LikeFolio's Consumer Happiness data on Papa John's has been incredible […]

Monday Preview

June 6, 2022

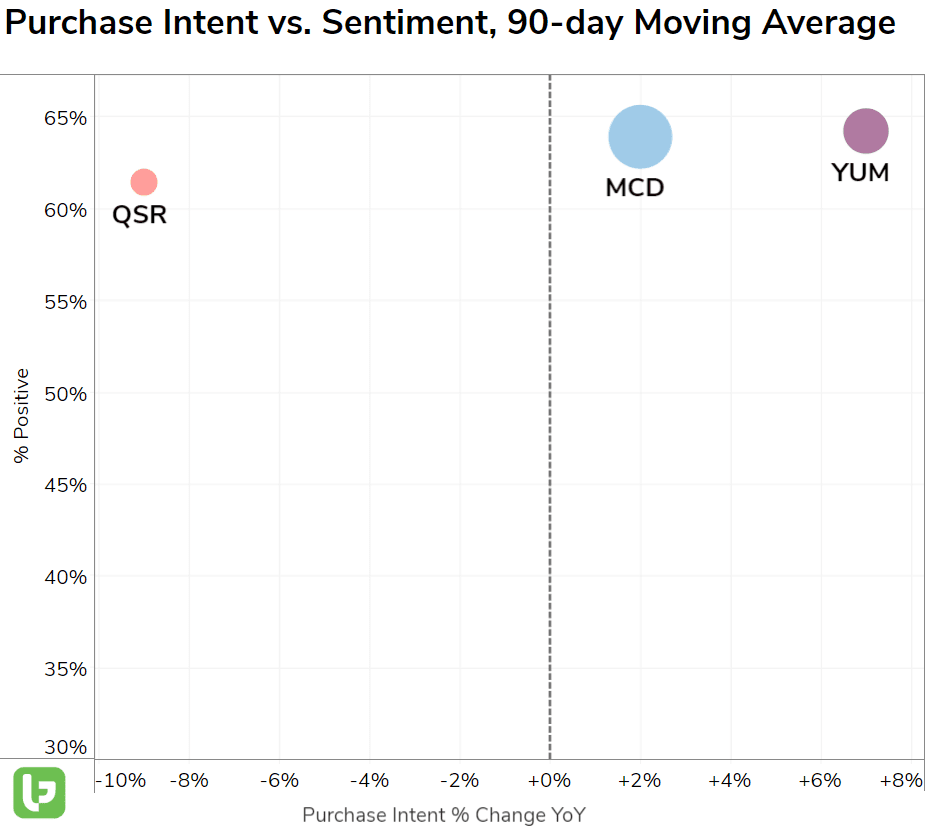

| Here are some key stats and data points on stocks LikeFolio is watching this week: Yum! Brands (YUM) |

- YUM Brands (YUM) demand is surging, most recently propelled by a more successful-than-expected launch of Taco Bell's Mexican Pizza.

- LikeFolio mentions of ordering Mexican Pizza from Taco Bell surged +185% higher vs. the last time the fast-food chain released the menu item 2 years ago.

- YUM shares are trading -14% lower in 2022, mostly due to underperformance in China and anticipated headwinds from suspended business in Russia.

- YUM is outperforming fast-food peers among English speakers, as consumers increasingly seek on-the-go options.

- Collectively, fast-food demand has risen by +26% YoY as consumers resume busy travel and social schedules.

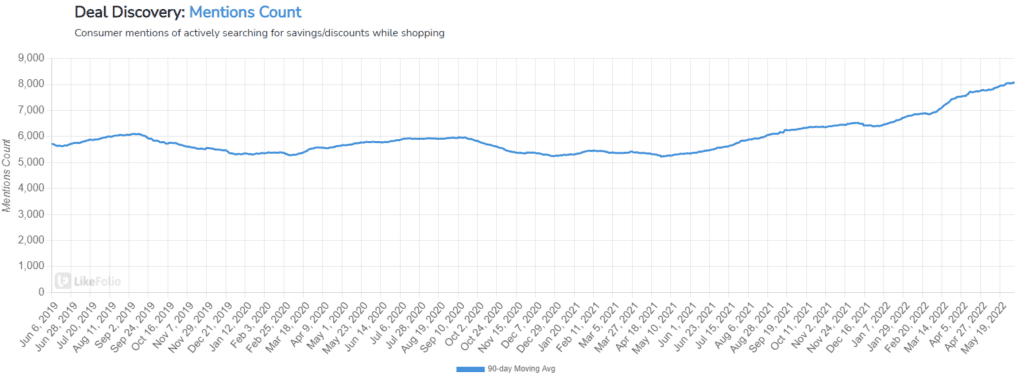

| Five Below (FIVE) |

- Discount retailer Five Below will post earnings for its latest quarter after market Wednesday, June 8th.

- With inflation rising, and Deal Discovery mentions climbing at +53% YoY, FIVE Purchase Intent and Overall Mentions are also creeping higher.

- Based on a 30-day moving average, consumer Purchase Intent Mentions are trending at +40% QoQ and +5% YoY, while Overall Mentions are pacing at +13% YoY.

