my grandmother would load me up and drive me 45 minutes to the nearest “big city” to shop for new school clothes and treat me to unlimited salad and breadsticks.

I was in heaven. To me, this was fine dining.

Fast forward (several) years, and Olive Garden parent Darden is really leaning into the fine-dining segment, making a play for the upscale with its recent acquisition of Ruth's Chris to add alongside its other high-end banners like The Capital Grille.

However, LikeFolio data suggests it's the heartwarming, value-driven brands like Olive Garden and LongHorn Steakhouse that are leading Darden's growth of late.

Playing Darden from Here

Back in May, LikeFolio flagged a bearish trend for Darden, noting a consumer pull-back in dining out. Fast forward, and DRI shares have indeed dipped by about -8%.

Are we still bearish? Here’s how we see it…

Darden is effectively leveraging its delivery and curbside options

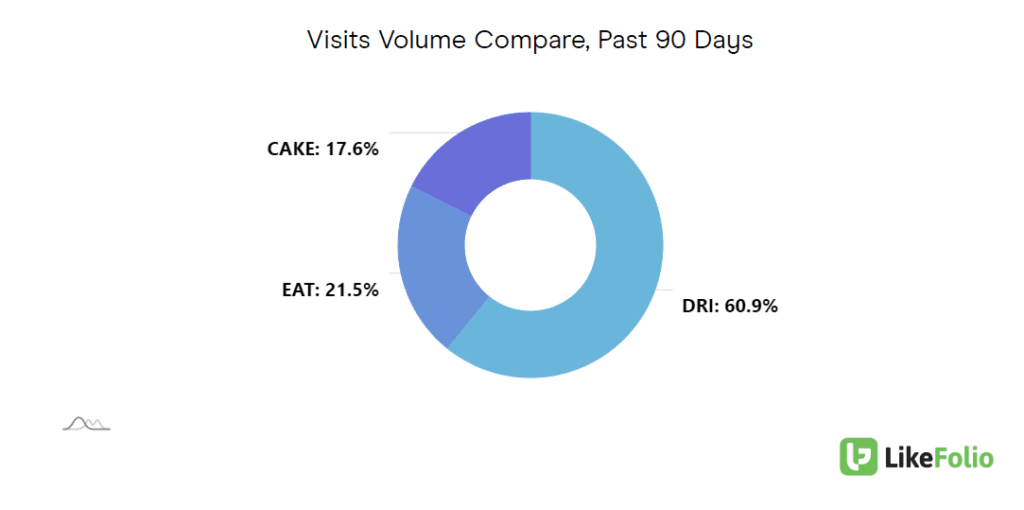

It commands just over 60% of web mentions when compares vs. EAT and CAKE.

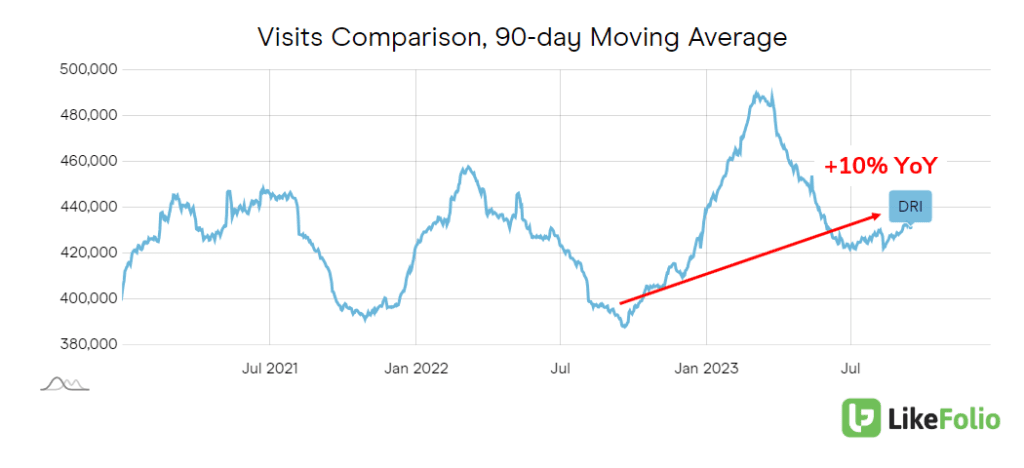

It is also logging continued growth in this arena during a typical-down season, with web visits to one of its restaurant banners increasing by +10% on a YoY basis.

