PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

This Stock is Set to Dominate Super Bowl Snacking Frenzy

Super Bowl week is the pinnacle of snacking season.

No, seriously.

Last year's Super Bowl festivities catapulted savory snack consumption to a record-breaking 118 million pounds, driving sales up by 29% from 2022, and amassing nearly $800 million, capping off the largest snacking week of the year.

This surge underscores the Super Bowl's unparalleled impact on the snack food industry and highlights the significant opportunity it presents for leading players like PepsiCo (which reports earnings this week).

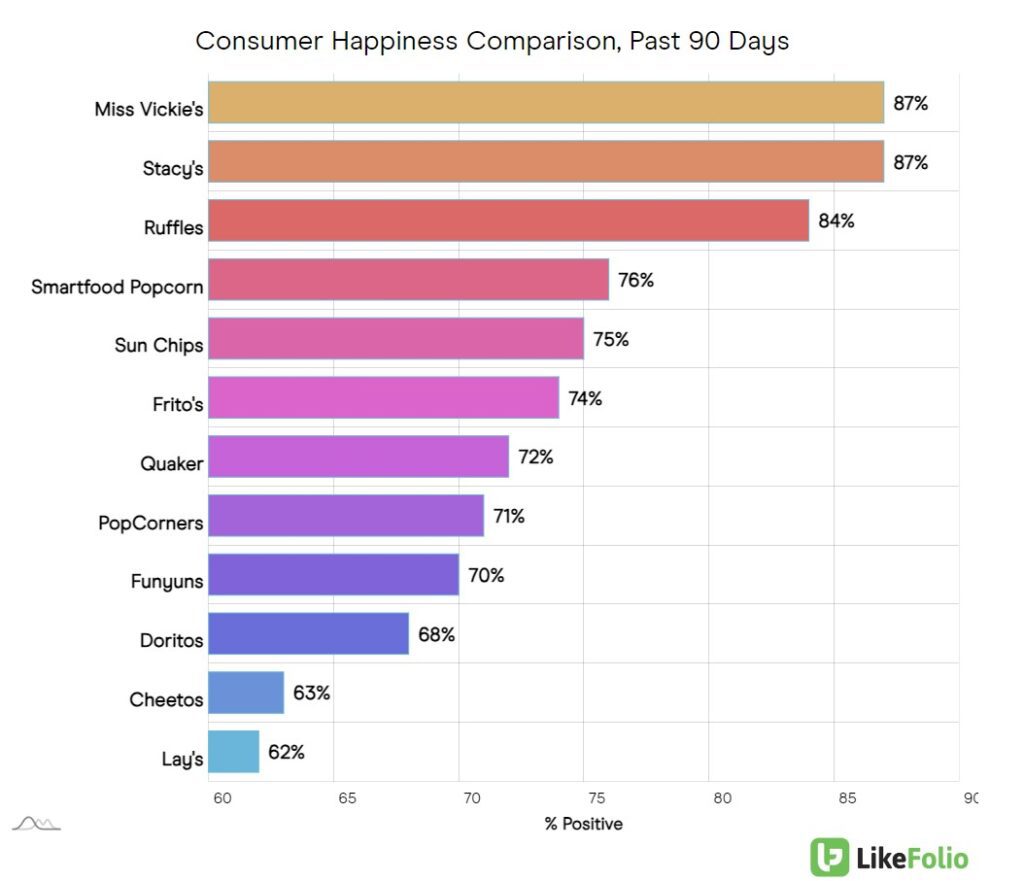

PepsiCo is perfectly positioned to capture the hearts and appetites of millions this weekend powered by its brand portfolio that balances indulgence and health-conscious options, from the crunchy delights of "eetos" to the wholesome goodness of Stacy's Pita Chips and PopCorners.

In fact, all of the brands below are owned by PEP – and likely coming to a coffee table near you.