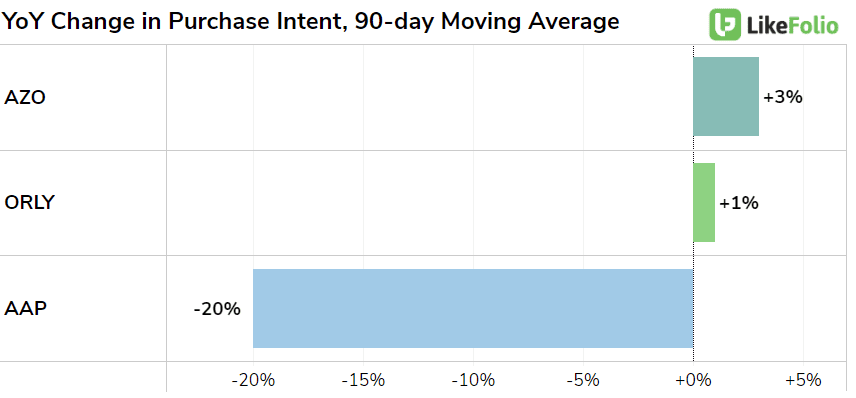

| AutoZone (AZO) |

- AutoZone is outperforming its peers (ORLY and AAP) within the auto part sector.

- AZO maintains more than 85% of overall auto parts retail mention volume and shows signs of market share expansion.

- Additionally, DIY Auto Maintenance is on track to peak high this season, currently pacing +15% higher on a year-over-year basis.

- On its third-quarter earnings report, AutoZone beat analyst expectations, sending the stock higher. But will continued supply chain issues eventually catch up with auto part retailers?

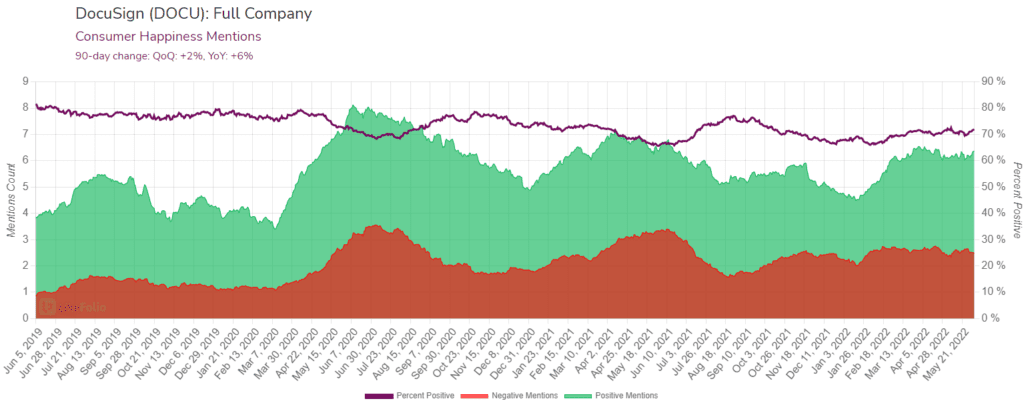

| DocuSign (DOCU) |

- DocuSign, a recent addition to the LikeFolio coverage list, is reporting earnings after market Thursday, June 9.

- Consumer Happiness is pacing at +2% QoQ and +6% YoY, giving it a positive sentiment score of ~72%.

- However, demand is slowing with consumer Purchase Intent at -8% YoY, driven by a decline in work from home trends.

- The company’s previous revenue guidance disappointed, and while demand is still well above pre-pandemic levels, DOCU shares are down more than 70% from their post-pandemic highs.

| CVS Health Corporation (CVS) |

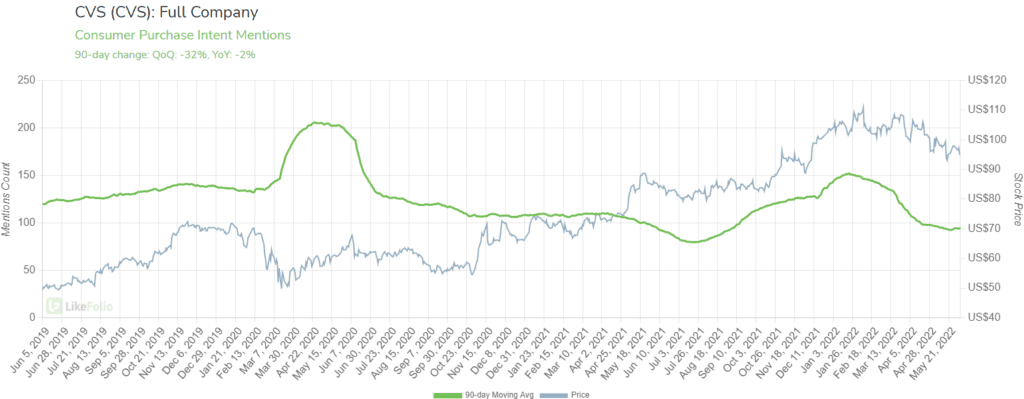

- CVS hasn’t been too significantly impacted by the broader market downturn this year, with its shares down only 8% in 2022.

- Nevertheless, the stock is one to watch this week. Demand is now declining at -32% QoQ and -2% YoY, fueled by a drop-off in Purchase Intent for its Pharmacy and Health services.

- Overall Mentions are sliding too, pacing -30% YoY.

- Consumer demand for its competitors is also falling (Rite-Aid -31% YoY, Walgreens -20% YoY), but their respective stocks have seen larger year-to-date declines.

- So, could we see a dip in CVS this week?

Want FULL Access? Click Here for LikeFolio Pro

Tags: