Can Darden Restaurants Continue on its Recovery Trajectory? ($DRI) Since […]

Where’s the beef?

Darden (DRI) – parent of consumer-dining favorites Olive Garden, LongHorn Steakhouse, Cheddar’s, and Capital Grille – reports Q4 earnings before the bell on Thursday, June 22.

…And the market will be looking for much-needed insight into the state of the consumer.

Has persistent inflation set its scope on casual (and fine) dining, yet?

We know in the 3rd quarter Darden reported growth and even outperformance vs. peersas consumers hung on to eating out as an "affordable luxury."

The real question now is: did this strength persist through the Summer?

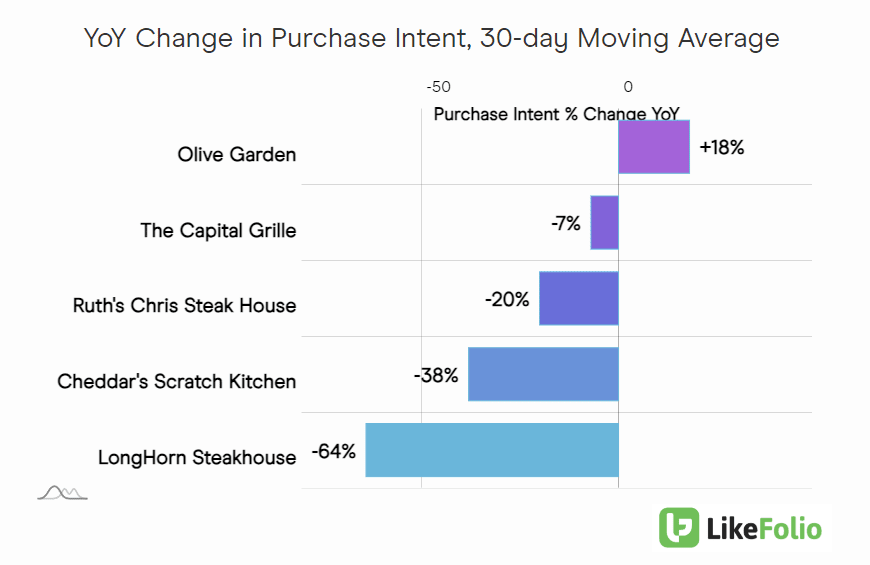

Consumer demand mentions reveal that many consumers may finally be trading down from higher-end dining excursions.

Luckily for DRI investors, the company has a restaurant for that, too.

OIive Garden, which drives nearly half of Darden's revenue shows continued strength and resilience, with demand up +18% YoY over the last month.

However, the decline in its higher end and other restaurant segments may be reason for some pause…especially as the stock trades near all-time highs.

This report also comes at a big moment in company history. Darden just completed a major acquisition of Ruth's Chris Steak House.

Ruth's Chris joins Darden's fine-dining portfolio alongside The Capital Grille and Eddie V's. This segment has driven growth for Darden alongside affluent consumer resilience post-pandemic, with average weekly sales more than doubling pre-Covid levels – and a high bar.

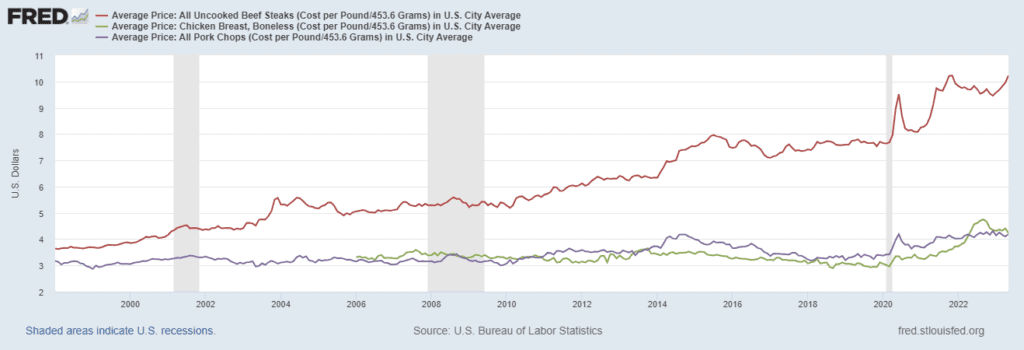

Heading into this release, one external factor we're also tracking is the cost of beef.

