When social-data and stock price are moving sharply in opposite […]

New traders are flexing...

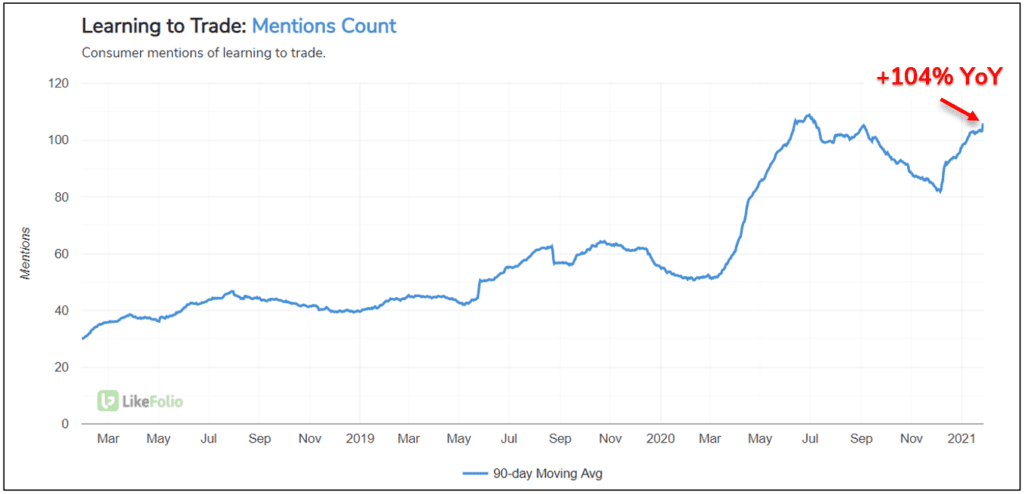

Trend Watch: Learning to Trade

Over the past year, LikeFolio trend data has shown a massive increase in the number of consumers talking about learning to trade. Looking at the trajectory of the chart below, there is a clear adoption spark as the market tanked alongside the dispersal of $1200 stimulus checks in April 2020. These mentions are surging again: New Trading Mentions increased +104% YoY in the past 90 days. Mentions like this.

Robinhood

Speaking of new traders...

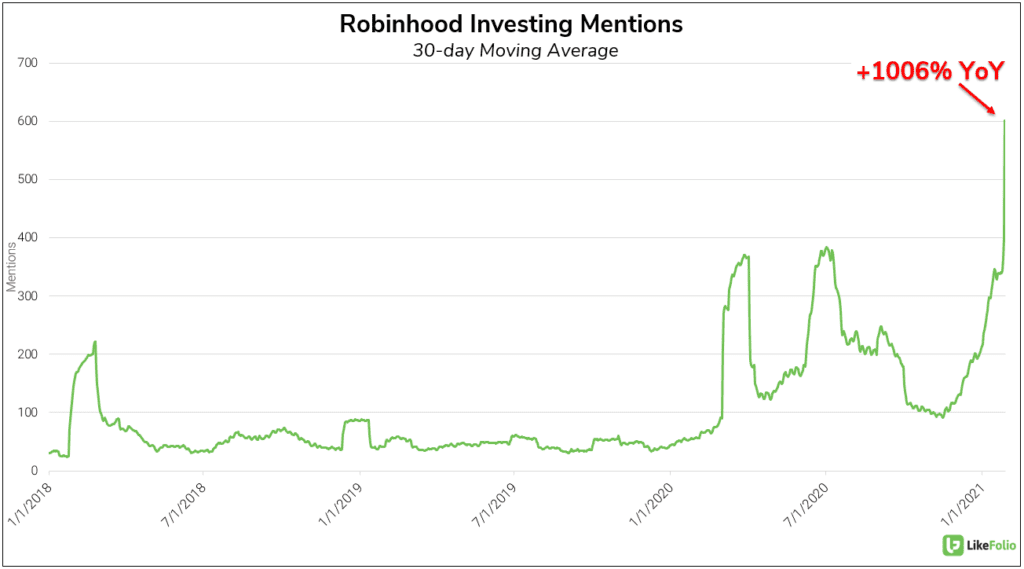

It’s not a stretch to say that the previous trend is closely linked to the unprecedented market events seen in the past week, especially considering the new traders’ platform of choice: Robinhood.

Robinhood’s simplistic design and lack of fees has made it the trading platform of choice for many market newcomers. Consumer mentions of investing in stocks and cryptocurrency using the Robinhood app are up a whopping +1006% YoY.

Today, the upstart brokerage made the controversial decision to stop users from buying shares of GameStop (GME), following a concerted effort from many of its user to send the stock “to the moon.”

Considering that the recent surge in usage was due to the popularity of GME and other “meme stocks” -- popularized by Reddit's WallStreetBets forum -- this move could have major consequences for Robinhood. Tweets reveal concern on both sides of the political spectrum.

In fact, some users are already filing lawsuits against Robinhood as a result of its GameStop trading restrictions.

We’ll be closely monitoring the fallout in the coming days and months...