Nvidia (NVDA) Would you look at that?! It's no leg […]

The Biggest Name in PC Gaming ($NVDA)

Nvidia (NVDA) is hands down one of LikeFolio’s favorite companies —

It hasn’t disappointed since we entered a long-term bullish position in late 2019, with shares now trading more than 400% above our initial entry.

A lot has changed since then (not just the stock price)… So, are we still maintaining that outlook today?

Yes, and there’s a simple reason why: Nvidia still shows dominance in the consumer GPU and PC Gaming markets.

Although the scope of NVDA’s B2B offerings has expanded dramatically in recent years, there’s still a critical, consumer-facing component at the core of the company: Gaming.

As per the most recent earnings report (22Q4), Nvidia’s gaming segment accounted for 45% of total revenue, with sales up +37% YoY.

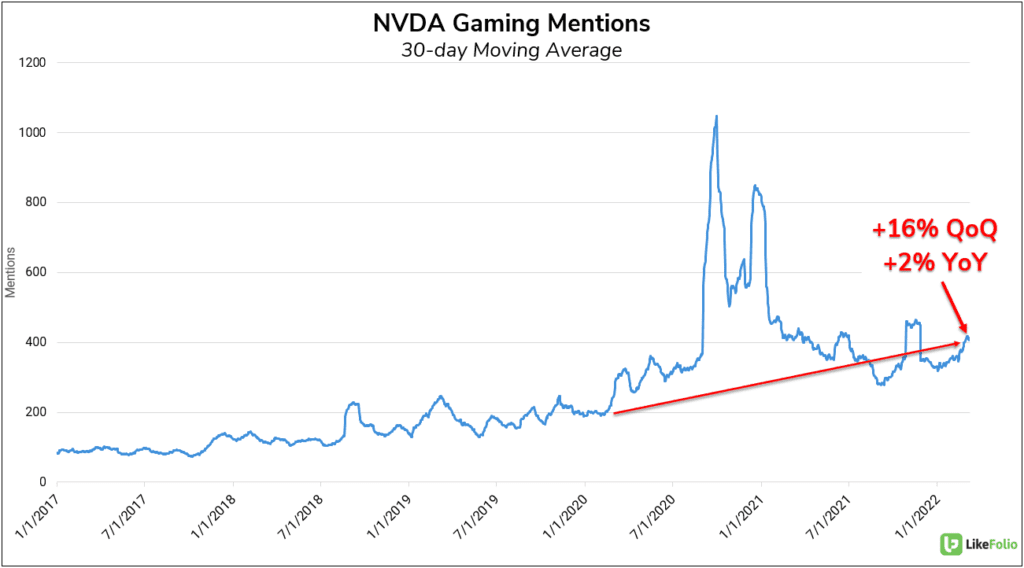

Underlying Mentions point to similar strength:

We saw an unprecedented surge in NVDA’s gaming-specific mentions during the COVID-19 lockdowns…Although that trend normalized over the following year, it has since resumed a positive trajectory: +16% QoQ (30d MA).

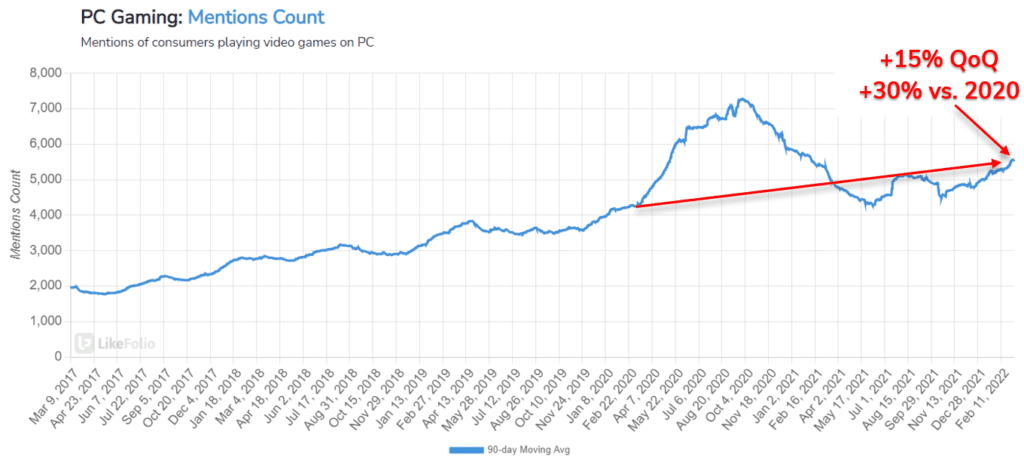

In fact, we’re seeing the same pattern manifest in the generic PC Gaming trend:

