Ulta is Making Strategic Moves ULTA is gaining momentum in […]

My top stock picks for beauty resurgence

Earlier today we sent LikeFolio members the November Trend Watch report.

And the timing was intentional.

All five of the names on the report are in the midst of what looks to be a brand resurgence…and likely at the top of consumer wish lists ahead of the holiday shopping season.

A few names almost made cut – the only issue?

These names have already been poppin’.

But high-level consumer macro trends are also screaming at us. Namely, one that reveals an uptick in consumer behavior among younger generations.

What are we talking about?

Beauty routines.

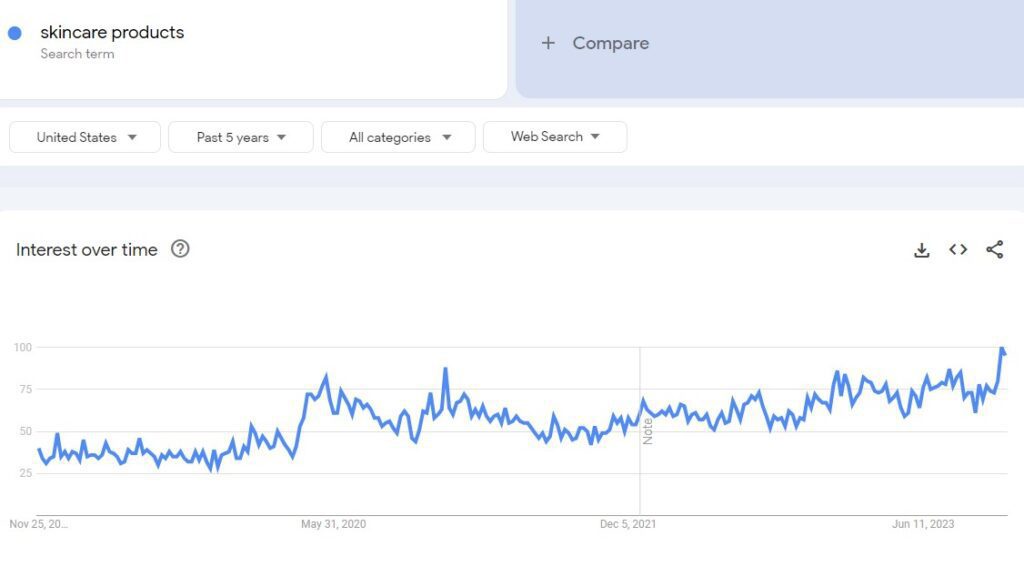

Consumer searches for skincare products are at multi-year highs:

And we’ve got our eyes on the future impact from Gen Alpha:

- Interest in Skincare Among Generation Alpha: Kids born in 2010 or later are increasingly interested in skincare, which is expected to boost beauty sales during the holiday season.

- Social Media's Role: Social media platforms, particularly TikTok, have a significant influence on Generation Alpha's skincare routines and product knowledge.

- Emerging Targeted Brands and Spending Power: Brands specifically catering to Generation Alpha are emerging. This generation, projected to be the largest in history, is expected to wield considerable purchasing power, potentially surpassing millennials and Gen Z.

Here’s why 2 names in the LikeFolio coverage universe could trade higher on the back of strong gift-giving and growing consumer demand.

- ELF Beauty (ELF)

ELF Beauty's recent earnings report for Q2 Fiscal 2024 revealed impressive growth figures. Net sales surged by 76% to $215.5 million, marking the 19th consecutive quarter of growth. This growth was largely fueled by strengths in both retailer and e-commerce channels as consumers clamor to keep their makeup bags full.

But keen investors should keep their eyes on this: ELF Beauty completed the acquisition of Naturium, a high-performance skincare brand, which is projected to contribute significantly to the company's net sales and EBITDA in Fiscal 2024. The company updated its fiscal 2024 outlook, now expecting a 55-57% year-over-year increase in net sales, which includes the addition of Naturium.

LikeFolio shows consistent growth, with mention volume on the rise again, outpacing stock gains:

- Ulta Beauty (ULTA)

In Q2 2023, ULTA Beauty reported a 10.1% increase in net sales, reaching $2.5 billion, with a comparable sales increase of 8%. The company's diverse product range and strategic initiatives significantly contributed to this growth. Key achievements included:

- Strong performance across major categories like skincare, makeup, and hair care, with notable contributions from brands like Bubble, BYOMA, and Beautycounter.

- Innovative events like the Big Summer Beauty Sale, driving sales and market disruption.

- Double-digit growth in services, emphasizing newer services like ear piercings and keratin treatments.

- Enhanced digital and omnichannel presence, including virtual try-on tools and mobile app improvements, bolstering customer engagement.

These efforts, alongside a focus on clean, cruelty-free, and inclusive product offerings, have strengthened ULTA Beauty's position in the beauty market, reflecting a deep understanding of consumer trends and preferences.

LikeFolio data confirms forward-looking momentum.

Buzz growth is diverging greatly from recent stock performance:

The company is slated to report earnings next week, and the current set up is tantalizing.

We’ll be watching out for other major beneficiaries in this space, and members will be the first to know when we spot opportunities.