PayPal (PYPL) Last week we touched on a huge crypto […]

Paypal & Square are Doubling Down on Crypto Gains

Paypal & Square are Doubling Down on Crypto Gains

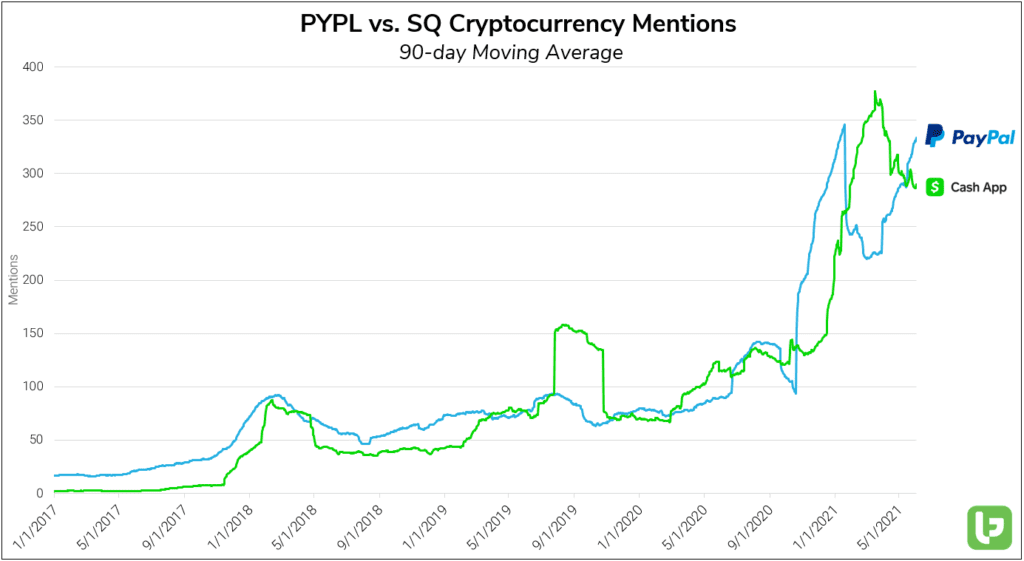

Comparing cryptocurrency-specific Mentions for Paypal (PYPL) and its P2P payment app 'Venmo' against those of Square (SQ) and its P2P platform 'Cash App', it's not hard to see why both companies are ramping up their crypto offerings.

On a 90-day moving average, Paypal/Venmo Cryptocurrency Mentions have risen by a whopping +268% YoY, while those of Square/Cashapp have gained a respectable +151% YoY.

Both companies are focusing on the future of crypto:

Paypal's CEO teased a "next generational digital wallet" coming in Q3, as well as pointing to cryptocurrency as a key growth engine for the company.

SQ recently launched the Cryptocurrency Open Patent Alliance (COPA), an open-source foundation for crypto patents to protect the community. Additionally, the company holds 8,027 Bitcoins.

Which Company has the edge?

Square (and CEO Jack Dorsey) were early adopters, launching bitcoin trading on Cash App in 2018. Since then, they've massively expanded the Cash App's cryptocurrency offerings to massive success -- Last quarter, SQ reported a +266% YoY revenue improvement, driven by a +666% YoY increase in Cash App sales (of which 527% came from Bitcoin trading).

Although Paypal has been a step behind in terms of rolling out crypto services, they've experienced undeniable success. The launch of "buy-hold-sell" functionality on Venmo puts the platform in direct competition with the Cash App, and Venmo looks like it's gaining steam.

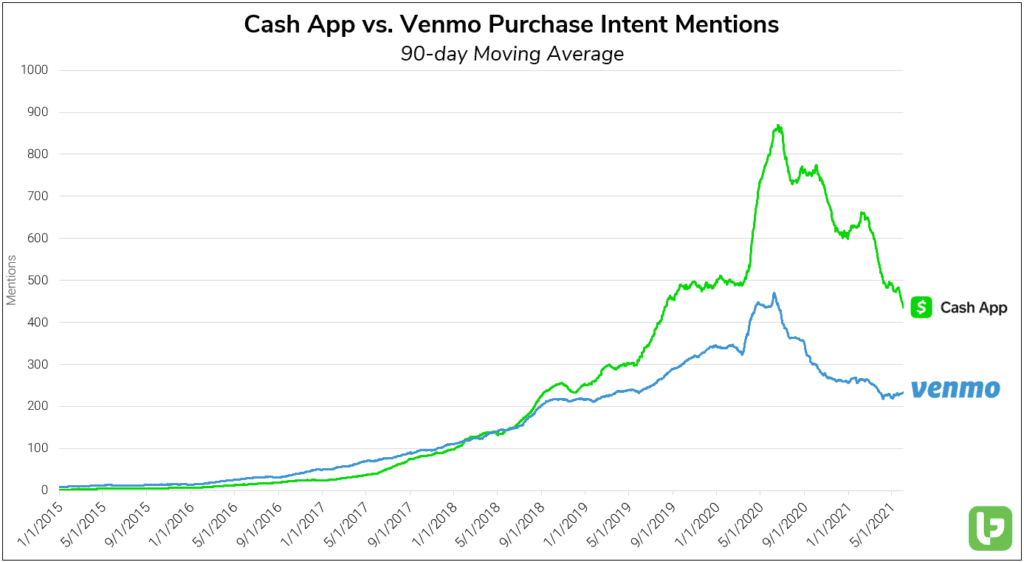

In terms of generic Purchase Intent Mentions, the Cash App is losing its edge.

Cash App is maintaining a slight PI volume lead in 2021, but Venmo is showing much stronger retention, bolstered by recent crypto-trading functionality.

SQ and PYPL have both thrown their lot in with the cryptocurrency markets, and their continued success will rely heavily on the success of Bitcoin.