Roku makes streaming devices that allow its customers to stream […]

Santa’s A-Team: Amazon $AMZN

Question for readers: if you had to pick a reindeer team to pull Santa’s sled, which team are you choosing – Amazon, FedEx, or UPS?

If you picked Amazon, you’d probably end up with the happiest customers.

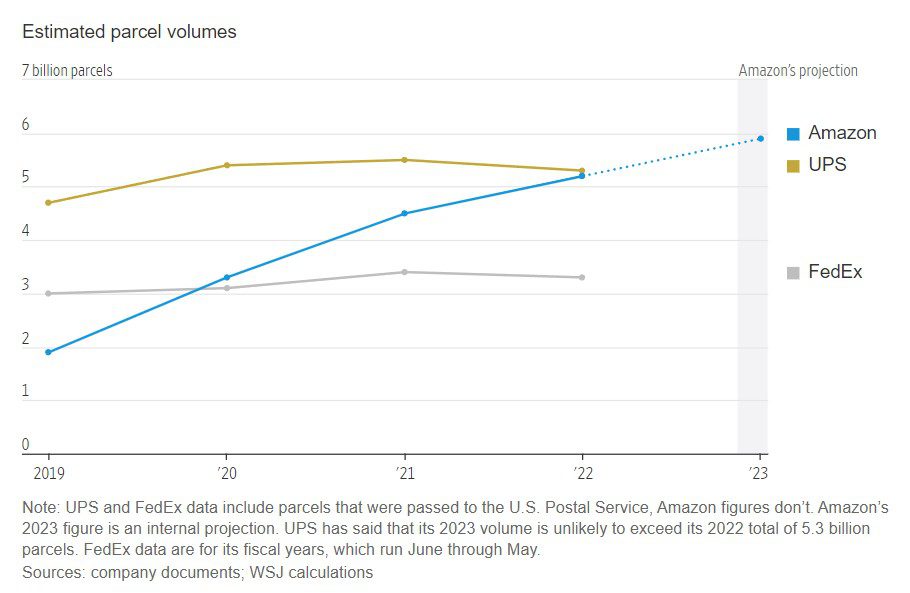

Amazon now leads major fulfillment specialists in parcel volumes. The company’s fine tuning of its delivery strategy to improve customer satisfaction and speed of delivery is only one example of how the company is providing value to consumers.

And it shows.

Over the past year, Amazon's stock (AMZN) has seen a significant increase, outperforming other major tech companies (like AAPL, MSFT, and even NFLX) with an over 80% rise in value.

This strong performance raises a critical question for Investors, especially as the company inches closer to levels where it was trading during its pandemic glory: Will Amazon continue on its upward trajectory, or is it poised for a correction?

LikeFolio data suggests the company still has more room for upside. Here’s why:

Ad Spend Beneficiary

The company's advertising sector, still in its early stages, is on track to generate an impressive $46.5 billion in revenue for 2023. This growth is particularly noteworthy as advertising budgets are expected to return closer to their pre-pandemic growth rates. The planned introduction of advertising on Prime Video next year is anticipated to further bolster this revenue stream, a strategy that has yielded positive results for competitors like Netflix.

eCommerce Winner

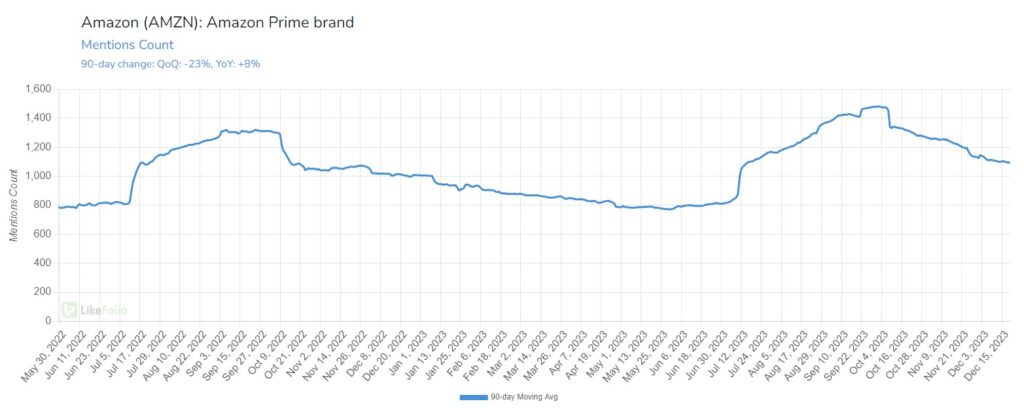

Amazon Prime, the company's flagship subscription service, is poised for a robust holiday season. Data from LikeFolio indicates an 8% year-over-year increase in Prime mentions, outperforming other major retailers like Target and Walmart.