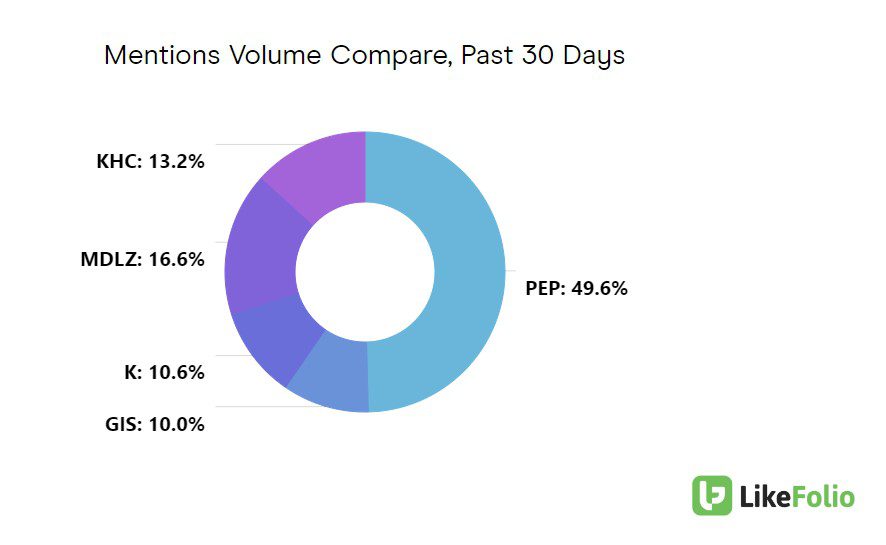

It’s not surprising that PepsiCo commands substantial consumer attention within the LikeFolio Universe. The company secures about half of the consumer mindshare when compared to competitors such as Kraft Heinz, Kellogg, General Mills, and Mondelez.

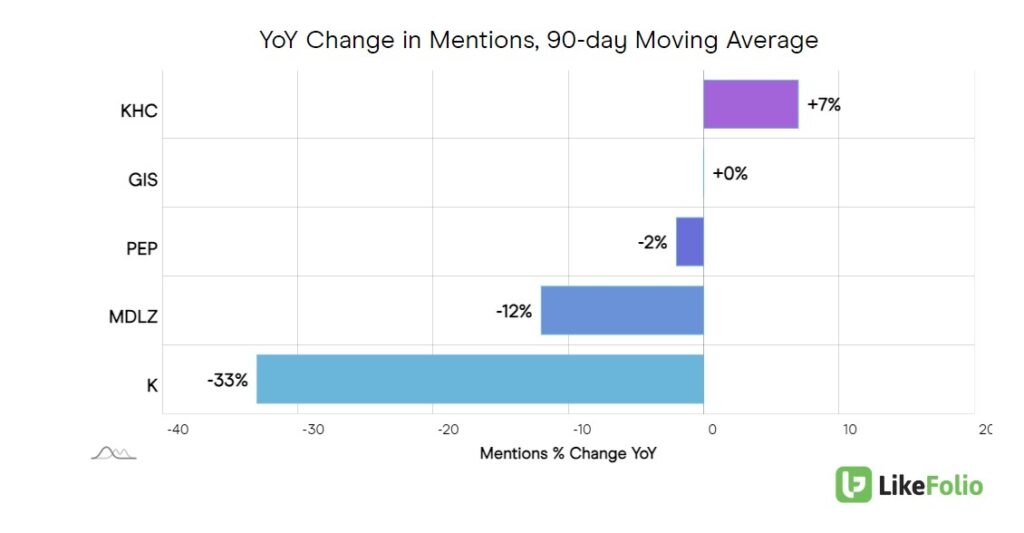

Even with a slight year-over-year decrease in product mentions (-2%), PepsiCo's prominence is undeniable, second only to Kraft Heinz, primarily due to the latter's success in dipping sauces.

PepsiCo’s beverage segment shows strength in performance brands, with names like Tropicana, Muscle Milk, Gatorade, and Aquafina marking year-over-year growth in mention volume. This diversification ensures PepsiCo's place not just on snack tables but also in beverage selections during the Super Bowl and beyond.

Financially, PepsiCo exceeded market expectations last quarter, debunking theories that health trends would seriously undermine snack consumption. But it is important to watch a key metric moving forward: volume.

Despite a revenue increase of +8.8% in Q3, volume actually slipped. PepsiCo was able to offset this with higher prices, shrinking portions, and smaller value packs.

LikeFolio metrics mirror this decrease in volume -- but we do not detect any material impacts on happiness. In fact, PEP sentiment is actually +6% higher YoY (67% positive) flexing its brand pricing power. In addition, PEP shares are currently trading -11% below May '23 highs.

Due to this mix of metrics and expectations we are officially neutral heading into earnings.

But we are optimistic about near-term snacking prospects. As the snack food industry's most lucrative week unfolds, PEP is sure to be a major beneficiary.

We’re watching for other major Super Bowl winners, too!

Members can expect a special edition Trend Watch report highlighting big game winners.