Mentions are rising near-term, while simultaneously displaying strength vs. pre-COVID levels: +30% vs. 2020 on a 90-day moving average.

It’s clear that the uptick in PC Gaming mentions wasn’t just a flash in the pan, it’s a prevailing trend in consumer behavior… And Nvidia stands to benefit disproportionately.

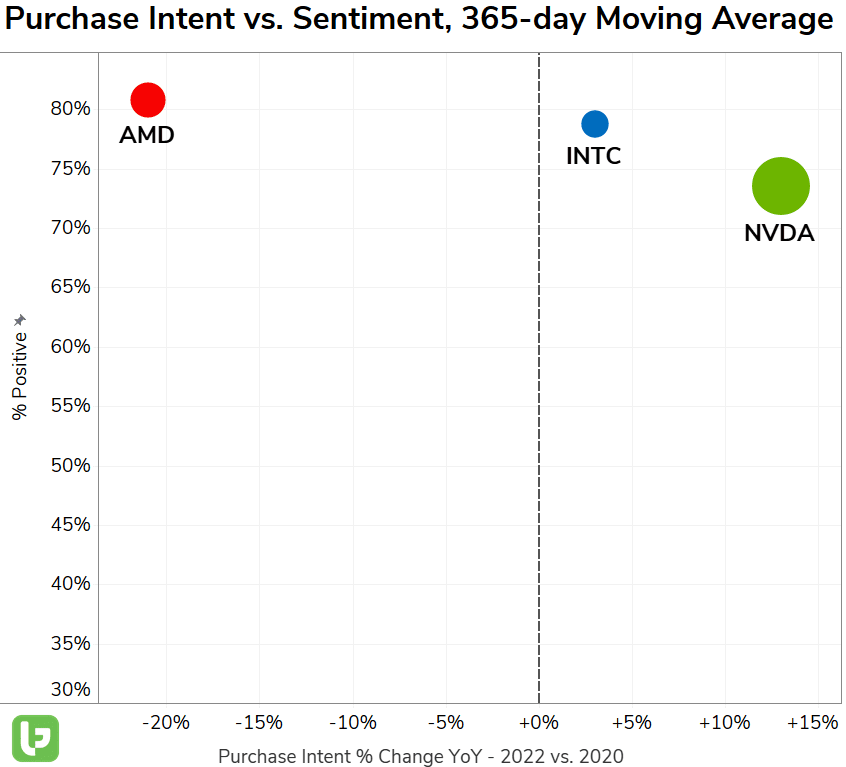

Consumer demand for NVDA’s graphics cards and software shows long-term strength when compared to notable industry competitors.

AMD and Intel (INTC) both show slightly higher levels of consumer Happiness, but it’s important to note that both companies have a smaller sample size than that of NVDA and are lagging in terms of long-term PI growth.

In addition to its PC gaming dominance, the B2B aspects of NVDA’s business have been equally impressive, with ‘Data Center’ segment revenues gaining +71% YoY last quarter, driven higher by demand for AI applications from names like Meta Platforms (FB) and Block (SQ).

The data center side of the business represents a significant blind spot for us, but NVDA has yet to disappoint in that regard…Nvidia’s management team also hasn’t disappointed in how they’ve handled ongoing production and supply chain problems. However, this remains an area of concern in the short-to-mid term.

Overall, NVDA is still one of our favorite companies — Based on its ongoing importance within a growing PC Gaming market and strong historical performance, we’re comfortable maintaining a long-term bullish outlook on the stock.