Nordstrom is the biggest gainer in the S&P 500 today -- here's how LikeFolio data predicted the move.

Nordstrom Thrives when Consumers Shop In-Store

May 25, 2021

Nordstrom Thrives when Consumers Shop In-Store

Nordstrom data reveals a mixed bag heading into earnings.

Bright Spots

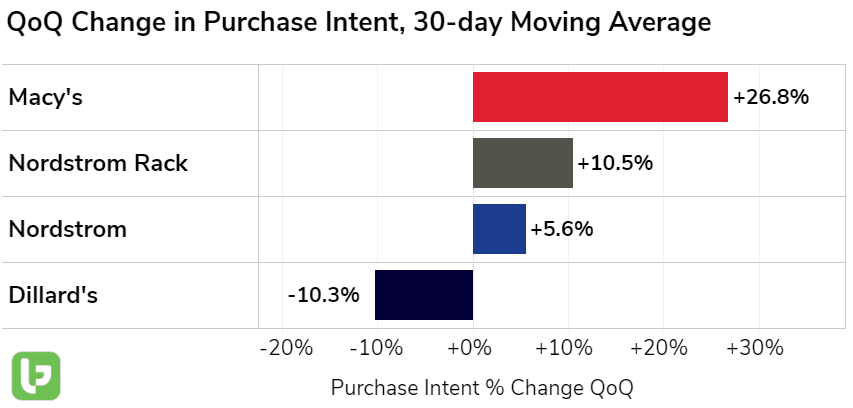

- Nordstrom Rack near-term strength: Consumer mentions of shopping at/from Nordstrom's discount arm are showing signs of traction: +10.5% QoQ -- this is in line with the overall uptick in apparel shopping we've recorded, and higher vs. the flagship Nordstrom Brand. This is also a very different story vs. TJX (-14% QoQ), who suffered from international closures.

- Happiness Rebound: JWN Consumer Happiness has improved by 8 points YoY as consumers return to stores. Nordstrom Happiness was dinged during Covid as shores were shuttered.

- Nordstrom's edge comes from its in-store experiences and outstanding customer service...essentially non-existent in the age of social distancing and limited personal interactions. This is driving the sentiment rebound.

Weak Spots

- Digital Execution. Nordstrom was unable to replicate its outstanding in-store experience online, and the company has room for fulfillment improvement. In Q4, ~10% of online orders were picked up in stores and ~30% of online orders were fulfilled from stores. This is much lower than retailers like TGT, and even KSS for that matter.

- Digital demand growth has normalized. eCommerce mention growth boomed during the onset of the pandemic, and even during the last holiday season, and has since normalized.

JWN releases 21Q1 results on May 25 after market close.