Stitch Fix (SFIX) Last quarter, SFIX shares fell 14% after […]

Fiverr & Upwork: Still Good Buys? ($FVRR, $UPWK)

Fiverr ($FVRR) and Upwork ($UPWK) fill a similar niche within the market.

Both companies provide an online talent marketplace for freelancers, allowing employers to connect with and contract independent professionals.

Both companies fit the bill for “high-growth tech stock” with triple-digit P/E ratios and impressive revenue growth…Both sport an incredibly similar valuation: ~$4.25B

We put out a bullish call on both these names in 2021, based on strong underlying demand growth and the ‘Work from Home’ behavior showing sure signs of stickiness with consumers and businesses alike. Despite our optimistic outlook, neither company has faired particularly well over the past year:

- FVRR shares are trading -42% YoY and -66% below their 2021 ATH

- UPWK shares are trading -2% YoY and -46% below their 2021 ATH.

So, was our thesis completely incorrect?

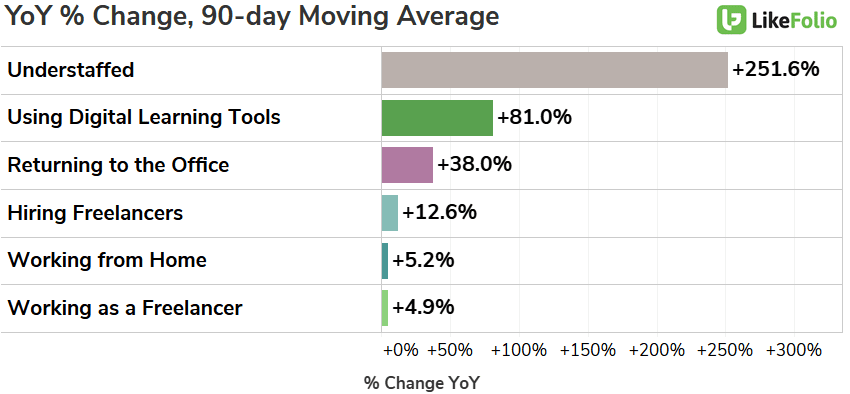

An updated view of the relevant trends provides some insight into the current job market:

Although relative strength in the “returning to the office” trend points to significant workplace normalization, there are other factors in play:

Mentions of Working from Home have yet to show significant pullback and freelancer demand from employers is on the rise.

Anyone who’s been out and about in the US can surmise that the massive rise in the “understaffed” trend is a likely consequence of scarce uptake for traditional service jobs in the wake of the pandemic, but its +252% YoY growth makes it worthy of consideration for all jobs.

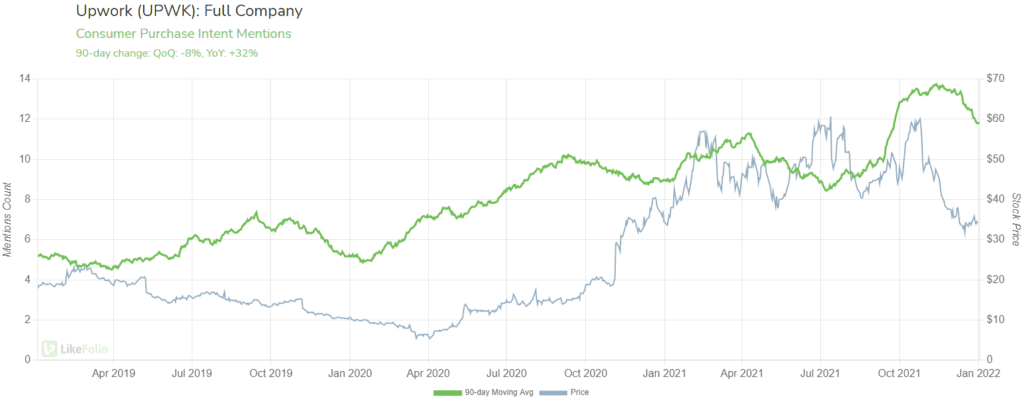

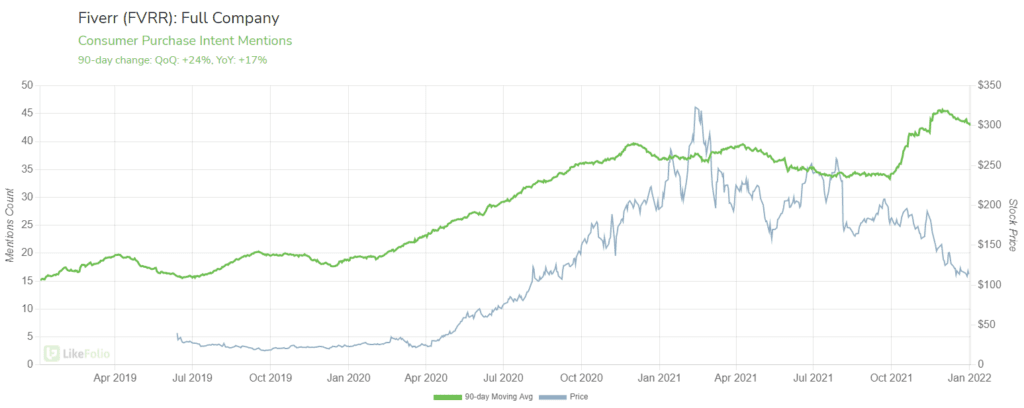

On an individual level, Mentions of employers and freelancers utilizing both marketplaces are showing strength:

Upwork Purchase Intent has gained +23% YoY, with a predictable near-term pullback over the “slow” holiday period.

Fiverr PI follows a similar trend, showing a significant volume boost in Q4 of 2021.

So, both companies look impressive from a PI standpoint, but Upwork emerges as the leader in terms of total Buzz growth. Underlying mention volume for Fiverr has not enjoyed the same uptrend as its Purchase Intent Mentions — Upwork’s Total Mentions are outperforming.

Both companies sport phenomenally high levels of consumer happiness (>80% positive), but UPWK has a slight advantage in that category as well.

FVRR shares have sold off more heavily, but considering the stock’s meteoric rise in 2020, it’s got a lot further to fall. Meanwhile, UPWK shares have been less volatile over time and are starting to show signs of bottoming after an aggressive sell-off in the final months of 2021.