Modelo, Corona Hard Seltzer driving $STZ Demand Last quarter, Constellation […]

Dry January? Not for Modelo (STZ) shareholders!

On a typical evening out, you might notice a shift in the drink choices of your buddies. Less often is it the light lagers of old, and more frequently, it's a dark, rich Modelo.

This isn't just a random preference; it's a trend mirroring a broader movement within the beer industry, one that Constellation Brands (STZ) is capitalizing on with its diverse portfolio, particularly with Modelo.

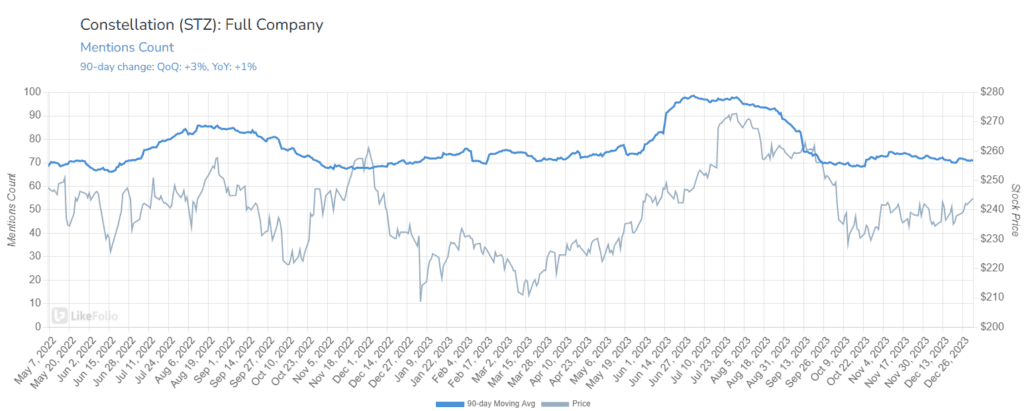

As we approach STZ's earnings, a modest 1% increase in mentions from last year doesn't tell the whole story.

The beer industry is navigating choppy waters, with U.S. beer sales on track for their lowest point since 1999, as younger consumers pivot to spirits and recent controversies tarnish the reputation of once-favorites like Bud Light. But here's where Constellation Brands bucks the trend.

Last quarter, Constellation's beer segment saw a robust 12% growth in sales year-over-year, propelled by an impressive 9% increase in shipments.

Leading this charge?

Modelo.

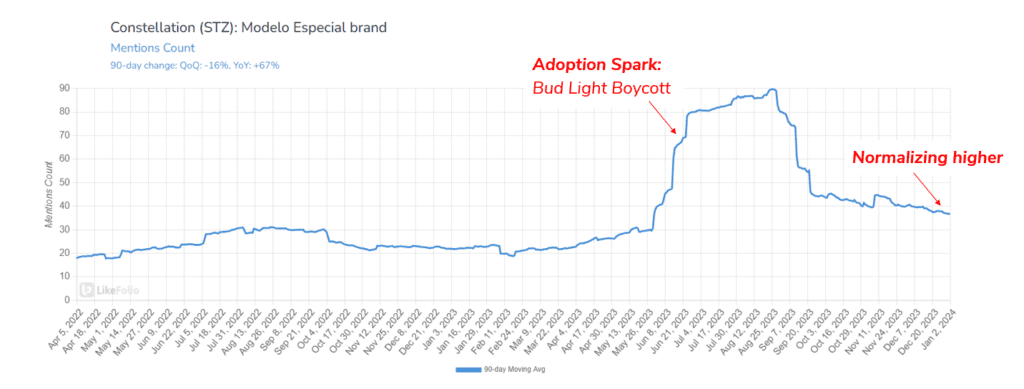

This brand didn't just inherit the "best-selling brand in the US beer category" title post-Bud Light's fiasco; it was already on an upward trajectory.

The LikeFolio data underscores this success. Following the backlash, Modelo held on to a consumer adoption surge and appears to have fostered lasting loyalty.

Even months later, mentions remain a significant +67% higher year-over-year. This isn't just growth; it's sustained momentum, a critical factor as STZ heads into earnings.

Constellation's portfolio isn't just about beer. With brands like Meiomi (wine), Corona, High West (whiskey), Prisoner (wine), Funky Buddha (craft beer), and Pacifico, it's a testament to the company's adaptability and understanding of evolving consumer tastes. This diversity provides stability and a strategic advantage in a volatile market.

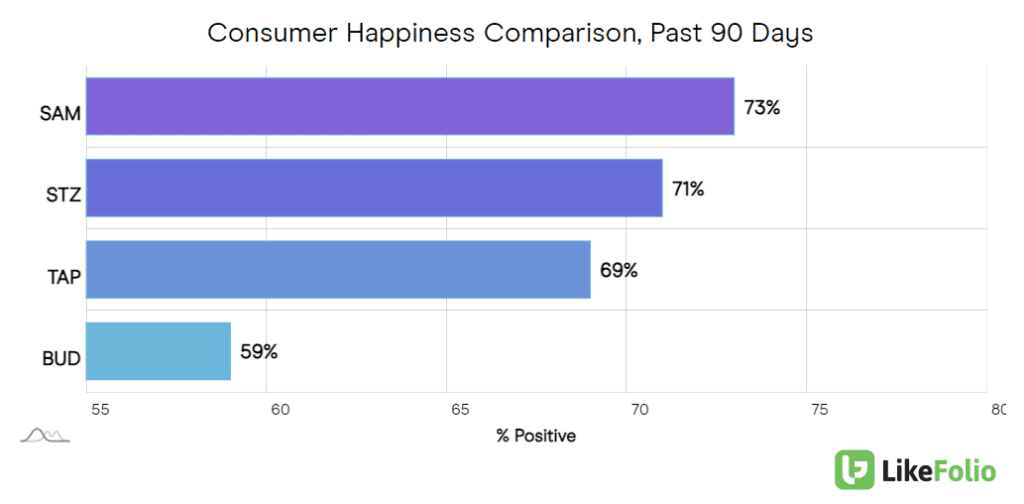

This breadth also contributes to Constellation's standing in the LikeFolio happiness rankings, with a commendable 71% positive sentiment – in the upper echelon with niche brewer Boston Beer Co (SAM).

As we lean into earnings, our signal is right on the neutral-to-bullish line. Modelo's strength is particularly promising. If Constellation can also surprise with its wine and spirits, particularly with powerhouses like Meiomi and Kim Crawford, it's set to clear the bar comfortably, especially considering the stock’s pullback from July highs.

In essence, while the beer industry grapples with changing tides, Constellation Brands, led by Modelo, is navigating these waters with a steady hand and a clear vision. Keep an eye on this one; it's shaping up to be a story of resilience and strategic triumph.