Here's what LikeFolio data was showing heading into the Walmart earnings report that sent the stock 10% higher.

Is Food Inflation Behind Us? $WMT $DG $KR

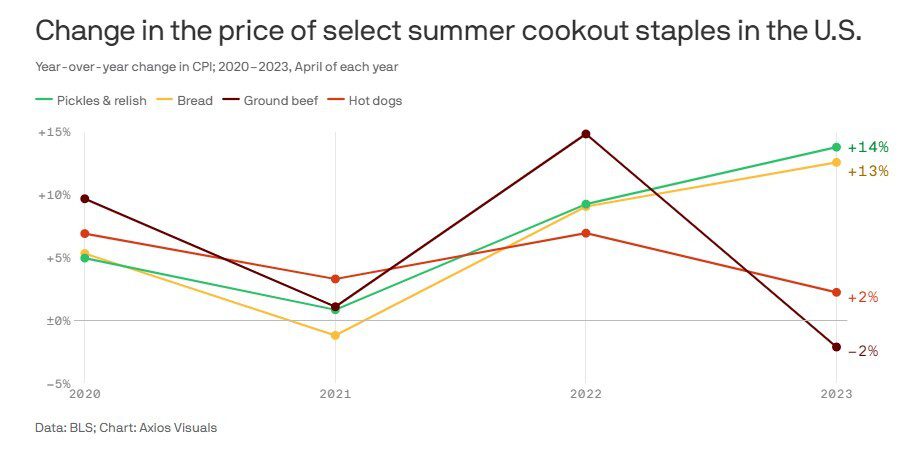

When you fired up the grill over the weekend to celebrate Memorial Day, was your grocery bill a punch to the gut?

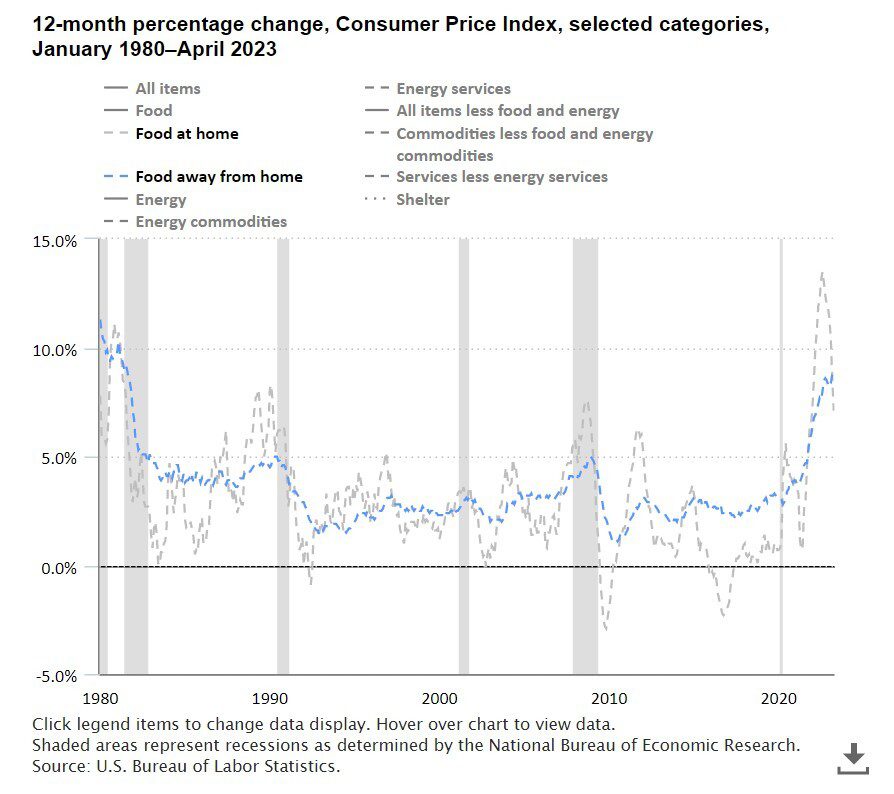

Despite cooling rates of inflation for food-at-home purchases, the costs still shake out +7% higher than a year ago.

And food prices aren’t cooling at restaurants either. In fact, food prices away from home remain elevated at an even steeper clip: nearly +9% YoY.

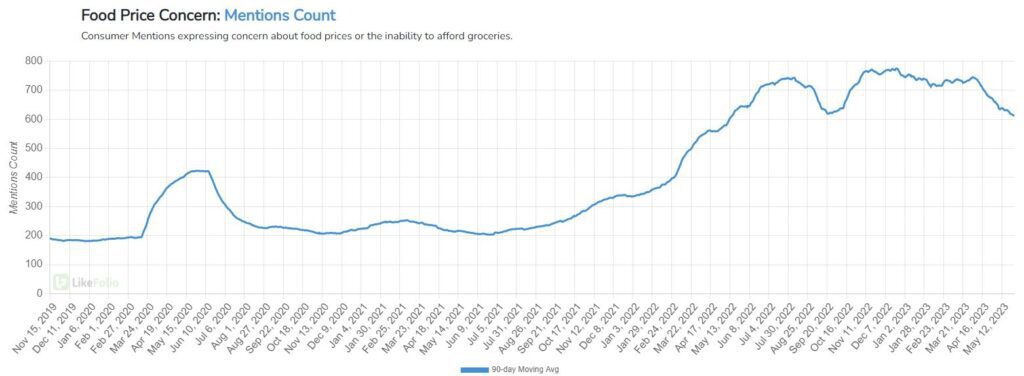

These persistently high levels of inflation continue to be top of mind for consumers.

