United Airlines (UAL) When it comes to consumer Purchase Intent […]

The second-best airline has our attention

As we buckle up for earnings season, our research team is zooming in on some of the most anticipated names set to report in the upcoming weeks.

Among them, we're keeping a particularly close eye on a company that's currently ranked second in our airline coverage universe.

While being in second place might seem unremarkable, it's the market expectations around this company that have piqued our interest.

Despite showing signs of gaining traction with consumers, is stock has lagged behind all major competitors over the last quarter.

And with earnings on the horizon, this could spell an opportunity for investors to capitalize on any potential surprises.

The company in question? United Airlines (UAL).

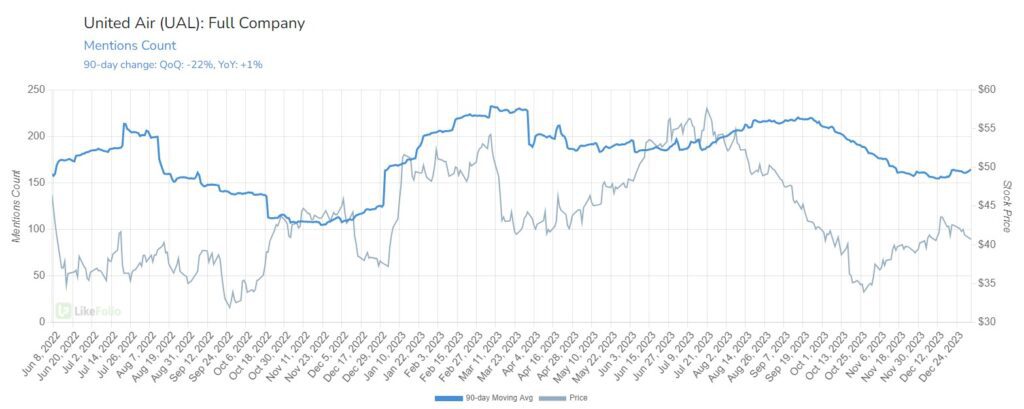

UAL stock has trailed all peers over the last 3 months, trading about ~4% lower while the rest are flat to slightly positive (DAL leading the way at +7%).

You can see an even more drastic decline from July highs on the chart above in gray.

What’s going on?

United Airlines reported a stronger-than-expected performance in Q3 with adjusted earnings per share of $3.65 and revenue of $14.48 billion.

However, Q4 guidance was impacted by rising jet fuel costs and the halt of flights to Tel Aviv due to the Israel-Hamas conflict, leading to lowered earnings projections and a near 10% drop in United shares. Additional factors like higher labor costs, delayed aircraft, and air traffic controller shortages contributed to a bleak Q4 outlook.

Translation: the bar is low.

But some metrics are shaping up for United in the LikeFolio universe.

Consider the following:

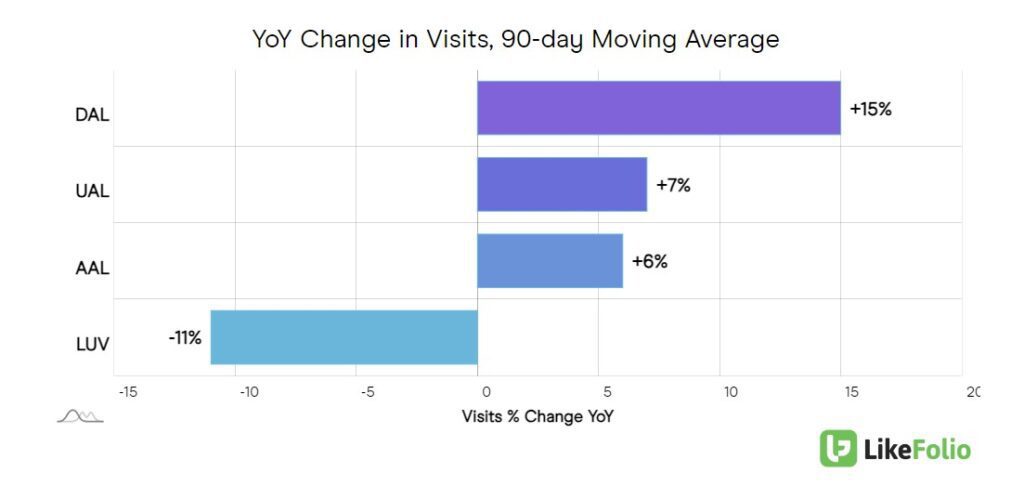

- Web visits are up +7% YoY, trailing only Delta (DAL).

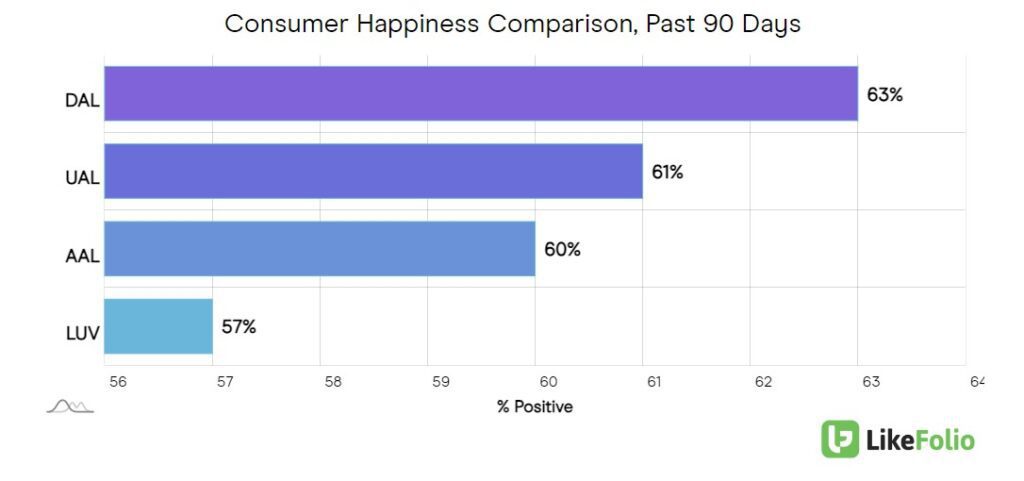

- Happiness metrics paint a similar ranking, with UAL at 61% positive:

This move into the upper tier has been driven by the company’s own strategic offerings.

United has been beefing up premium offerings and it seems to be resonating with consumers, boosting happiness and brand value at large.

For reference, last quarter premium plus capacity was 5 times what it was in the same quarter in 2019. The company also plans to increase first class seats by departure by +80% by 2027 as the airline notes consumers willing to pay more for an elevated experience.

These moves may lead to long-term customer acquisition.

On the macro front, travel appears robust (for now).

Mastercard noted that despite inflation claiming a larger chunk of change for essentials, consumers are prioritizing discretionary spending that matters most to them, and right now that means events and travel.

TSA throughput stats confirm this. The number of travelers recorded in the month of December '23 was nearly 10% higher vs. December '22.

Bottom line: Competitive levels of happiness and web traffic make this name an attractive name to watch for long-term investors.

But decelerating mention volume (flipping negative on a 30-day moving average), and international weakness in China and amid the Israeli conflict gives us room for pause.

We'll be evaluating this name again before earnings in a few week to determine if the opportunity is ripe...