Last September we used Purchase Intent data to predict that […]

Monday Preview: $AAPL $KMX $PINS

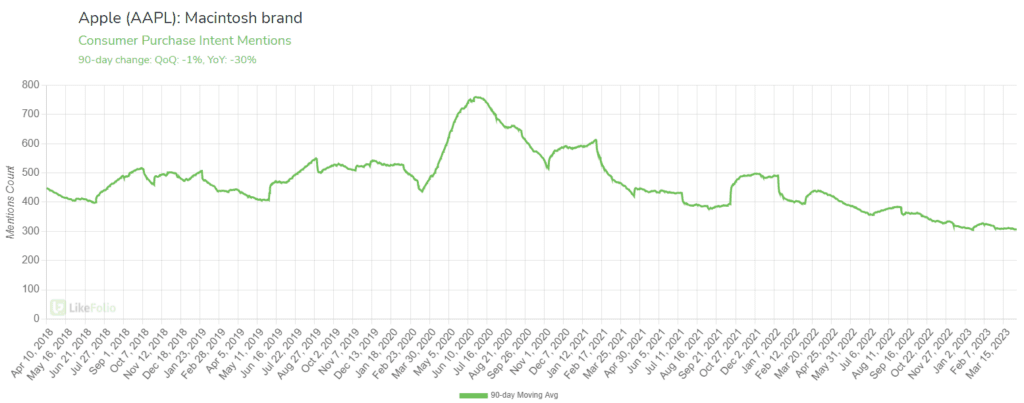

Apple (AAPL) in Hot Water over PC Concerns

Apple shares dipped today following reports that the company’s global computer shipments fell by -40% vs. the same quarter a year ago.

LikeFolio real-time data supports weakening demand for Apple’s Mac products – Purchase Intent mentions have dropped by -30% YoY and this weakness is intensifying (demand has slipped by -35% YoY on a 30-day Moving Average).

Last week Apple shares received a boost driven by suspected strong iPhone demand and production in Asia.

LikeFolio data reveals comparative weakness among English speakers, with demand capping off 23Q2 -25% lower on a YoY basis.

Apple reports Q2 earnings in early May, and early data points to hardware disappointment.

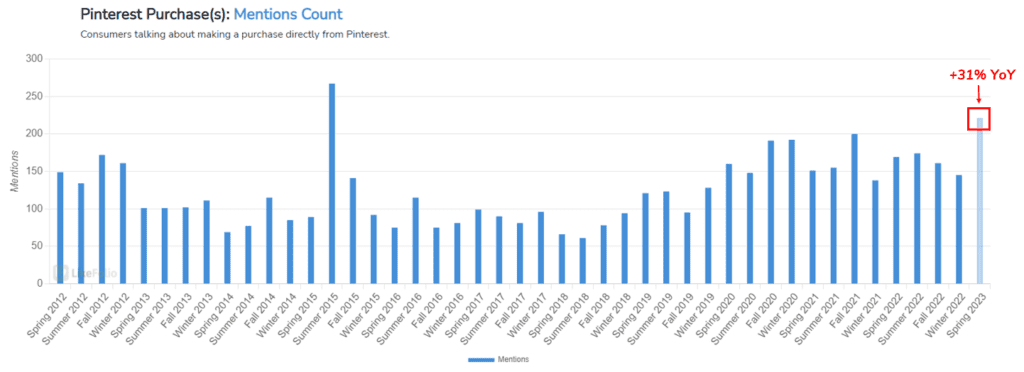

Pinterest (PINS) Poised for a Comeback?

We featured PINS as a potential big winner back in November due to:

- Improving Consumer Demand Metrics

- High Levels of Consumer Happiness

- Macro Trend Tailwind

- Stock Trading at Low (Comparative) Levels

Now it looks like Wall Street is catching on.

The company has logged praise from advertisers for its LiveRamp partnership to help clients better understand what is and isn’t working and better target consumers, which could help to drive budget increases.

Consumer mentions of completing a purchase of a brand or product discovered on Pinterest look strong this Spring, on pace to best last year’s mark by +31%.

PINS shares are trading +23% higher since LikeFolio’s initial turnaround watch flag in November.

