Nike reported an awesome quarter Tuesday evening. The stock is […]

NKE: Ready to Fly?

Nike’s last earnings event was a breath of fresh air for investors.

The company finally got a handle on operational headwinds that weighed on the stock in the first half of the year.

Nike's recent operational strategies and efforts to improve margins reflect a focused and adaptive approach to the challenges in the retail and manufacturing sectors.

Behind the scenes, Nike has been actively working on optimizing its supply chain and inventory management. This is evident from the 10% reduction in inventory compared to the previous year, a strategic move that not only reduces storage and holding costs but also minimizes the risk of excess stock leading to heavy discounting.

From a margin perspective, Nike is implementing several key initiatives. One of the primary strategies is the improvement of gross margins through strategic pricing moves. This involves carefully balancing the price points of their products to maximize profitability without alienating their customer base. Furthermore, Nike is focusing on reducing production costs.

Perhaps the most significant area of focus, at least from LikeFolio’s perspective, is the shift towards more direct-to-consumer (DTC) sales.

By selling directly through its own stores and online platforms, Nike is able to bypass intermediaries, which not only improves profit margins but also gives them greater control over brand presentation and customer experience. This DTC approach is complemented by a robust digital presence, harnessing e-commerce and digital marketing to reach a wider audience more effectively.

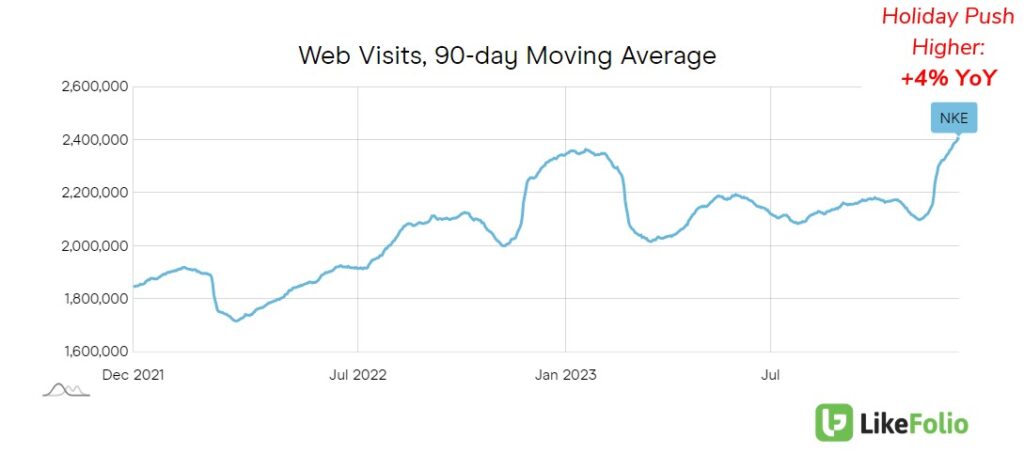

Data suggests it’s paying off.

NKE web traffic is up +4% this holiday season – you can see it jump during Black Friday shopping last month.

Nike anticipates its revenue to increase by a mid-single-digit percentage for its full fiscal year. Currently, analysts predict a revenue growth of around 4% -- right in line with trending metrics.

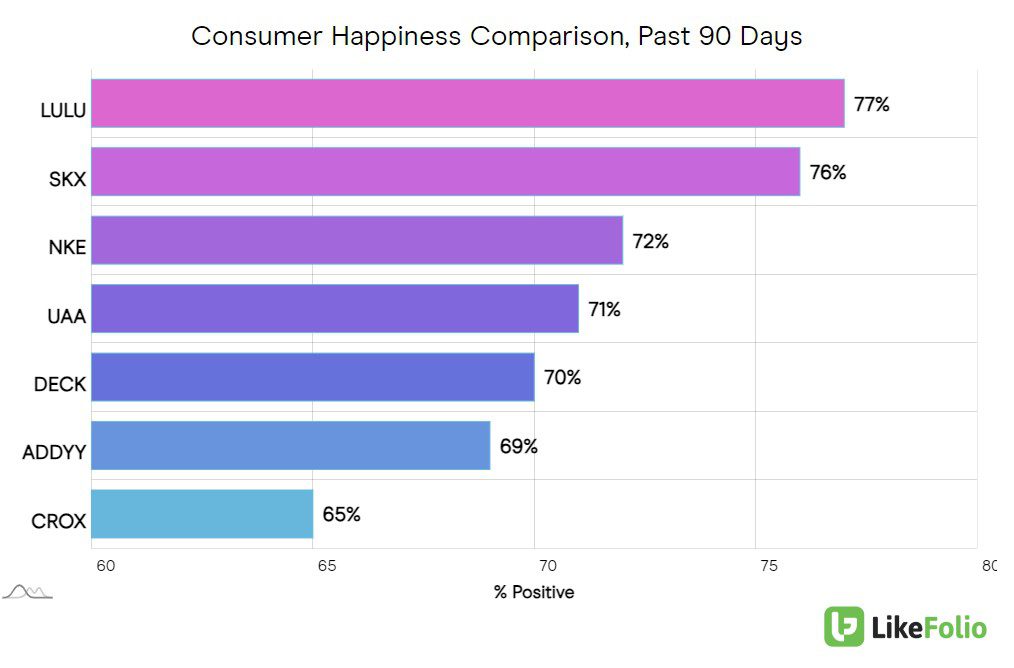

In addition, Nike has improved its overall consumer happiness ratings over the last year, placing it in the upper echelon of footwear and apparel retail peers (up +5% on a YoY basis).

What is driving growth?

Its Jordan Brand, its NIKE Stores, and premium offerings in China.

While we can’t speak to performance internationally, we can see continued traction in Nike’s Jordan brand, with mentions up +6% YoY, outperforming digital traffic at large.

Heading into earnings our signal is Bullish, propelled by perhaps higher than expected consumer metrics and a more organized structure under the hood.

Note: NKE is a key retailer who has faced shrink aka organized retail theft. Any mentions here could send shares lower despite a strong report.