In regard to trading volume, Coinbase is the largest cryptocurrency […]

Our top stock of 2024

Peter Lynch's rise from a golf caddy to the head of the Fidelity Magellan Fund is a remarkable journey. His early interactions with Fidelity executives sparked a deep interest in finance, leading him to pursue a career in investment.

At Fidelity, he transformed the Magellan Fund, achieving an impressive average annual return of 29.2% -- more than double the S&P 500 stock market index and making it the best-performing mutual fund in the world. His guiding principle, "Know what you own, and know why you own it," emphasized a deep understanding of investments.

Lynch's approach was hands-on.

He championed the idea that by understanding the fundamentals of a business, its products, its competitive edge, and its place in the industry, an investor could invest not just with their capital but with conviction.

This conviction, according to Lynch’s philosophy, is what separates successful investors from the rest.

And it is with conviction that LikeFolio is stepping into 2024.

Our conviction lies in powerful consumer data, dripping into our system in real-time.

By understanding several powerful layers of metrics for tickers on the company, brand, and even product level helps us to know what we own.

The company we’re about to review is officially our top pick of 2024.

- Coinbase (COIN) Poised for Major Growth: The Rise of DeFi in 2024

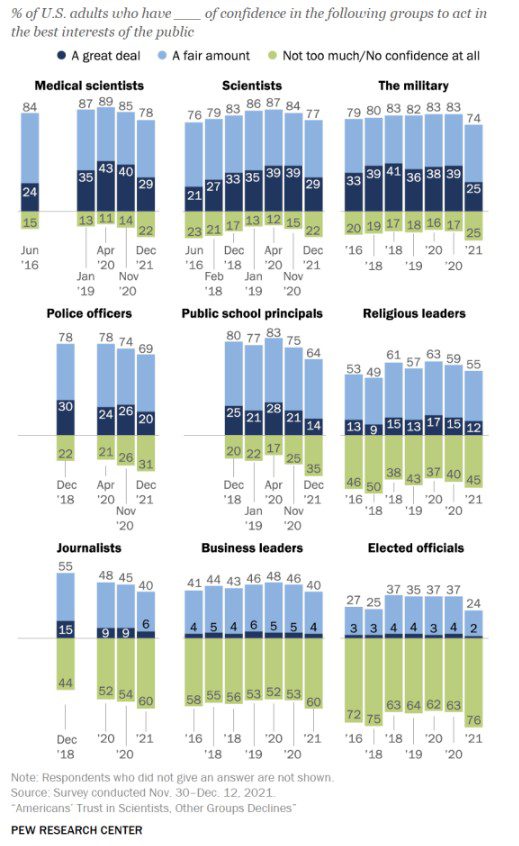

2024 is shaping up to be the year of Decentralized Finance (DeFi), driven by a profound shift in trust away from traditional institutions at large.

This skepticism denotes a significant transformation in consumer sentiment, marked by a desire for more autonomy, transparency, and resilience against traditional economic fluctuations.

The recovery of the DeFi market is evidenced by key metrics, particularly the total value locked (TVL) and transactional volume. The TVL, which measures the amount of assets committed to DeFi protocols, is nearing $50 billion. This marks a significant recovery from its October low, reflecting increased participation, capital inflow, and adoption levels in the DeFi sector.

Political discourse and economic upheavals are further fanning the flames, marking 2024 as a pivotal year for DeFi's move to the financial forefront.

