Trend Watch -- Looking Ahead We knew this day would […]

Is Zoom (ZM) Video Dominance Waning?

Is Zoom (ZM) Video Dominance Waning?

It's time to read the writing on the wall. Zoom growth is slowing down.

In its last report, the company warned growth is expected to slow in future quarters, especially vs. a pandemic-fueled 2020.

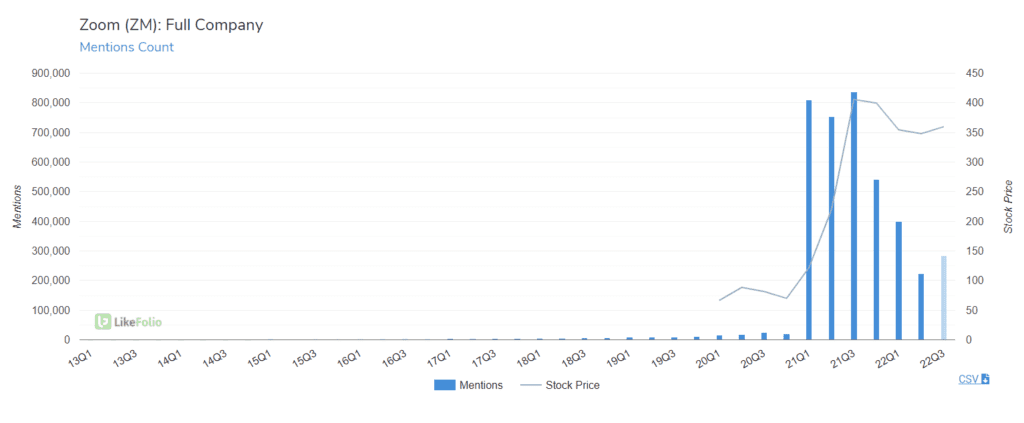

LikeFolio data certainly reflects this slowdown.

Zoom Mentions, the most highly correlated metric to Zoom revenue, decreased -70% YoY in 22Q2.

We are seeing signs of a seasonal boost as students return to schools and universities and resume usage, but these levels are much lower vs. 2020.

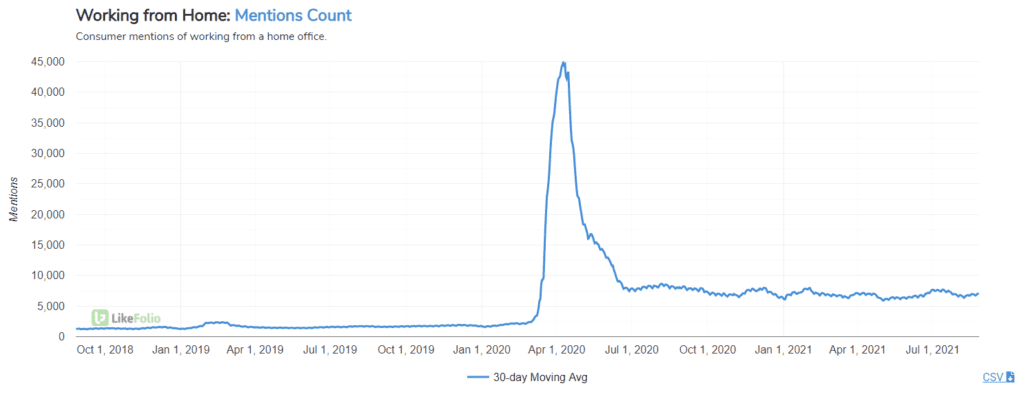

To be clear, the pandemic induced a massive shift in consumer behavior, accelerating the adoption of digital and "remote" technologies that Zoom provides.

You can see this permanent change so clearly on the working from home mention chart below. The "new normal" is much higher vs. 2019 (+300%).

However, This pull-forward effect can't last forever...

Zoom Purchase Intent, indicative of new user growth, has dropped -31% vs. last quarter. And mentions, indicative of regular usage, have dropped by nearly the same clip.

LikeFolio's Earnings Score is Bearish for ZM due to normalization in both of these metrics. Even though we aren't detecting major signs of cancellation, a slow-down in user growth may spook investors.

We'll be watching to see if the company can meet expectations when it reports 22Q2 earnings August 30 after the bell.