Roku makes streaming devices that allow its customers to stream […]

Roku’s $60 Billion Opportunity

It’s a relatable scene.

You're curled up on the couch, scrolling through endless streaming options, trying to find that one show you've been eager to watch.

Then it hits you – the beauty of Roku's platform makes this search seamless, aggregating shows across services with its global search feature.

As Roku gears up for its earnings report (Feb. 15 after the bell) it's not just the convenience of streaming that's under the microscope but also Roku's pivotal role in a massive industry shift.

Last quarter, the streaming giant noted, "Traditional TV ads in the US, as everyone probably knows, is a $60 billion a year business. It's all going to move to streaming and there's going to be multiple winners.”

Let that sink in – the potential shift in ad dollars underway.

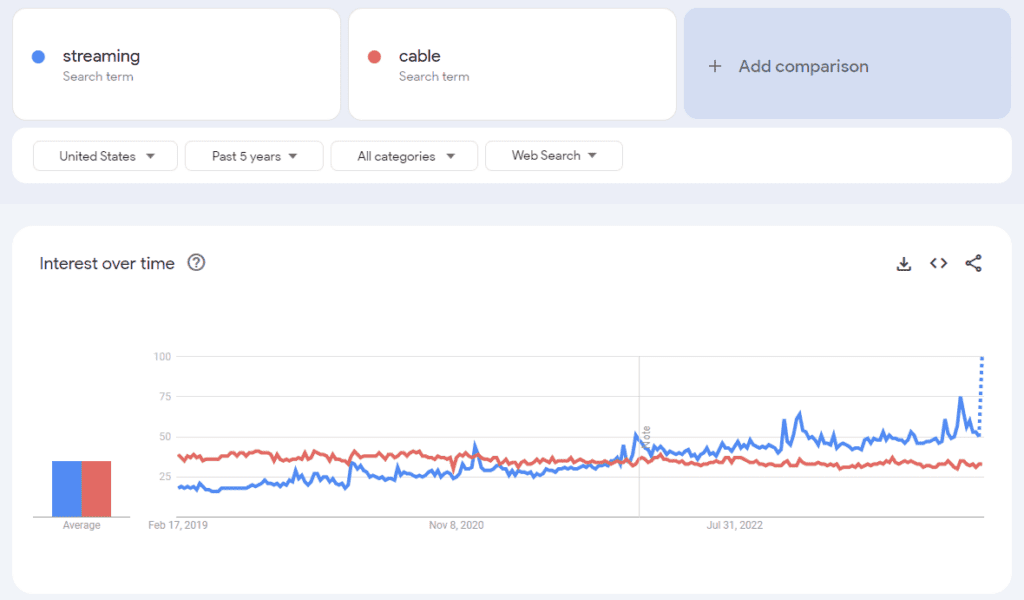

Consumer searches confirm the movement of eyeballs on screens:

And ROKU stands to gain, especially as a key player even in broadband households: “Our platform, obviously, has significant scale engagement, first-party data, unique ad products. And like we said before, in the US, our scale is approaching half of broadband households, that makes us a tremendously important platform to be involved in for everyone in the ecosystem."

Navigating the Streaming Evolution: Roku's Strategy and Performance

With over 75.8 million active accounts, Roku not only leads the U.S. streaming distribution market but also stands at the forefront of the advertising revolution in streaming, poised to capitalize on the $60 billion shift from traditional TV ads. The platform's emphasis on user experience, demonstrated by features like global search, positions it uniquely in the streaming wars, especially as streaming service fatigue sets in among viewers.

The Long-term Bullish Case for Roku

- Ad Market Potential: Roku's significant engagement and unique advertising products position it to win big as TV advertising dollars flow into streaming.

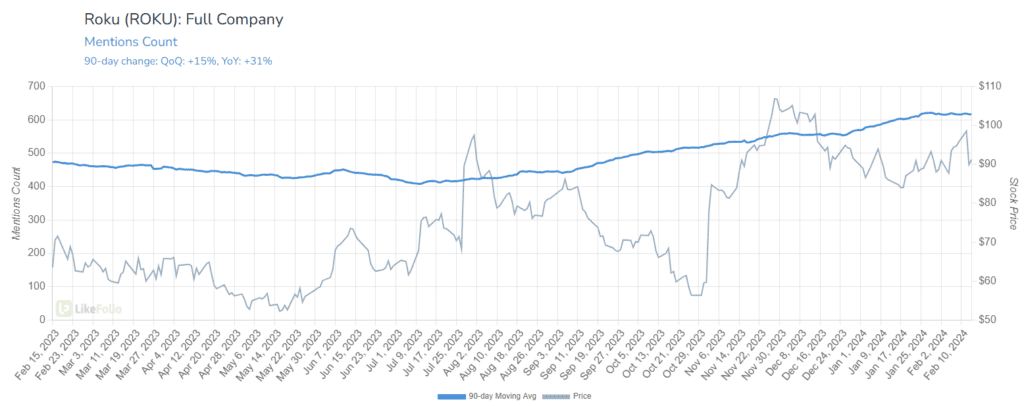

- Growth and Engagement: Recent quarters have seen Roku outperform expectations, with revenue growth accelerating to +20% YoY and streaming hours surging. LikeFolio's mention buzz shows a notable uptick, indicating robust platform engagement and growing market interest.

Challenges on the Horizon

- Expectations vs. Reality: The impressive previous quarter raises the bar high for Roku. In addition, rumors of Walmart's potential entry into the TV business via a $2 billion Vizio acquisition stands to challenge Roku's dominance.

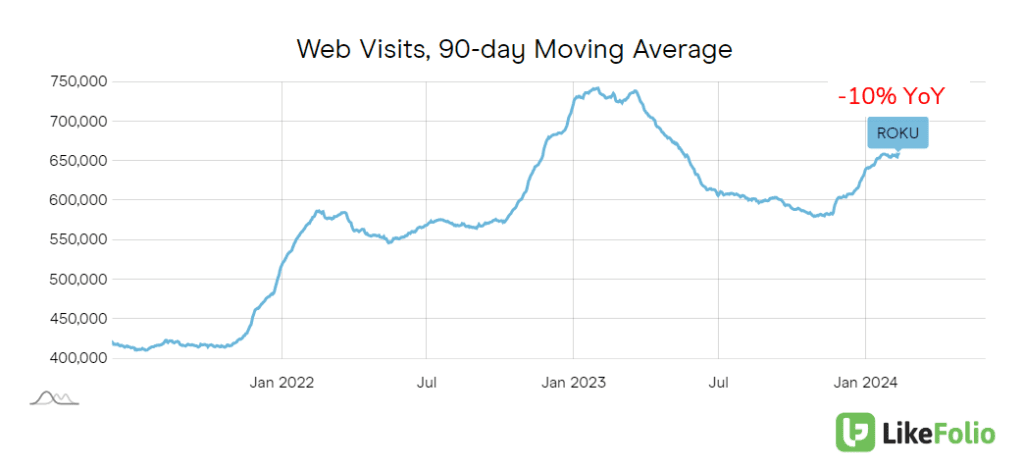

- Web Traffic and Competition Concerns: A -10% YoY slowdown in web traffic signals caution, alongside increasing competition from platforms like Apple TV, which boasts higher user satisfaction.

In LikeFolio's Eyes

Roku's future blends immense opportunity with the realities of heightened expectations and competitive pressures. The transition of TV ad spending to streaming highlights Roku's strategic importance in the ecosystem, buoyed by its large user base and innovative ad solutions.

But we are detecting signs of some near-term bumps in the road. If ROKU stock sinks on a good but not gangbusters report, we are buyers of a dip.