Footlocker (FL) Last quarter, Footlocker stole our thunder when it […]

Intuit (INTU) Demand is Showing Signs of Weakness

Intuit (INTU) Demand is Showing Signs of Weakness

In honor of Tax Day, we're revisiting a company that has been dominated the consumer tax preparation market for a number of years: Intuit (INTU).

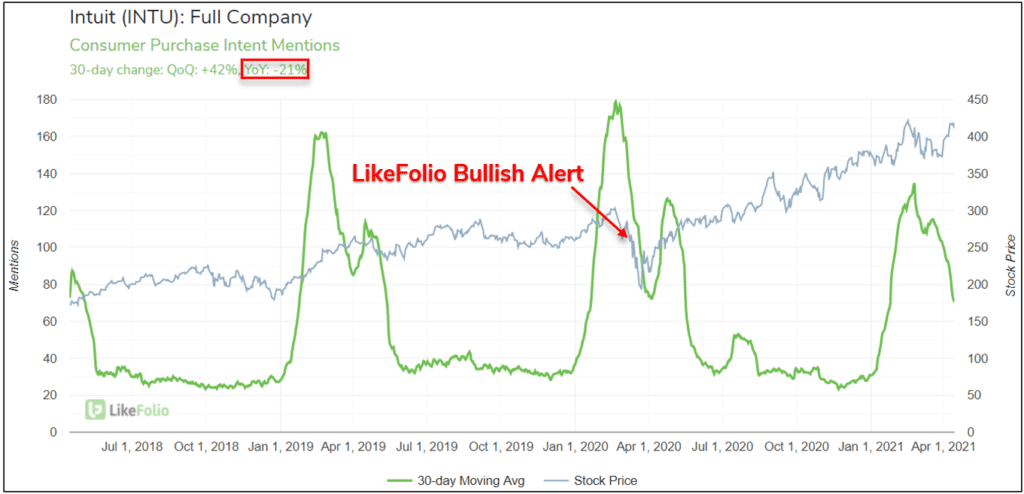

Last year March, we noted record Purchase Intent Mention volume during the broader market sell-off -- Our bullish alert has gained more than +60% since entry, but things aren't looking so promising this year...

Consumer Demand for Intuit's software, namely TurboTax, has slid precariously from the all-time highs seen last year, currently -21% YoY on a 30-day moving average.

With INTU stock at an all-time high, you might consider taking some profits off the table if you have a long positions.

H&R Block is experiencing similar YoY weakness, and we can't help but wonder if Square's (SQ) acquisition of Credit Karma is already having an impact on the consumer tax preparation industry.