Despite recent market volatility and some arguing for a bear […]

Rideshare Demand is Surging

Rideshare Demand is Surging

LikeFolio data is recording a recovery-related surge in rideshare demand on a 30day Moving Average:

- Ridesharing for travel (to or from a hotel or airport) increased +30% QoQ

- Ridesharing for entertainment like a bar or restaurant increased +15% QoQ

- Ridesharing to and from work increased +10% QoQ (working from home mentions decreased -10% QoQ in the same time frame)

In addition, mentions of booking or taking a flight and traveling for work are showing signs of improvement: +29% YoY and +20% YoY respectively. All of these shifts in consumer behavior serve as tailwinds for companies like Uber and Lyft, at least when it comes to consumer demand. Lyft Purchase Intent data is showing signs of short-term recovery.

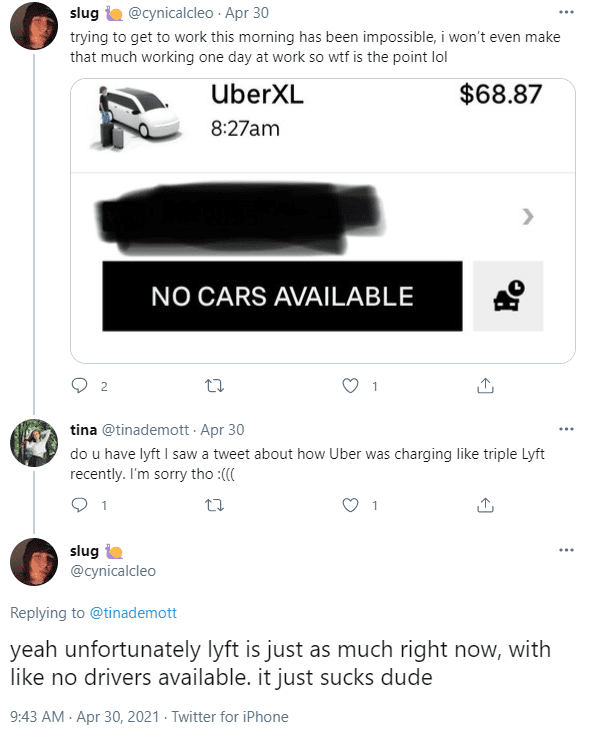

Usage and download mentions have increased +49% QoQ, and also show YoY improvement. However, headwinds loom in the form of potential gig worker benefit regulation and driver shortages. Signs of potential driver shortages are palpable in LYFT Negative Sentiment mentions. Consumer Happiness has fallen -7% YoY, with mentions referencing increased costs and lack of drivers.

On the bright side, rideshare demand is returning. On the other hand, headwinds are mounting...and Lyft may not have been able to fully capitalize on this demand in the last quarter. We'll see what investors latch onto when Lyft reports 21Q1 Earnings May 4 after the bell.