Macy's reports earnings on August 15th. The stock has run from $17 to nearly $42 since late 2017. Is there more in the tank, or is the stock ready for a breather?

Earnings Season Countdown

Earnings Season is upon us.

For earnings season pass holders, that means Sunday Earnings Sheets will begin hitting your inbox in just under 2 weeks! (We can’t wait either).

Now is a great time for a quick refresher course to set our minds right.

Here’s a quick overview of HOW earnings season works – and why it’s so powerful.

Let’s go!

What is Earnings Season Pass?

Earnings Season Pass is a great way for traders to play company earnings reactions. It’s also a great tool for longer-term investors to have to help manage their portfolios – is it time to close out positions, or add to it? Use real-time data from the mouths (and clicks!) of consumers to understand how consumer demand and happiness is trending. Each season lasts 10 weeks, aligning when companies report quarterly earnings). Naturally, there are 4 seasons a year, to match each quarter. LikeFolio delivers a Sunday Earnings Sheet every Sunday of the season that features a powerful signal for each company in our world set to report in the upcoming week.

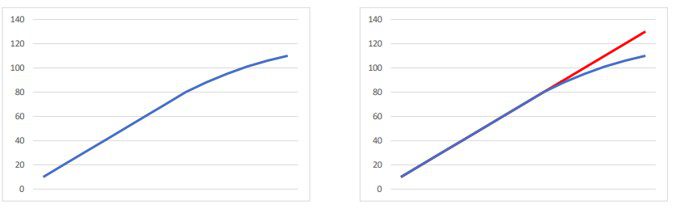

How it Works (the math)

Signal Creation: At LikeFolio, we track a lot of metrics – from consumer happiness to actual mentions of purchases (demand) and even web traffic stats, like visits to company websites. We use ALL of these metrics to create a single score that drives our earnings signal: the LikeFolio Earnings Score.

LikeFolio Earnings Score: a proprietary score indicating how bullish or bearish we are for this company’s earnings reaction. Scores will range from -100 to +100, with negative numbers being a bearish indication, and positive numbers being a bullish indication. The larger the number, the stronger the indication. It takes into account the values of Demand Growth, and Happiness Growth, as well as how predictive those metrics have been in the past for each specific company. This means each company’s score is carefully calibrated and fine tuned to lean on the most predictive metrics we’re tracking. Powerful stuff.

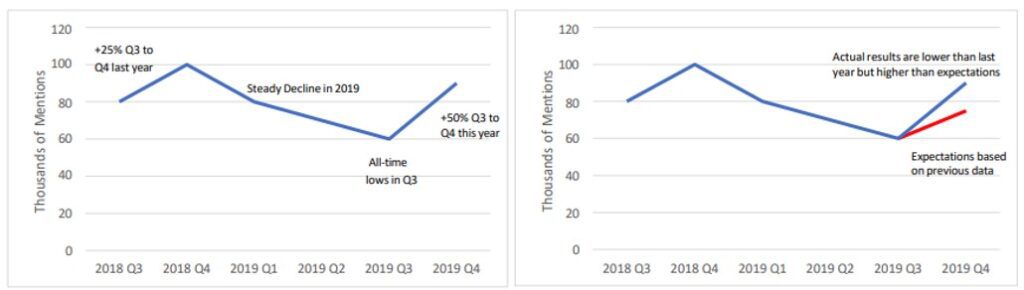

Setting the bar: We account for expectations and seasonality. This means that demand levels at all-time highs may not result in a bullish score if the rate of growth has slowed.

Conversely, demand levels lower than previously established but now growing at a faster clip could result in a bullish score.

Bottom line: we are gauging where the bar is set, and whether or not data suggests the company can clear it.

Members can expect the first Sunday Earnings Sheet on Sunday, Jan. 14.

And next week will officially be EARNINGS PREVIEW WEEK.

Get pumped!

P.S. It’s not too late to get in on the earnings action or protect your portfolio. Simply reply to this email to find out how to access LikeFolio Earnings Season Pass.