Mentions of food price concerns have tempered somewhat YoY as the reality has had time to sink in but remain +191% higher on a 2-year basis.

How is this sustained macro pressure translating to companies in the LikeFolio universe?

Here are 2 core themes we’re watching emerge:

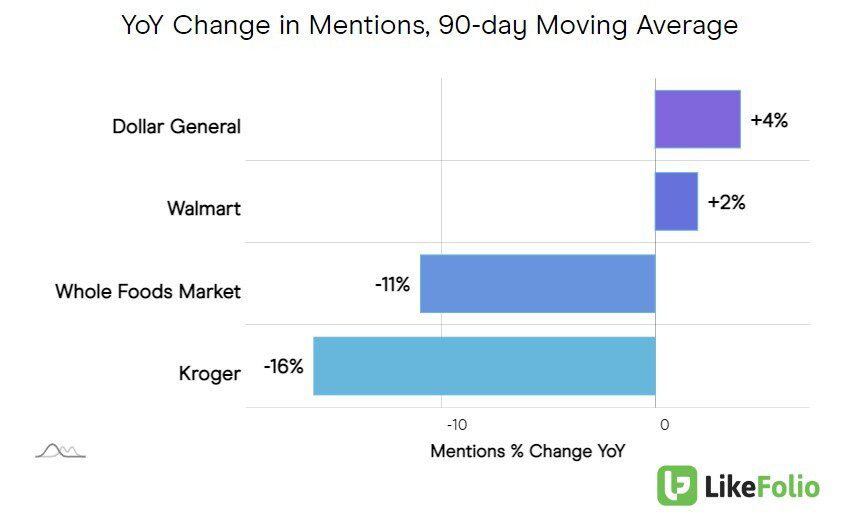

1) Retailers providing consumers with savings are benefitting right now…but the customer experience is lacking.

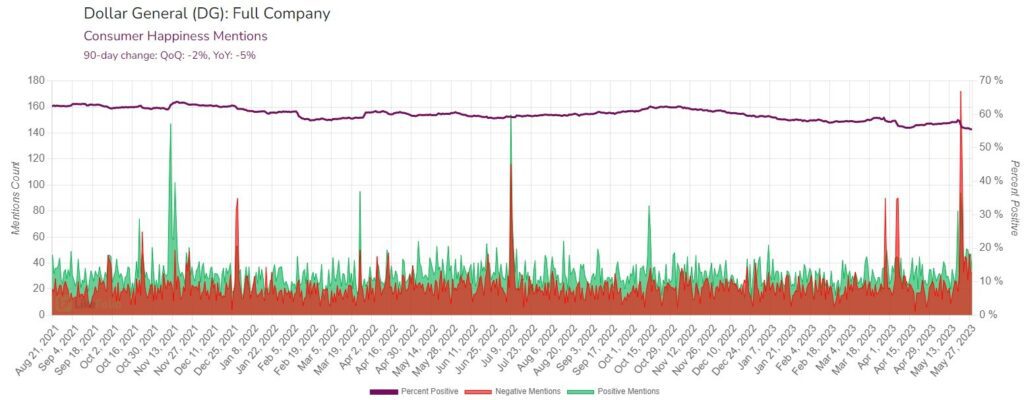

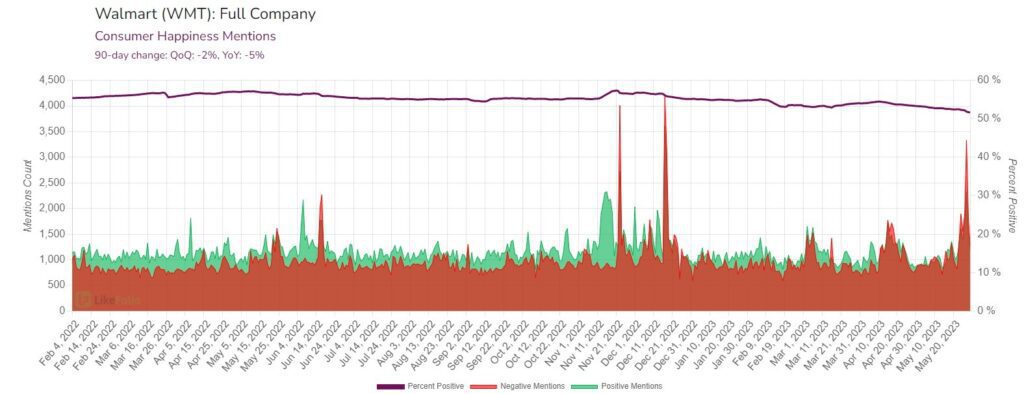

Consider Walmart (WMT) and Dollar General (DG).