Moreover, the service's customer satisfaction, as reflected in its happiness rating, has seen a year-over-year increase of 7 points. This uptick suggests a strengthening relationship between Amazon and its consumer base, which could translate into sustained revenue growth.

Logistics King

In the realm of logistics and delivery, Amazon has surpassed industry giants FedEx and UPS in parcel volume as of 2022 and is expected to further extend its lead.

This dominance in logistics is a strategic advantage, enabling Amazon to offer faster delivery times, which in turn enhances customer satisfaction and loyalty.

The company's recent earnings call highlighted the growth in purchases of consumables and everyday essentials, indicating that consumers are increasingly relying on Amazon for a broader range of their shopping needs.

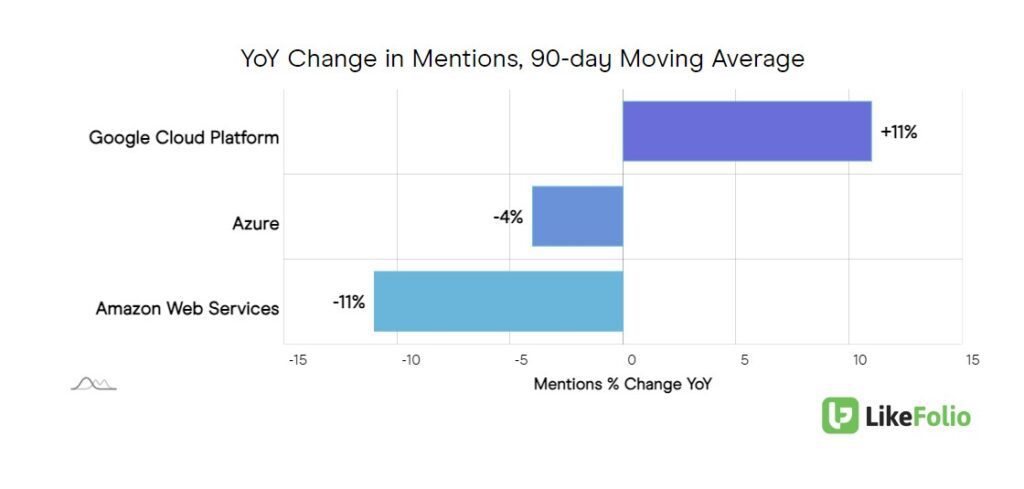

Aside from these positive indicators, Amazon's cloud computing segment, AWS, faces challenges.

The growth rate for AWS decelerated from 35% in 2019 to under 15% in 2023.

LikeFolio data suggests that this trend may continue, with AWS trailing behind other cloud services in terms of mention buzz momentum.

This slowdown is a critical area for investors to monitor, given AWS's significant contribution to Amazon's overall profitability.

We’ll be watching for increased engagement at the start of the new year, driven by generative AI improvements. On its last call, Amazon noted, “The number of companies building generative AI apps in AWS is substantial and growing very quickly, including adidas, Booking.com, Bridgewater, Clariant, GoDaddy, LexisNexis, Merck, Royal Philips and United Airlines, to name a few. We are also seeing success with generative AI start-ups like Perplexity.ai who chose to go all in with AWS, including running future models in Trainium and Inferentia.”

This adoption could help to turn the company’s cloud growth rate around.

Bottom Line: Amazon is still a Beast Likely Worth Betting On

Looking ahead, Amazon's strategic position in advertising, retail, and cloud computing sets a promising stage for 2024. While AWS faces growth challenges, the company's broad and diversified business model, coupled with a strong track record of innovation and market adaptation, provides a solid foundation for future growth. As investors consider their positions, the multifaceted nature of Amazon's business and its proven ability to evolve should be key factors in any long-term investment strategy.