DRI buzz is building

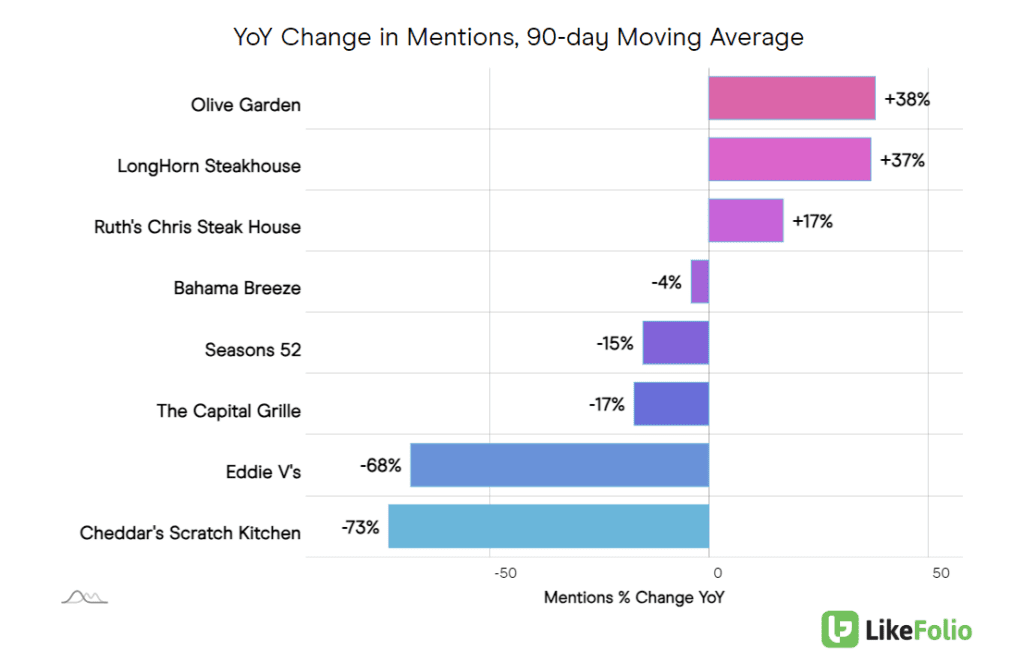

Mentions are currently pacing +21% higher YoY, driven by strength in its Olive Garden, LongHorn Steakhouse, and Ruth's Chris brands.

The relative contrast between its value brands (Olive Garden and Longhorn) vs. higher-end brands like Eddie V's and The Capital Grille suggests consumers may still be trading down to more affordable excursions.

It is promising to see some traction in Ruth's Chris brand post-acquisition.

The Happiness Hurdle

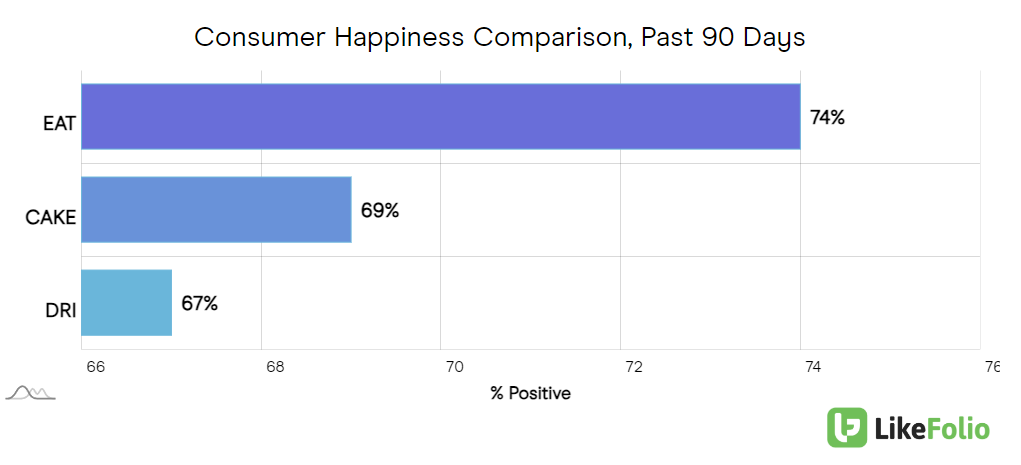

While Darden's digital strategy and diverse brand portfolio are commendable, there's one area that needs a sprinkle of seasoning: consumer happiness.

This metric played a pivotal role in LikeFolio's bearish alert earlier this year.

At 67% positive, Darden lags behind peers like CAKE and EAT.

However, it's not all gloomy. Darden acknowledges this gap and is actively working to elevate its dining experience. Initiatives like the "back-to-basics" philosophy, focusing on food, service, and atmosphere, are steps in the right direction.

Anecdote: The recent "Steak Master Series" at LongHorn Steakhouse, a grilling competition and training program, is a testament to Darden's commitment to quality and consumer satisfaction.

Bottom Line

Darden's digital strategy and value brands are clear bright spots, positioning the company well in a competitive landscape. However, the quest for heightened consumer happiness remains. As Darden continues to innovate and improve, investors and diners alike will be watching closely. After all, in the world of dining, a happy customer is the most valuable asset.

We have an open bearish alert from May but have already seen a pull-back since then. We wouldn't be surprised to see a pop on earnings on a better-than-expected forecast and lowered bar.