Roku makes streaming devices that allow its customers to stream […]

Prime Day: Can Amazon keep besting its own records?

Prime Day: Can Amazon keep besting its own records?

Amazon changed the game.

A decade ago, the thought of having household items delivered in 2 days to your front porch was groundbreaking. But now it's the norm.

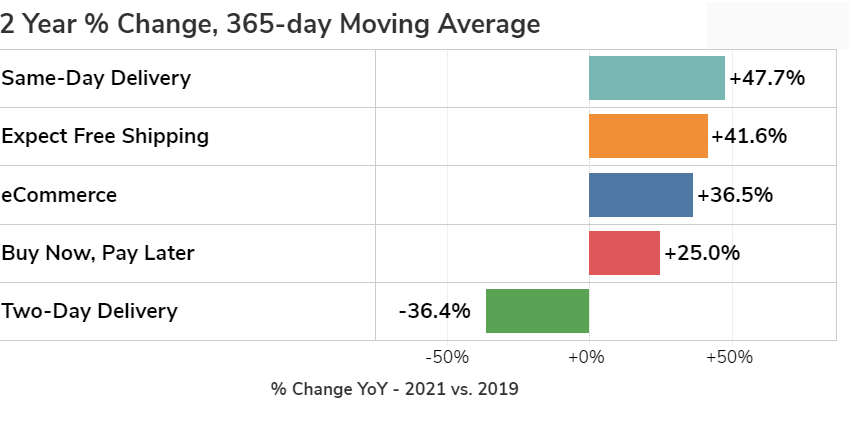

From a trend perspective, two-day delivery is now considered "slow". You can see the drop-off in mentions vs. 2 years ago (-36%). In contrast, same-day delivery is recording the most significant growth: +48% vs. 2019.

We've seen this reflected in recent success with Target and Walmart same-day services that also feature curbside pickup...an area where Amazon now has a disadvantage.

That's not the only area where Amazon is lagging -- mentions of an Amazon package being late, or taking longer than desired for delivery have increased +20% since 2019. This drag on Sentiment was evident during the most recent holiday season, where Consumer Happiness sank lower than 55% positive. While sentiment has rebounded, continued mentions of long shipping times highlight an area of potential improvement for Amazon.

On the flip side, Amazon is doing well expanding its company purpose.

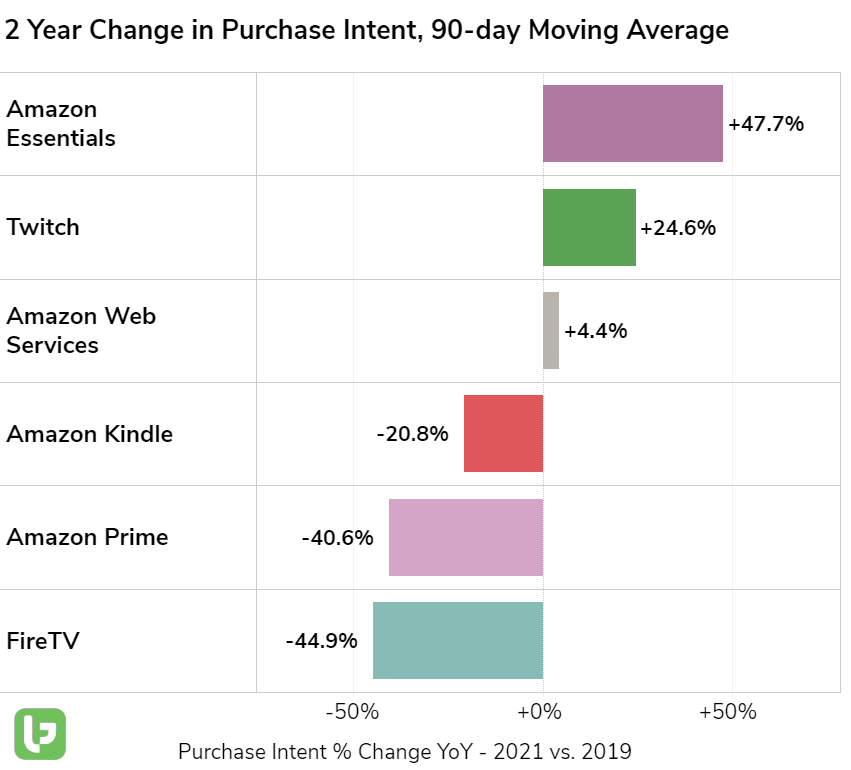

On the brand breakdown, you can see growth in AWS, Amazon-branded essential items, and video game streaming service Twitch.

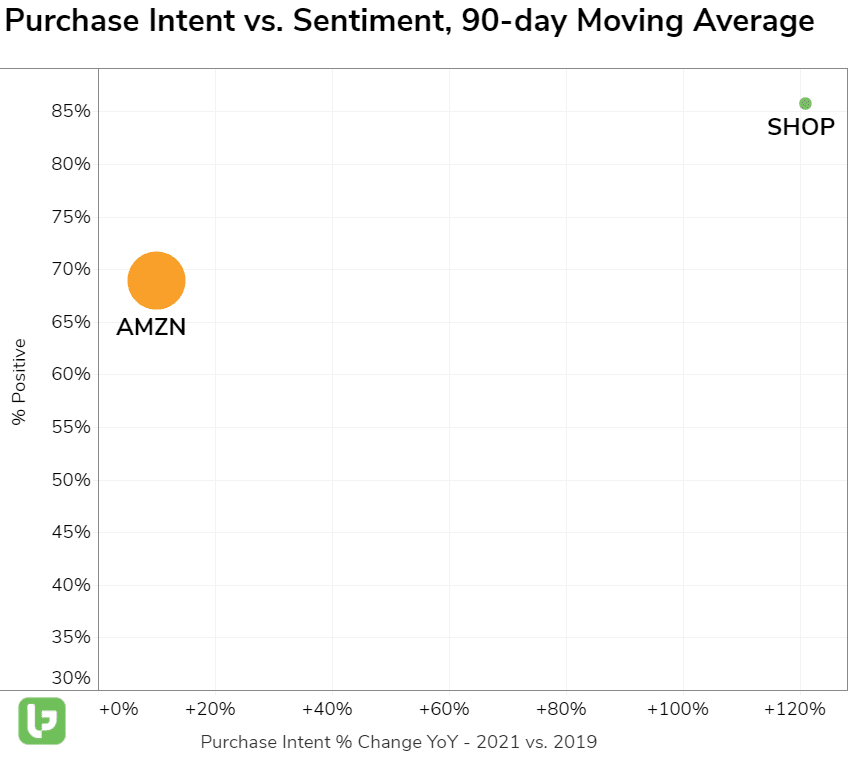

Long-term, we've got our eye on the anti-Amazon: Shopify. You can see where Shopify sits in the eyes of consumers on the outlier grid below.

While boasting a much smaller mention volume, Shopify's growth and happiness are significantly outpacing its eCommerce peer. LikeFolio mentions of using Shop Pay are currently pacing +58% YoY.

So, it's clear Amazon has integrated itself into the daily lives of consumers. But its relevance isn't guaranteed to hold at these levels. We're watching very closely as competent competition builds...and will be especially interested to see how today's Prime Day event plays out. Amazon has more than 200 million Prime subscribers, 50 million more than early 2020.

Company-wide Purchase Intent mentions were already near ~70% of yesterday's total volume by 11 a.m. Expect an update on Amazon as well as other retailers like $WMT, $TGT, and even $BBY to see how things shake out in the next few days.