According to reports by the Wall Street Journal, the number of cattle in the U.S. is at its lowest level in ~a decade, and U.S. beef production is expected to drop by more than 2 billion pounds in 2024. Translation: beef is only expected to get more expensive.

Rising prices could impact an area where our data doesn't have insight: margins.

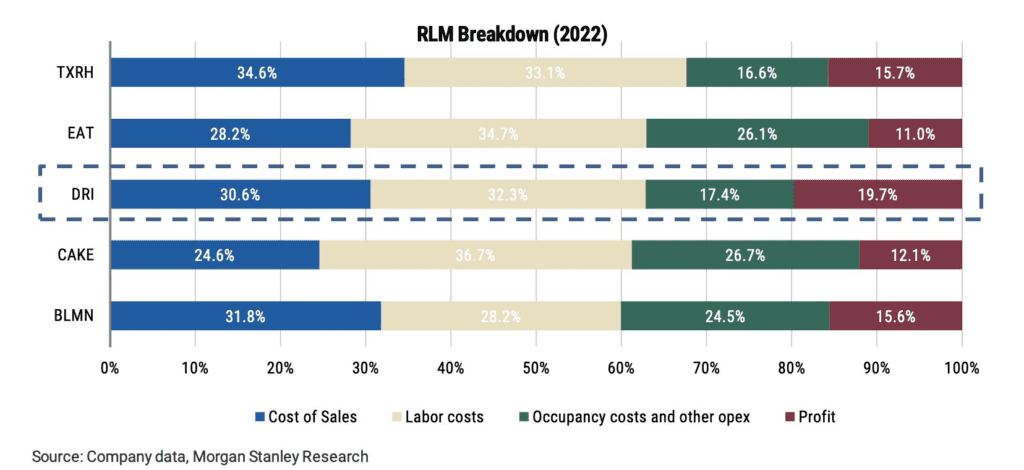

Darden led the pack in 2022 according to research from Morgan Stanley. But rising prices as it expands its beef exposure may hamper margin growth in the near term.

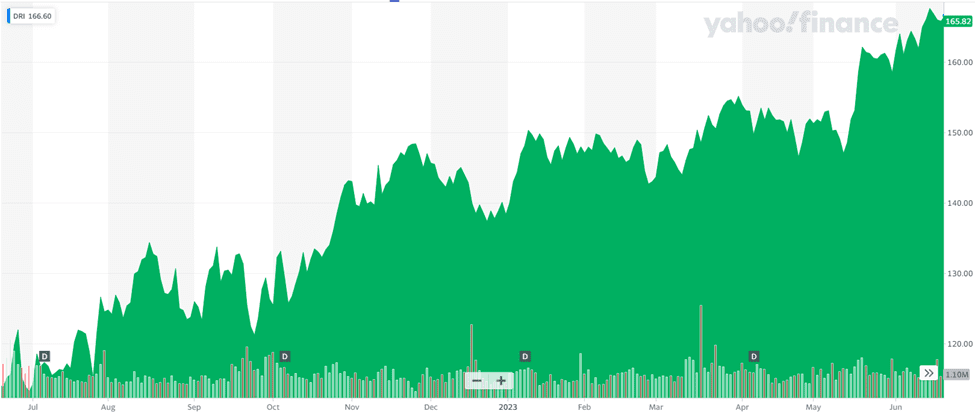

We're neutral ahead of earning (DRI has a score of -12), and watching long-term bearish divergence form.