Kroger (KR) is Falling Behind its Competition Kroger Purchase Intent […]

The Street Expects a Strong Report from Kroger (KR)

The Street Expects a Strong Report from Kroger (KR)

KR shares are flirting with all-time highs ahead of the company's next earnings report, up +45% year-to-date.

The Street has high expectations, driven by optimism surrounding growth potential for Kroger's digital offerings.

What does LikeFolio suggest?

Kroger may have a hard time hitting the mark.

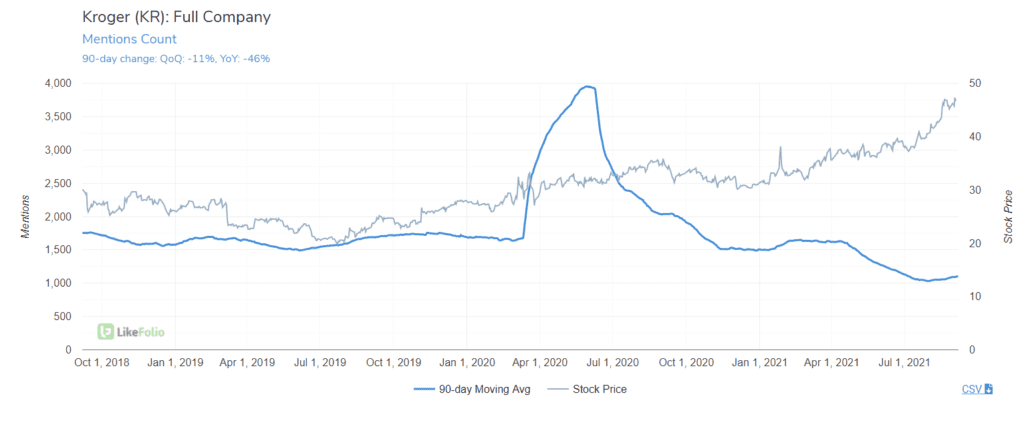

Kroger mention volume growth, historically the most correlated metric in regard to revenue, is slumping.

You can see this weakness on the chart below.

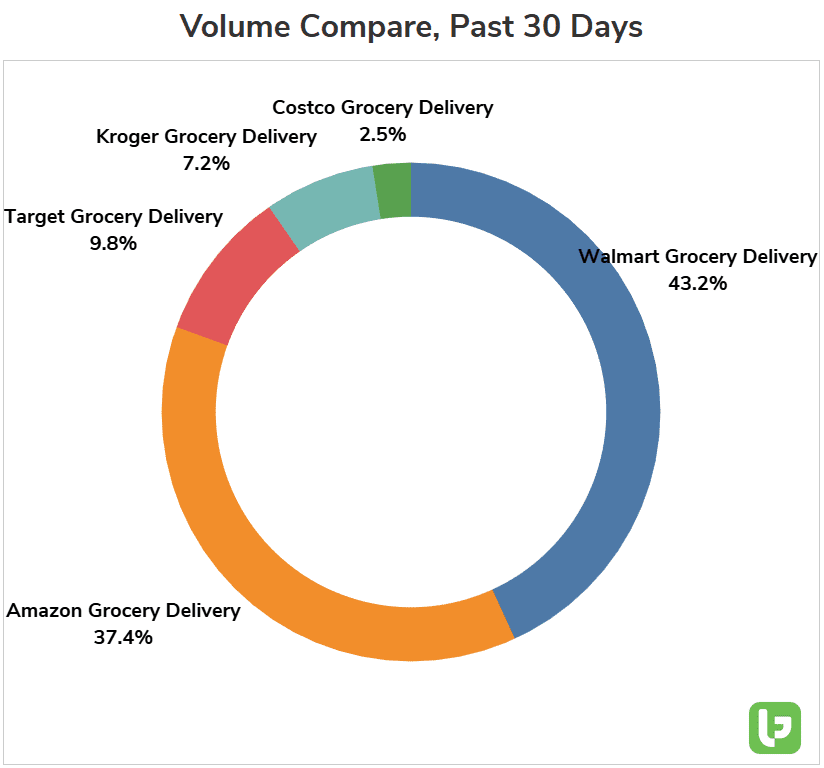

In addition, Kroger significantly trails eCommerce-heavy peers when it comes to digital grocery fulfillment.

Walmart and Amazon are dominant in the grocery delivery segment, with Target rounding out third place in total market share.

Kroger currently maintains around ~7% of total grocery delivery mentions, but has shown signs of modest improvement.

A year ago, Kroger's share was ~5.7%.

However, this capture may not be enough to make a significant dent in the company's report.