Translation: who is to benefit? Over the past year, day-to-day […]

$ROSS Earnings Deep Dive

Imagine the thrill of discovering a hidden gem in a bargain bin. That's the essence of shopping at Ross Stores - a blend of surprise and delight when consumers snag a high quality item at a lowered price.

Ross Stores (ROST) is set to announce its earnings today, November 16, after the closing bell. LikeFolio's Earnings Score is a bullish +37, driven by a strong showing in demand and customer happiness – and the bargain hunting scores customers keep raving about, like in the tweet above.

But with the stock recently peaking at year-to-date highs, the looming question is: Has the bar been set too high for Ross?

Let’s dive in.

Looking at the retail landscape, it's helpful to consider TJX Companies, Ross's peer in the discount retail sector. Earlier this week TJX reported strong Q3 FY24 results, with a notable 6% increase in comparable store sales and significant growth in its Marmaxx and HomeGoods divisions. Its gross profit margin improved to 31.1%, and it returned a generous $1.0 billion to shareholders…and it raised guidance. Yet, despite these positive results, TJX shares declined post-earnings, highlighting a potential disconnect between market expectations and reality.

So, where does Ross stand in comparison to TJX?

LikeFolio’s data paints a promising picture for Ross, the operator of Ross Dress for Less and dd's Discounts.

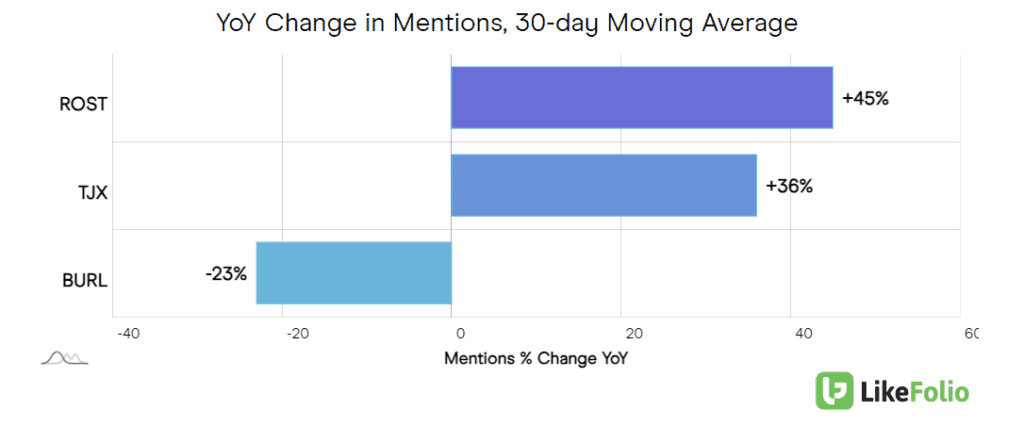

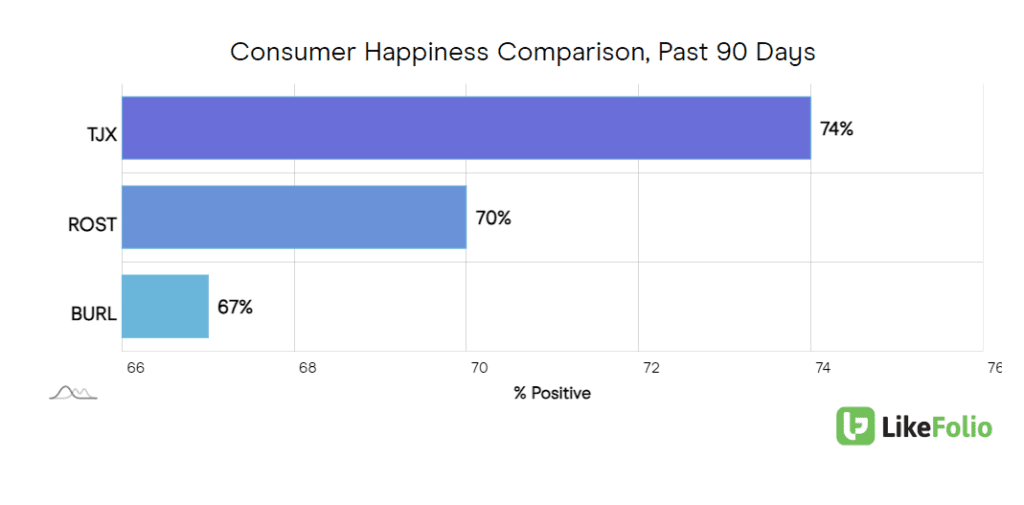

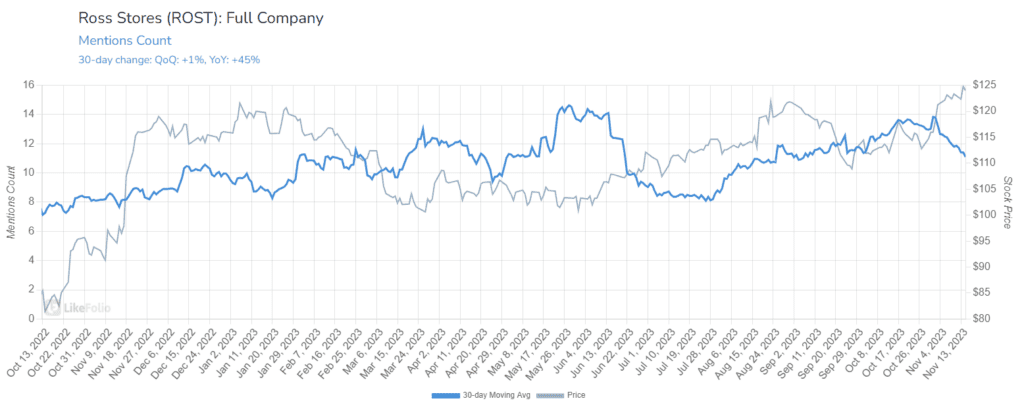

There's a significant buzz building: mentions have increased by 23% year-over-year on a 90-day moving average, and an even more robust 45% on a 30-day average, surpassing TJX's buzz growth, albeit with a smaller sample size.

This increasing buzz is propelled by Ross's aggressive expansion strategy. It has opened 43 Ross Stores and 8 dd's DISCOUNTS stores in just two months, culminating in 97 new locations in 2023 alone. Its ambitions don't stop there, as it plans to significantly increase its store count in the future by the hundreds.

In terms of customer happiness, Ross stands at a stable 70% positive, squarely in the middle of the pack vs. peers.

This sentiment level is consistent quarter-over-quarter, even as the buzz around the brand accelerates. Shoppers are particularly vocal about their 'Ross finds,' especially in the toy category as the holiday season nears.

Last quarter, Ross's earnings were bolstered by strong sales and effective inventory management. It reported a 5% increase in comparable store sales and a 15% reduction in total consolidated inventories.

This strategic approach to inventory, coupled with growth in key areas like cosmetics and accessories, has been noted by the market. Ross's shares have increased by +15% over the past six months. You can see this move vs. mention growth on the chart below.

The Bottom Line

Now, time for the tough question: Will Ross's treasure hunt lead to a pot of gold, or will a high bar prove too difficult to clear?

LikeFolio's metrics point toward a strong earnings report for Ross. Our raw earnings signal is Bullish.

However, the retail sector is navigating a challenging environment, as demonstrated by TJX and Walmart's recent earnings experiences. High expectations are proving hard to meet. For investors and market watchers, the key is to remain risk-defined.