Despite recent market volatility and some arguing for a bear […]

Grubhub is Falling Behind

Grubhub is Falling Behind

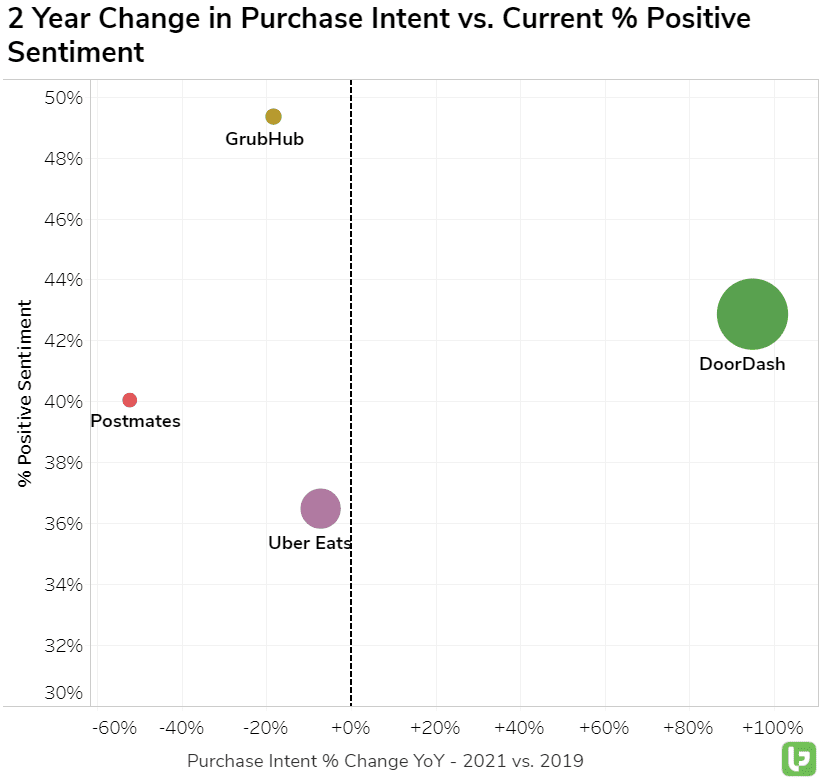

In terms of consumer Demand, Grubhub (GRUB) has fallen well behind its largest competitor in the U.S. market, DoorDash (DASH). Although Grubhub boasts industry-leading consumer Happiness levels (still below 50% positive), its Purchase Intent mentions are currently -18% below their 2019 level on a 90-day moving average.

Under normal circumstances, this would represent a bearish indicator for the company. But last June, Just Eat Takeaway, a European food delivery service, announced an agreement to acquire Grubhub (GRUB) for $7.3B. GRUB shareholders stand to receive .6710 Just Eat Takeaway.com (TKWY.AS) ordinary shares if/when the deal closes… Depending on your outlook this provides a speculative opportunity. Any positive updates regarding the transaction could contribute to an increase in Just Eat’s stock price (the underlying buyout price of Grubhub.) Conversely, if the deal falls through, expect to see GRUB shares trading lower.