Airbnb (ABNB) AirbnB is set to report earnings for the […]

Early Easter timing is helping this name

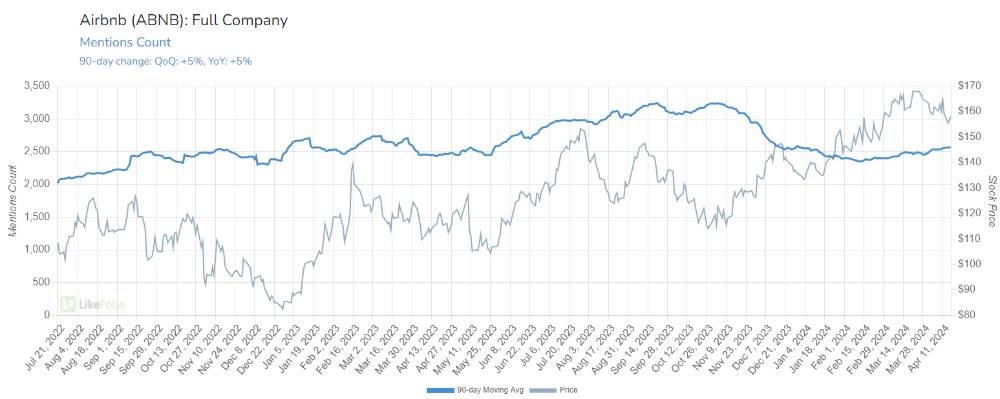

After a tough winter on the consumer sentiment front, we are finally seeing some signs of life out of ABNB.

Though the company continues to trail traditional lodging peers in happiness and web traffic growth, its own metrics are showing signs of improvement as consumers plan Summer travel and report on Spring Break activities.

- Mentions have ramped from +5% YoY to +13% YoY on a 90-day to 30-day Moving Average. (A quarter ago mentions were down -6% YoY).

- Web visits have improved from -4% YoY to flat in the same time frame. (A quarter ago traffic was registering -8% YoY).

Perceived high pricing, added fees (cleaning, service) and a list of chores to do on your way out has suppressed ABNB happiness levels below more consumer-friendly peers.

The company is also working through new regulations, most recently in Michigan but historically present in wide swaths of the country, from our own Louisville, KY to NYC and even the EU.

Last quarter, ABNB posted a wider than expected loss attributed to lodging taxes reserves and nonrecurring tax withholding expenses of $1 billion. Conversely, it reported 98.8 million nights and experiences booked, +12% YoY and slightly exceeding expectations.

Much of this growth is being driven by significant international expansion that my not show up in english-speaking data. Areas of hot interest include the Asia-Pacific and Latin-America regions.

Looking ahead, we expect continued international growth and expansion -- and are watching for an intriguing announcement from the company, tucked away in its last shareholders letter:

"We also believe that now is the time for us to expand beyond our core business and reinvent Airbnb. While this will be a gradual, multi-year journey, we’re excited to share more about this later in 2024."

Interesting.

Investors should brace for potential news next quarter related to this hinted-at announcement, as well as a YoY boost from the early timing of Easter.

ABNB shares have pulled back a bit from March highs but remain nearly +40% higher YoY.

Recent consumer momentum (thanks in part to early holiday travel) may have given the company what it needed to clear expectations for Q1.

We'll be watching to see if this momentum sustains in the next few weeks ahead of earnings.