PayPal (PYPL) Last week we touched on a huge crypto […]

Square (SQ) and PayPal (PYPL) are Running a Tight Race

Square (SQ) and PayPal (PYPL) are Running a Tight Race

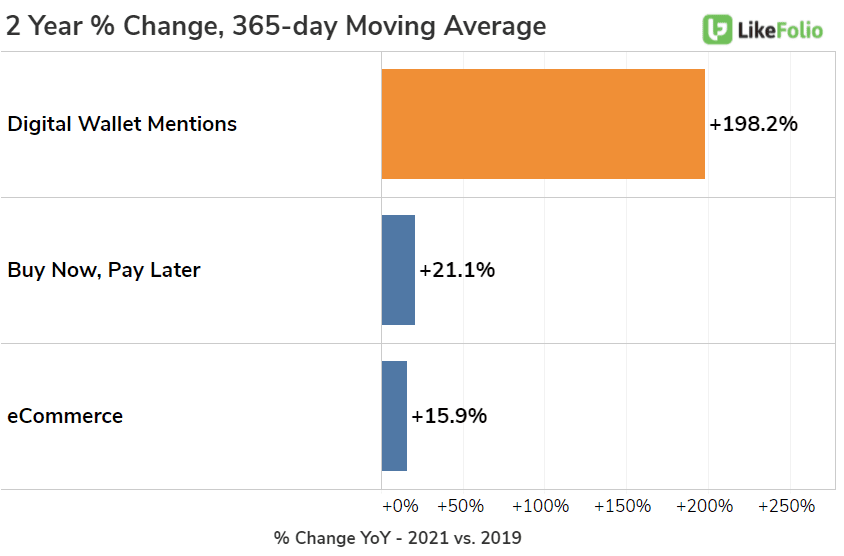

When it comes to transactions, one thing is clear: the future is digital, comprehensive, and user-friendly.

This is why we have a close eye on two major players in the digital wallet space: Square (SQ) and PayPal (PYPL).

From a size perspective, these names are akin to David and Goliath. PayPal's market cap exceeds $304 billion vs. Square's $108 billion.

However, in recent years we've watched Square dazzle consumers and grow rapidly, sending shares soaring...more than +250% since our first SQ Bullish Alert in 2019.

While Square chipped away at digital market share via its Square suite for small businesses and explosive Cash App for individuals, PayPal appeared to be playing defense.

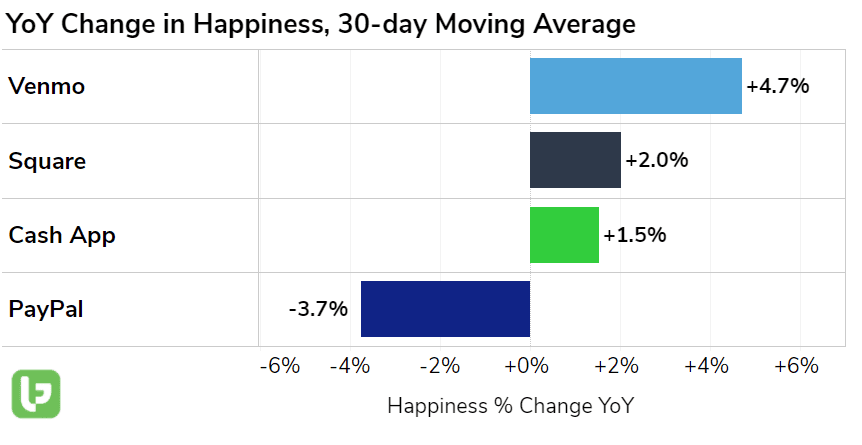

Now, it looks like PayPal is finally taking steps to close the perceived gap in user experience, led by strength in its Venmo brand.

The consumer happiness chart above showcases that PayPal efforts to redesign its traditional peer-to-peer payment app, Venmo, are paying off.

In addition, PayPal is proving it can continue to grow, with or without Ebay.

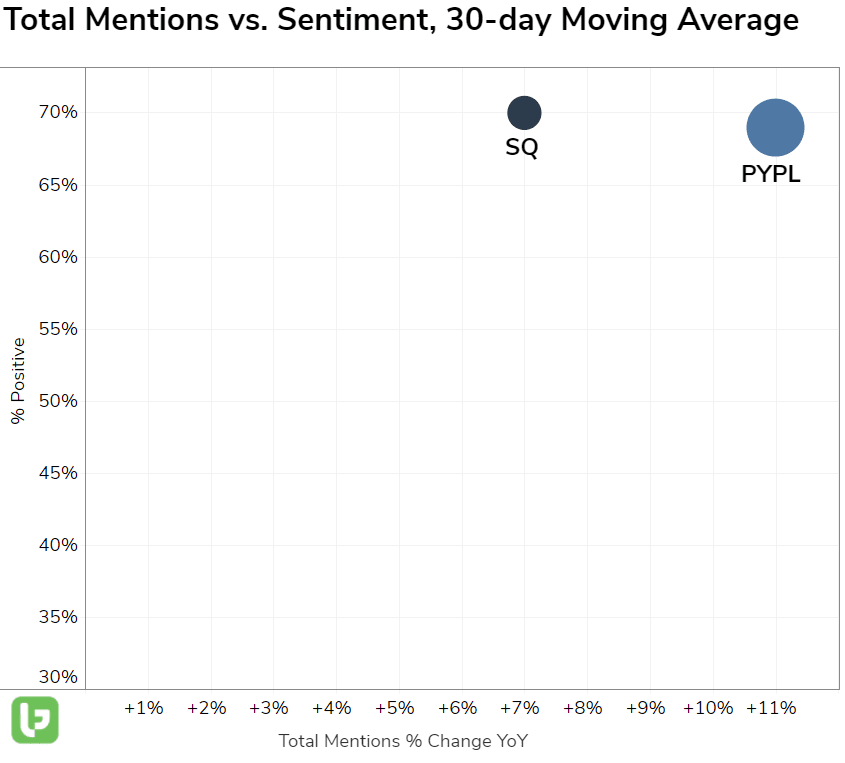

On a company level, the two players are now neck and neck.

Square and PayPal are both recording YoY growth in mention volume, boosted by major consumer macro trends including peer-to-peer transactions, crypto investing, contactless payments, and Buy-Now-Pay-Later options.

While PayPal boasts a higher mention volume and near-term growth rate, Square consumer happiness holds a slight edge.