- Rising Consumer Interest and Strong Sentiment: Coinbase at the Helm

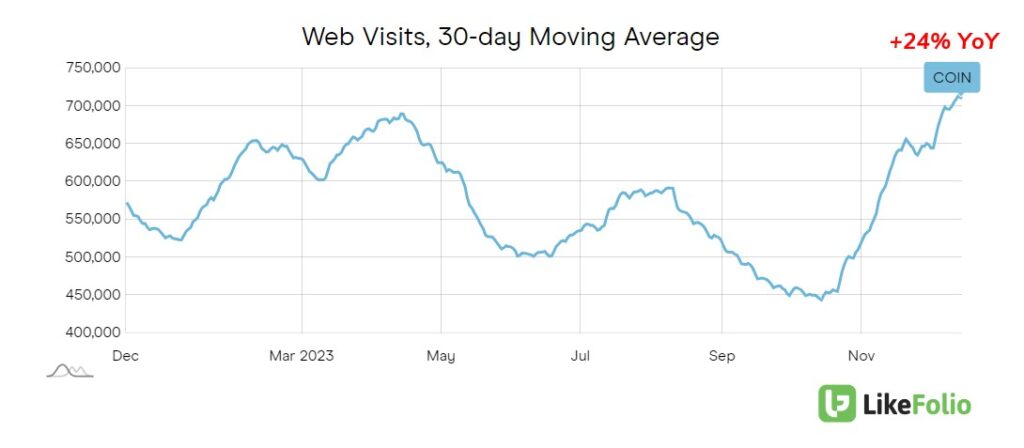

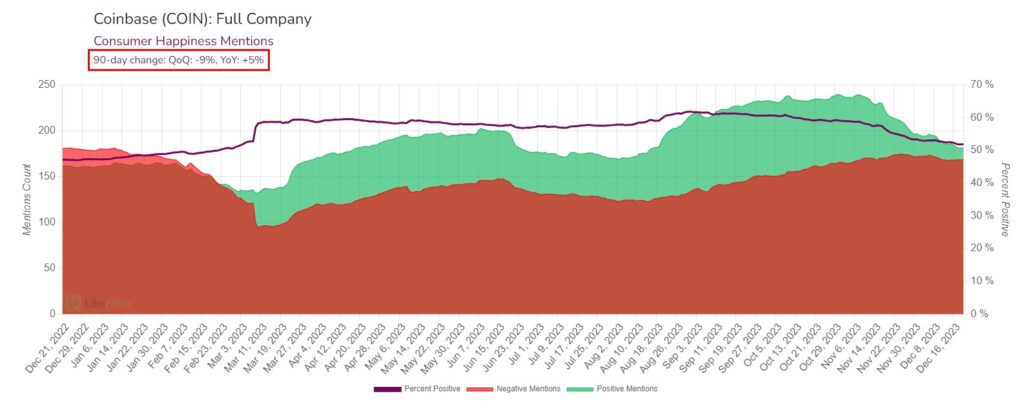

The increasing interest in DeFi is mirrored by the rising consumer engagement with platforms like Coinbase.

A notable uptick in web traffic and consumer searches for Coinbase indicates a growing demand for its services.

The platform's ease of use and higher trust levels compared to peers have contributed to a positive sentiment shift.

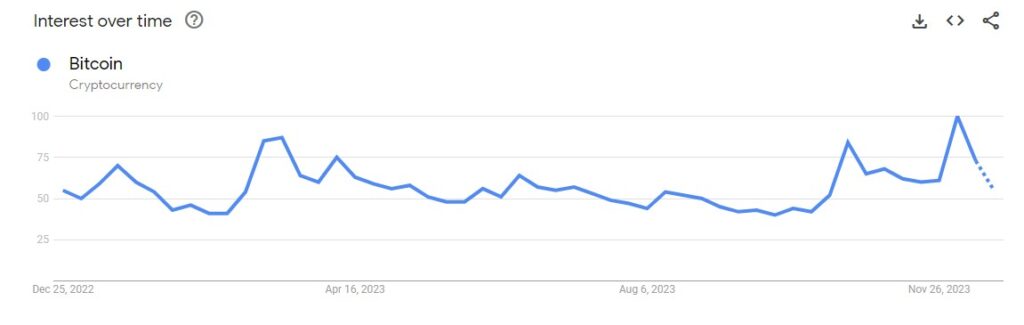

So has interest in cryptocurrency on a larger scale.

Google search interest suggests Bitcoin’s buzz is only rising YoY:

As Bitcoin's price soars (up more than +150% YTD), reflecting renewed investor confidence, Coinbase's revenue, which benefits from the cryptocurrency's trading volume, is poised for growth.

3. Coinbase's Strategic Moves: Expanding Crypto's Utility

Coinbase is actively shaping the future of finance.

Recognizing that crypto's utility extends beyond a store of value and trading, Coinbase is developing its product strategy around updating the financial system with innovations like stablecoins and staking services.

The recent launch of the Coinbase Wallet feature, allowing instant, fee-free money transfers via simple links, exemplifies the company's commitment to making financial transactions more accessible and efficient.

This forward-thinking approach positions Coinbase to be a potential tech giant of the future, leading the charge in the realm of decentralized services.

Bottom Line

In 2024, our approach is straightforward: trade and invest with conviction, a principle that has consistently driven successful investors.

Right now, that conviction lies in DeFi…and more importantly, Coinbase (COIN).

Looking ahead, we’ll continue to leverage powerful consumer insights to help traders and investors truly know what they own – and test their own hypothesis, unveiling more opportunities like COIN.