Both appear somewhat insulated when it comes to consumer mention volume momentum vs. higher end grocers like Kroger and Whole Foods.

The problem?

Walmart and Dollar General sit at the bottom of the pack in consumer happiness, near 55% positive.

Dollar General is struggling to keep consumers and its labor force happy.

Sentiment levels have slipped by -5% YoY to 55% positive as the company battles dirty stores, unstocked shelves, high turnover, and theft (you can see this instance of a DG manager chasing down a shoplifter with her vehicle).

Walmart happiness levels look similar (and even lower) vs. Dollar General.

Both companies are welcoming higher-earnings consumers into their stores who are hunting grocery deals. But a lackluster experience may mean long-term struggles to maintain momentum.

We’ll be keeping a close eye on sentiment for long-term signs of market share steal.

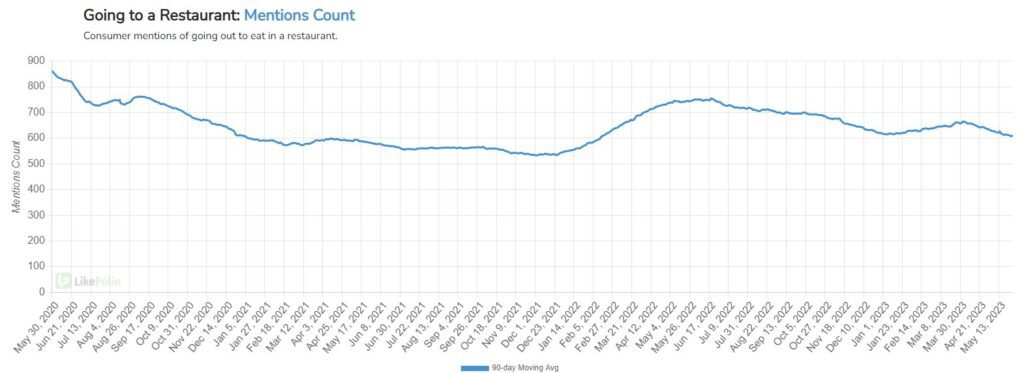

2) Sit-down restaurants are showing emerging signs of weakness

For months the cost to prepare food at home was greater than the perceived cost to go out to eat.

Couple that set up with a consumer prioritization of experiences, and you can feel the casual dining tailwinds at your back.

The problem is – that narrative has shifted.

Consumer mentions of going to a restaurant to eat have slipped by -19% YoY after resilience in 2022.

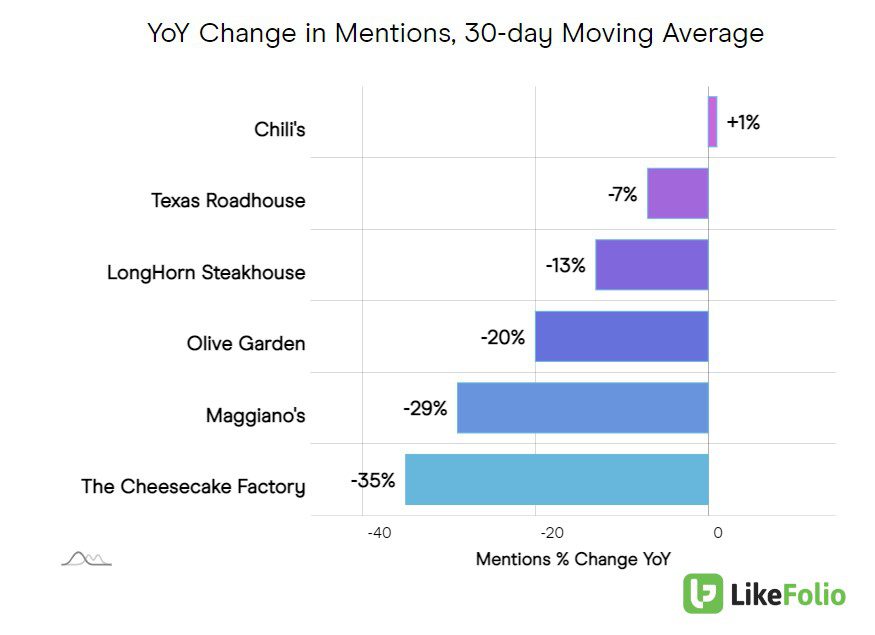

And this is beginning to weigh on consumer demand. Check out the mention buzz for popular restaurant names below:

Each parent company for the names above is trading higher than it was a year ago…

- DRI (Olive Garden, LongHorn Steakhouse): +28%

- EAT (Chili’s, Maggiano’s): +29%

- TXRH (Texas Roadhouse): +36%

- CAKE (Cheesecake Factory): +1%

We’re monitoring for bearish opportunities in these names as consumer demand shows signs of tempering.