CarMax Earnings: What We’re Watching

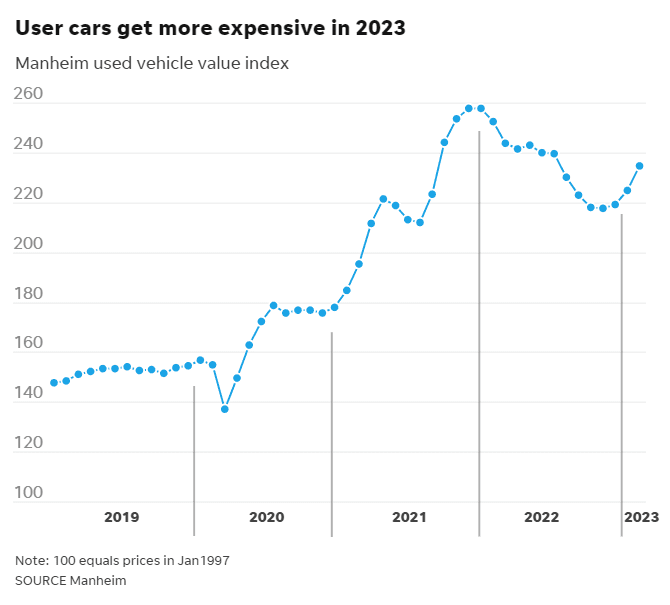

CarMax (KMX) faces persistent economic headwinds. Most significantly, higher rates and once-again-increasing used car prices are impacting new vehicle affordability and consumer demand. Used car prices rose +4.3% in February, re-igniting a major uptrend that began during the pandemic (see used car chart for reference). Used-car loan rates average ~10% for all buyers and just below 8% for those with excellent credit -- compare this to ~6% avg. rate for a new vehicle.

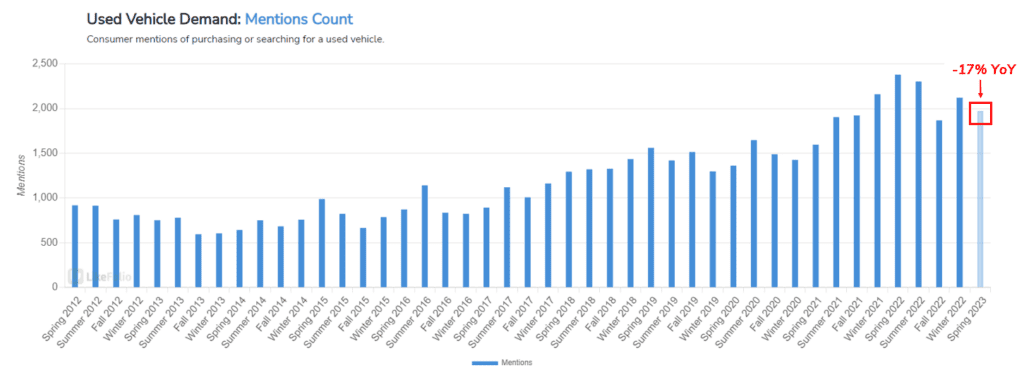

Used vehicle demand has slipped from late 2021/early 2022 highs, when new vehicle inventory was stretched and due to supply chain constraints and chip shortages. Mentions from consumers purchasing or planning to purchase a used vehicle are pacing -17% lower YoY.

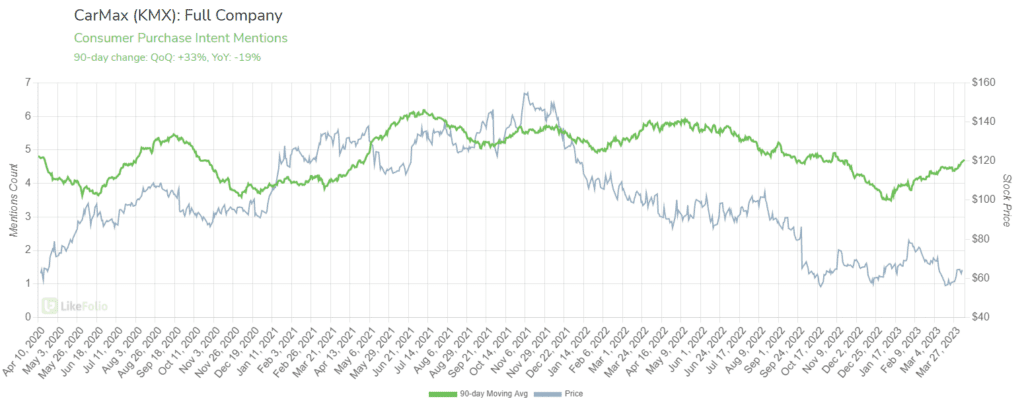

The hard truth for CarMax: Macro forces do appear to be weighing on consumer demand -- CarMax purchase intent is -19% lower vs. last year.

The good news for CarMax: the company is outperforming digital peers like Carvana and Vroom. KMX happiness has risen by +5% YoY to 61% positive. Consumers most often tout the stress-free experience that includes "no haggling." In contrast, Carvana happiness levels have slipped by -5% in the same time frame to 59% positive, and VRM trails far behind at 47% positive.

Looking ahead, CarMax is beating used-car peers and happiness improvements are a nice nod to the company's long-term prospects as economic conditions improve. Though demand is down YoY, so are shares: -40%. The market is already pricing in a nearly -12% decline in same-store sales.