At LikeFolio, we're watching for indicators that the consumer is […]

How we played “luxury” to an earnings profit

November 10, 2022

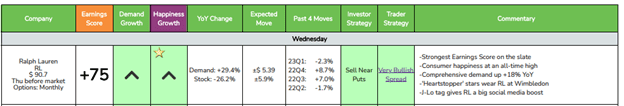

Yesterday, I went on the TD Ameritrade Network to discuss Ralph Lauren (RL) ahead of earnings.

The trade worked out nicely today, so I thought I’d share the notes that I had on hand for my appearance on the show... and how we ended up playing the trade.

Enjoy:

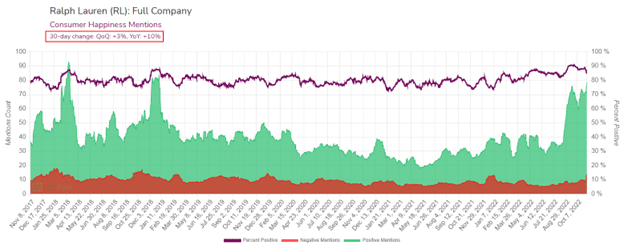

- Ralph Lauren is getting its groove back with consumers. Consumer demand is rising – +35% higher vs. last year – and sentiment levels have increased by nearly +10% in the same time frame.

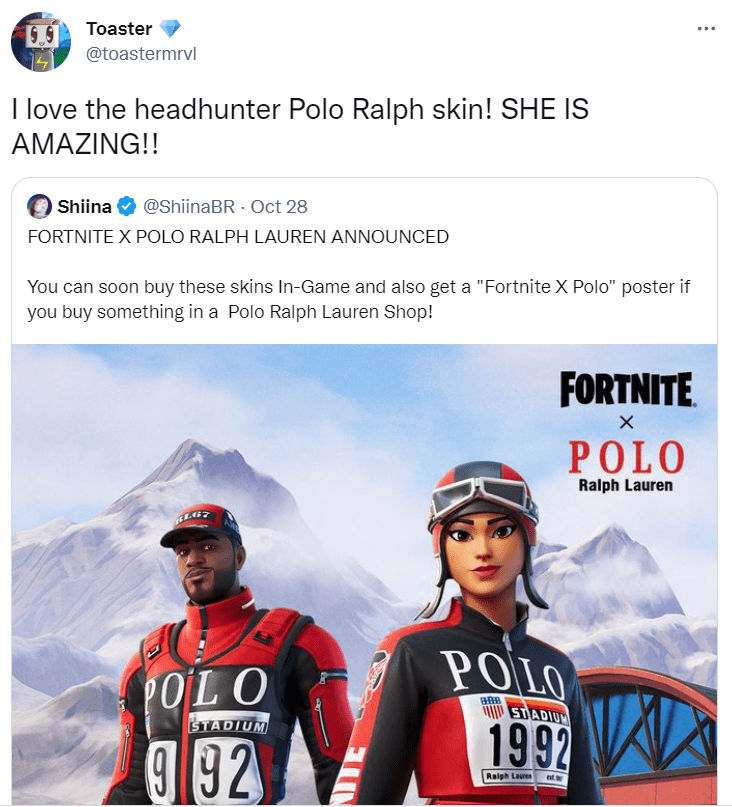

- Improvements are most notable among the retailer’s younger audience. RL is benefitting from fashion cycles favoring 90’s trends and from partnerships in the “Metaverse” with names like Fortnite.

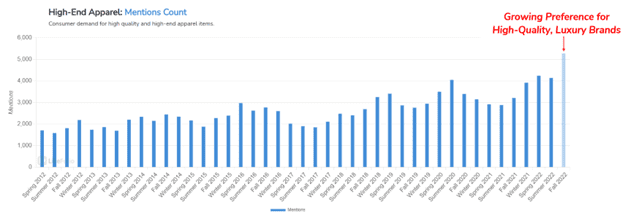

- Ralph Lauren’s renewed brand image supports a higher price point. Across the board, LikeFolio has noted that “luxury brands” are faring better vs. other brands due to their higher-earning consumer more insulated from the pains of inflation.

- RL shares are trading -25% lower YoY while demand and sentiment recover, presenting a bullish divergence opportunity. LikeFolio’s earnings score was +76 (one of the highest in our universe) ahead of the company’s 23Q2 report.

- RL shares surged higher by over 5% after the company beat Wall Street’s profit and revenue expectations.

LikeFolio’s clients are seeing big gains on the “Very bullish spread” trade from the LikeFolio Sunday Earnings sheet… and could see gains as high as 400% if RL continues higher from here.

To learn more about LikeFolio’s Earnings Season Pass product, schedule a demo with us.

Want deeper insights? Get Free Access to The Vault.

Tags: