“You know it's time to sell when shoeshine boys give […]

This Company is Betting on Cryptocurrency ($COIN)

This Company is Betting on Cryptocurrency ($COIN)

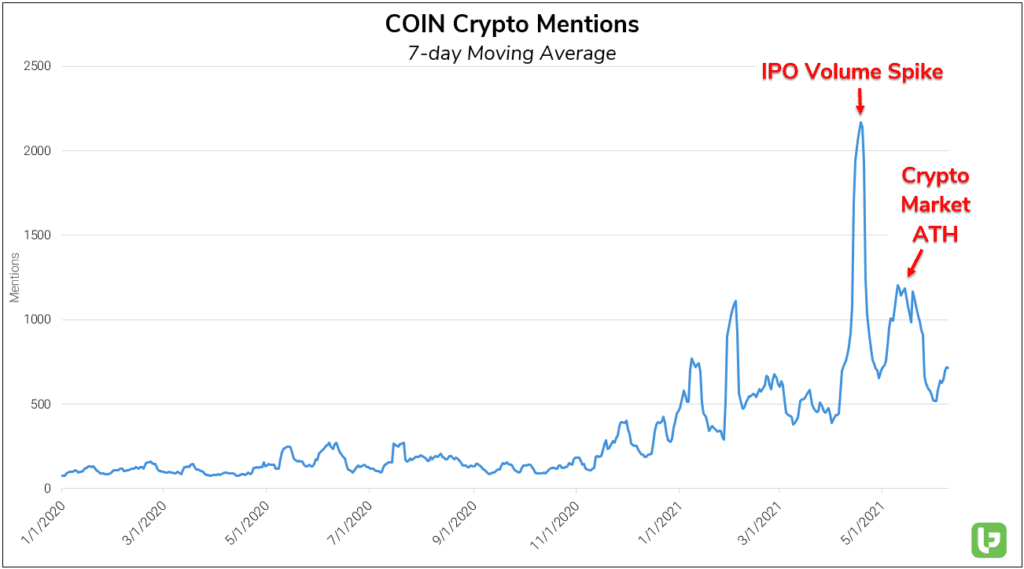

Coinbase Global (COIN) is the largest US cryptocurrency exchange and the only publicly-traded exchange in the world. The company’s IPO came just 1 month before the total cryptocurrency market cap reached the outstanding ATH around $2.4 trillion. Despite this piece of inopportune timing, underlying consumer Mentions show that the buying, selling, and holding of cryptocurrencies is alive and well on the Coinbase platform.

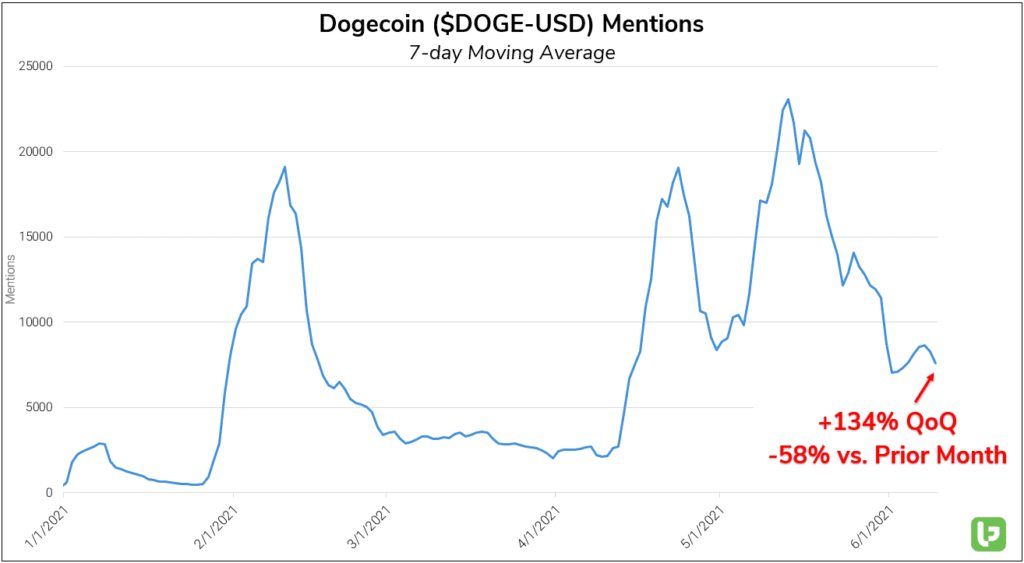

COIN shares have fallen nearly 50% from their post-IPO highs. Despite many investors having serious concerns about the future of Bitcoin ($BTC-USD) and the crypto market at large, this company seems unfazed by the correction, Coinbase recently expanded its margin lending offerings and continues to add new coins to its platform, including Dogecoin ($DOGE-USD). Speaking of DOGE, the meme-coin has not seen a significant boost in Mention volume since its official Coinbase listing last week. Mentions (and the price of Dogecoin) are holding at a higher level QoQ, but have declined significantly from the Musk-driven hype cycle seen in April/May.

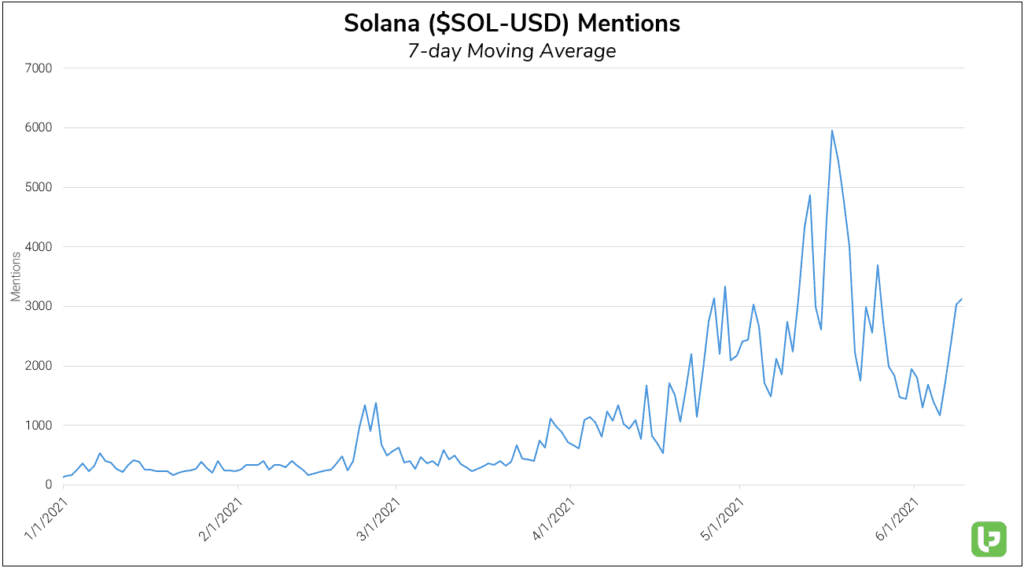

Meanwhile, DOGE is being vastly outperformed by a less-famous but more-promising coin: Solana ($SOL-USD).

Like many cryptocurrencies in the 'De-fi' space, Solana has a well-defined use-case and promises to be an essential aspect of an integrated blockchain ecosystem in the years to come. It's clear that the project has already attracted significant support, and the stubborn price recovery during a market-wide downturn has caused Mention volume to surge higher in the past week:

DOGE and SOL sit at opposite ends of the cryptocurrency spectrum. And, only time will tell if DOGE can stay relevant once the true implementation of blockchain technology begins.