Why has Avis Budget Group Gained +275% in 5 Months? […]

Now Trending: $CAR

CAR shares popped this morning on Morgan Stanley upgrade news.

The premise?

Avis Budget is operating a larger fleet vs. peers and getting more value per unit.

This upgrade has only fanned the Bullish flames for Avis Budget Group (CAR) stock.

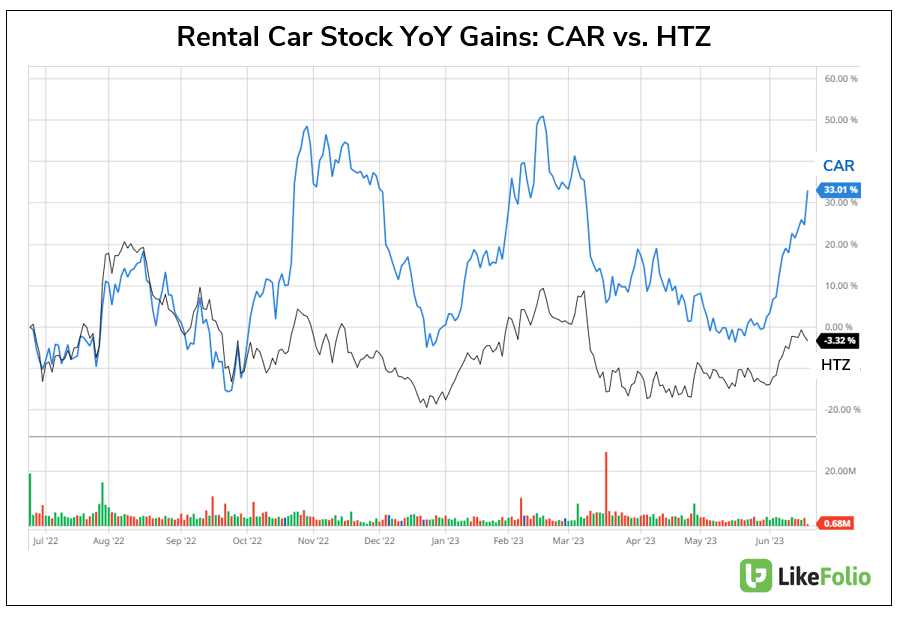

As you can see on the chart below, CAR shares are significantly outperforming rental peer and marketshare leader, HTZ, over the last year: +33% vs. -3% on a YoY basis.

As investors, it’s time to ask ourselves: is the recent upgrade and stock rally justified?

Based purely on consumer momentum, not necessarily.

LikeFolio data shows CAR is facing an uphill battle when it comes to consumer demand.

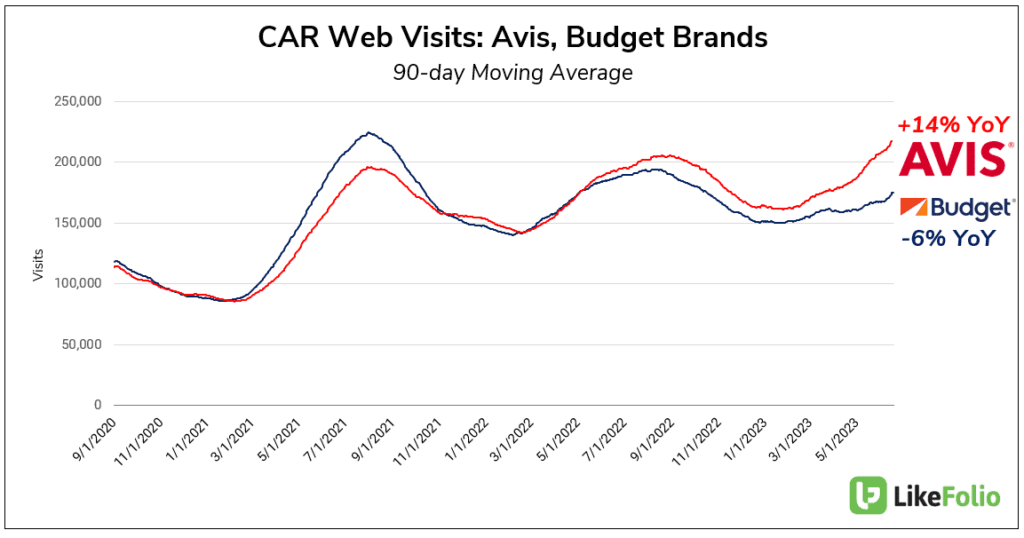

- While its Avis brand is showing some signs of traction when it comes to web visits (consumers logging on to check prices and rent a car), its Budget brand is recording comparative weakness.

Web traffic combined across both brands is about +2% higher than it was last year. A quarter ago it was +10% higher YoY -- this could be a warning of a slow-down in demand on the consumer side.

- Consumer searches for car rentals appear relatively flat on a YoY basis.

This matches some softening in consumer travel trends we've noted in recent months.

Bottom line: while we can't speak to the company's cost mitigation, high level consumer metrics for CAR don't appear robust.

In addition, news from earlier this month suggests the long-standing car rental model could be getting a bit more complicated: Uber is piloting a new peer-to-peer carsharing model in Toronto and Boston.

We’re sidelined for now, and if anything are watching for bearish divergence ahead of the company’s next earnings release in August.