United Parcel Service (UPS) After two quarters of explosive demand […]

FedEx Earnings Preview: Demand is Cooling Off ($FDX)

FedEx Earnings Preview: Demand is Cooling Off ($FDX)

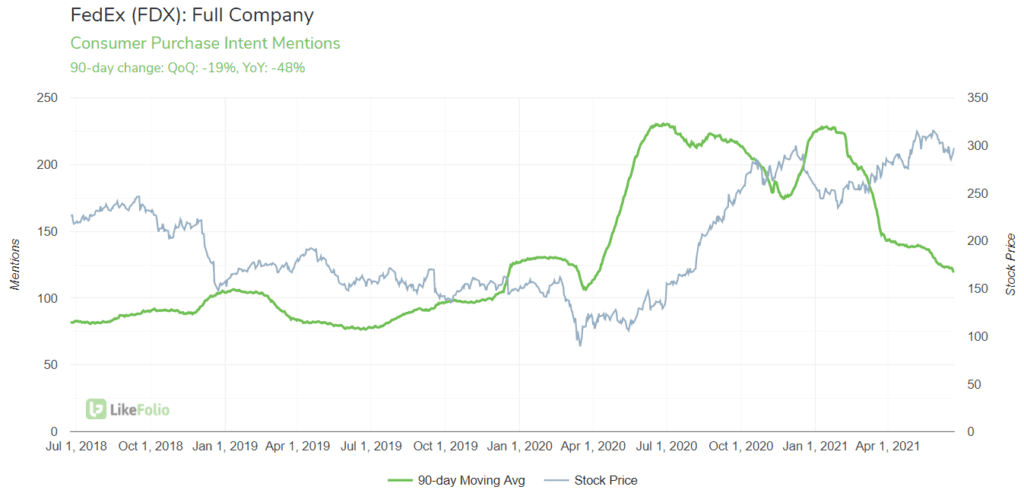

Over the past year, the rise of eCommerce across the globe has been a massive boon for shipping companies like FedEx (FDX). FDX Purchase Intent Mentions are still booming relative to pre-COVID levels, up +49% vs. 2019 on a 90-day moving average. However, growth has begun to cool off in recent months, down -48% YoY and -19% QoQ.

It’s no secret that elevated eCommerce Demand has been a key component of FDX’s record 2021 fiscal year. Last quarter (21Q3), FDX reported that U.S. domestic residential package volume mix was 70% versus 62% a year ago.

During the 21Q3 conference call, FDX management predicted further growth in the U.S. domestic parcel market, with eCommerce contributing 86% of that growth.

Overall, we’re still expecting to see FedEx report strong top-line revenue results, but that might not be enough to send shares to new highs, considering the market’s heightened expectations.