Here's what LikeFolio data was showing heading into the Walmart earnings report that sent the stock 10% higher.

Will $WMT follow $TGT higher?

Ahead of Walmart (WMT) earnings, it's crucial to approach analysis with the appropriate mindset --especially when contrasting Walmart's trajectory with its peers like Target (TGT).

Is the big box store’s stock setting up for a similar launch higher? Or is this a case of comparing apples to oranges?

Possibly the latter. Here’s what we’re watching at LikeFolio…

Retail Landscape Overview

The current retail scene offers a fragmented and complex picture. October saw U.S. retail sales dip marginally by 0.1%, less severe than the 0.3% fall economists forecasted. This slight decline is fragmented with an increase in certain sectors, such as health and personal care, while others like furniture and home stores experienced notable decreases.

Walmart’s Unique Positioning

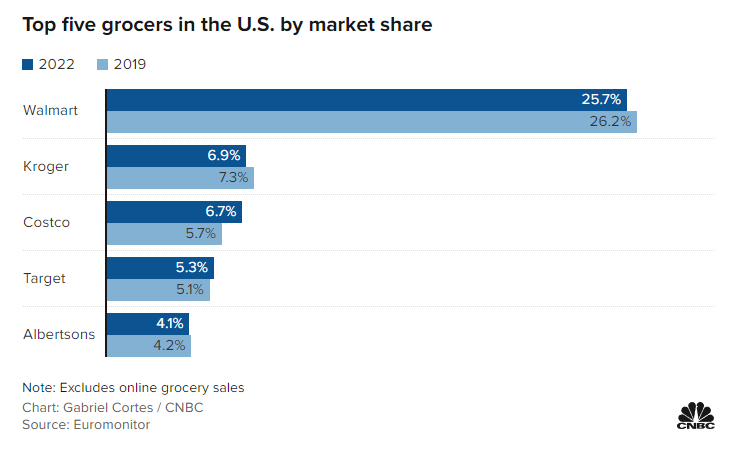

Walmart, primarily focused on essential items like groceries and personal care products, finds itself in a more stable segment. Did you know it’s the nation’s largest grocer?

This positioning starkly contrasts with Target, which emphasizes a broader range of goods including home items and apparel.

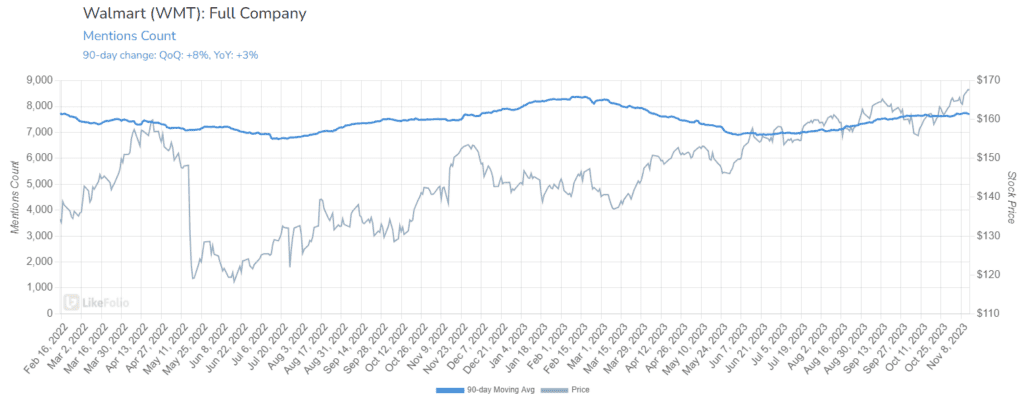

This difference is reflected in LikeFolio data, with Walmart’s buzz rising by +3% year-over-year as even higher-end consumers seek lower prices on staples.

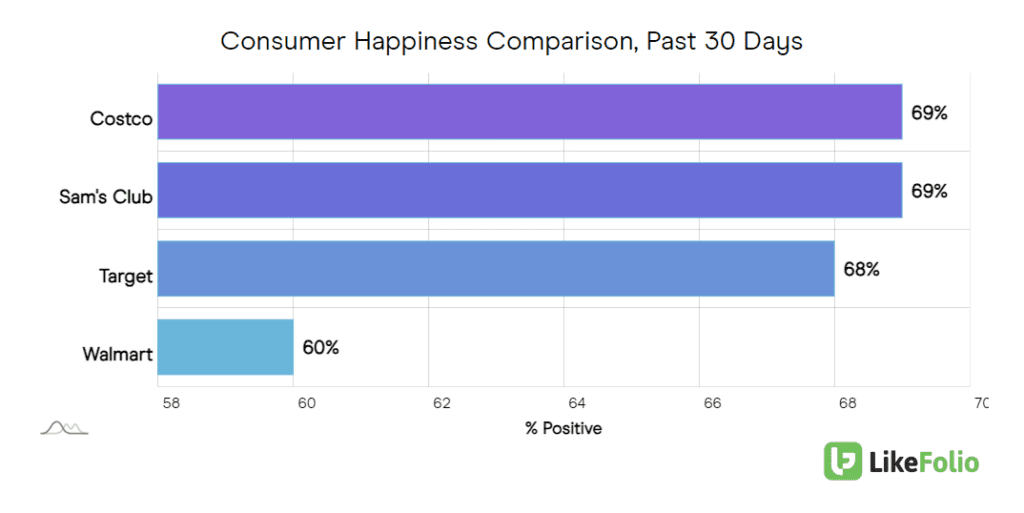

The company is also garnering positive traction in its Sam's Club offering -- the bulk retail brand is now on par with Costco from a happiness perspective, with happiness up +6% YoY.

Approaching Walmart’s Earnings

In preparing for Walmart's earnings, investor should keep several factors in mind:

- Target’s Inventory Management: Target's recent Q3 2023 earnings were bolstered more by efficient inventory management leading to a 14% reduction in inventory levels than by sales growth, as evident from a near -5% drop in comparable sales year over year. This highlights the significance of operational efficiency in the current retail environment.

- High Expectations for Walmart: Walmart faces a higher benchmark. In contrast to Target, which was trading nearly -20% lower over six months, Walmart shares saw an +11% increase in the same period and is currently trading near all-time highs. Last quarter, Walmart uplifted its guidance owing to robust e-commerce and grocery sales, reinforcing the high expectations set for this earnings report.

- Sustained Momentum but Cautious Optimism: Walmart and Sam's Club show continued momentum. However, the growth rate may not be sufficient to propel the stock beyond its current peak levels.

Bottom Line

Walmart’s focus on essential goods and successful e-commerce strategies position it uniquely in the retail sector. Heading into earnings, LikeFolio data does show continued momentum from Walmart and its bulk-retail brand, Sam's Club. But the growth rate may not be enough to lift shares above current all-time highs. We’re sidelined for this event.