Carvana Demand Approaching All-Time Highs LikeFolio published a Bullish alert for Carvana […]

Three Reasons Why Car Carvana is a Buy: ($CVNA)

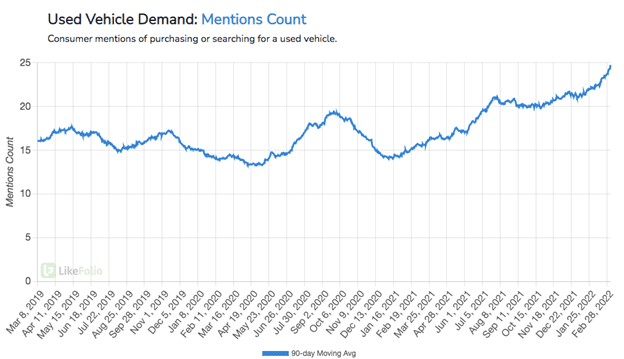

It’s no secret that the used car market has been on fire. The pandemic created a supply shortage and companies like Carvana were the beneficiaries.

The Tempe, Arizona headquartered company is best known for their used-car vending machines but as of recently, they’ve been buyers of used cars on the market.

However, many seem to be worried about macro-tail winds and a slow-down in used-car demand and whether or not they were overpaying for said purchases.

Carvana reported earnings a few weeks ago that showed they faced some challenges but their purchase of KAR Global, a used car auction firm, gave the company a temporary boost in share price the day after.

Since that earnings report the stock has traded down considerably near -30% and new 52-week lows.

So that makes us wonder if this might be an opportunity soon to start looking at a buy and we have three things to consider:

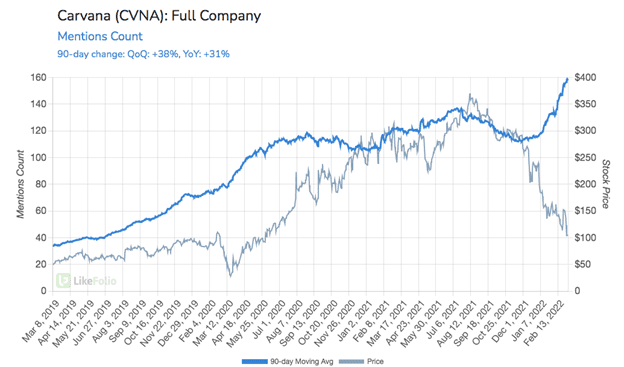

1. Mentions Counts are extraordinarily strong with YoY at +31% and QoQ at +38%, despite the dramatic drop in share price.

2. Used Vehicle Demand Mentions are trending at +59% YoY change and still not showing any signs of slowing down.

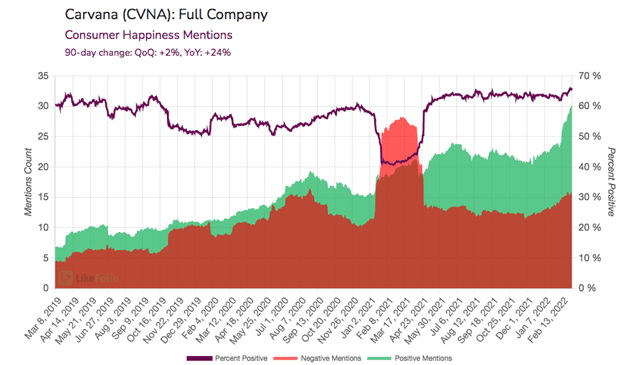

3. Happiness Mentions are significantly up at +24% YoY they continue to trend higher even above pre-pandemic levels.

So while some on Wall Street might be worried about the post-pandemic used car market the data is not showing signs of it slowing.