Crocs: in League of Its Own Thanks to re-opening fueled […]

Time for a CROX Turnaround?

In the quiet town of Niwot, Colorado, a boat shoe with a quirky design and a unique material sparked a global phenomenon.

Crocs, once a niche product, evolved into an emblem of comfort and versatility, challenging the norms of the footwear industry. This story of innovation and unexpected success underpins Crocs, Inc.'s journey from a boating accessory to a staple in millions of wardrobes worldwide.

To give scale, Crocs sold more than 37 million pairs of shoes in the third quarter of 2023, across both of its brands.

This is one of our favorite stories at LikeFolio.

But as Crocs approaches its next earnings release, the narrative shifts to a reflection on its strategic maneuvers, particularly the acquisition of Hey Dude, and how it stacks up in the fiercely competitive landscape of comfortable footwear.

Crocs' venture into diversification through the acquisition of Hey Dude was aimed at broadening its market appeal and tapping into new consumer segments.

However, this strategic move has presented its own set of challenges. The integration of Hey Dude contributes a significant 25% to Crocs' revenue but has been marked by growing pains and inefficiencies. The acquisition's timing and execution have been a noted pain point for several quarters.

On its last call, CROX noted, “While we are very pleased by our consolidated results in the first nine months of the year and the standout performance of our Crocs Brand, we recognize our HEYDUDE performance has fallen short of expectations.”

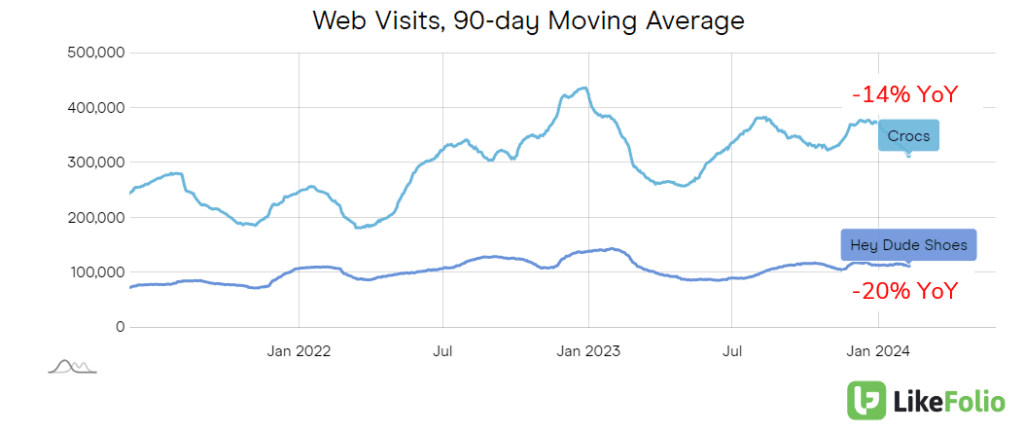

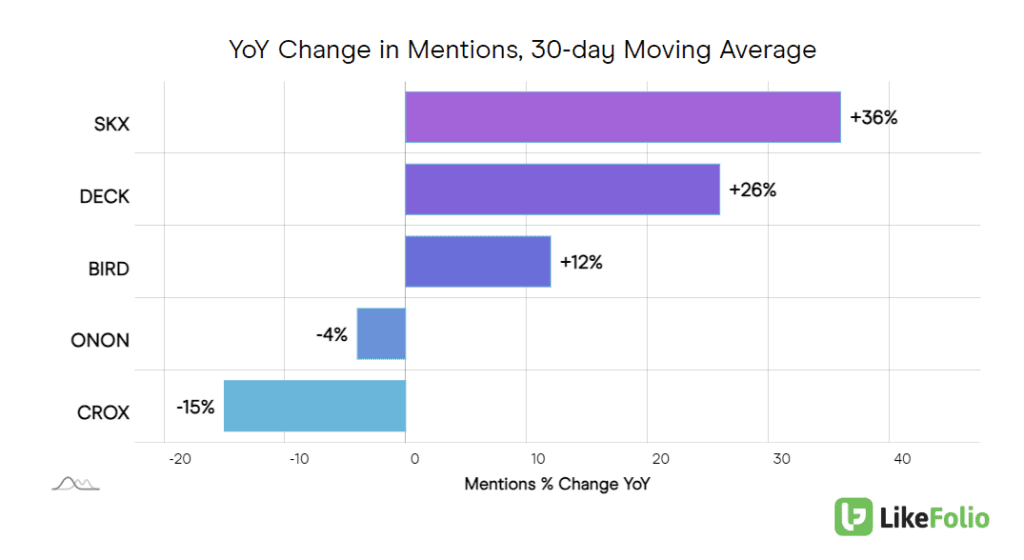

But LikeFolio data including mention volume and web traffic trends suggests a dampening interest in both the Crocs and Hey Dude brands (though Crocs is performing comparatively better).

Meanwhile, the broader market for comfortable footwear is experiencing a surge, led by competitors such as Deckers Outdoor Corporation (DECK).

Deckers, with its powerhouse brands UGG and HOKA, reported impressive growth, with UGG net sales up 15.2% to $1.072 billion and HOKA net sales increasing by 21.9% to $429.3 million. These figures not only highlight the robust demand for comfort-centric footwear but also underscore the competitive pressures facing Crocs in its quest for growth.

In this context, Skechers (SKX) also emerges as a formidable player, buoyed by a bullish outlook and robust web traffic data from LikeFolio.

Skechers' emphasis on merging comfort with style positions it advantageously within the shifting consumer trends favoring practical yet fashionable footwear options.

As Crocs navigates through this competitive terrain, its upcoming earnings report will be a test for the company's strategic decisions and its ability to adapt in a rapidly evolving market.

The integration of Hey Dude, alongside the performance of the core Crocs brand, will be scrutinized for signs of strategic success or missteps.

The market is betting on a CROX recovery.

The stock is up +22% in the last 3 months alone.

Part of this is spurred by CROX upward revisions in January, indicating fourth quarter revenue would increase +1% vs. decline 1%-4% (this is driven by Crocs overperformance -- Crocs brand revenue is expected to increase +10% while Hey Dude revenue declines -19%).

LikeFolio’s neutral earnings score implies other comfortable shoe names may be better bets to the upside for now.