DraftKings (DKNG) DraftKings has been busy, and is poised for […]

Trend Watch: Sports Betting Growth $DKNG $PENN

Trend Watch: Sports Betting Growth $DKNG $PENN

Sports Betting is seasonal (largest spikes around the Super Bowl, March Madness), dependent on legalization, and growing.

Online sports betting is only fully legal in 10 states right now, with legislation pending in a handful of others.

Global online betting is expected to exceed $92 billion by 2023, with sports betting comprising more than 40% of online betting activity.

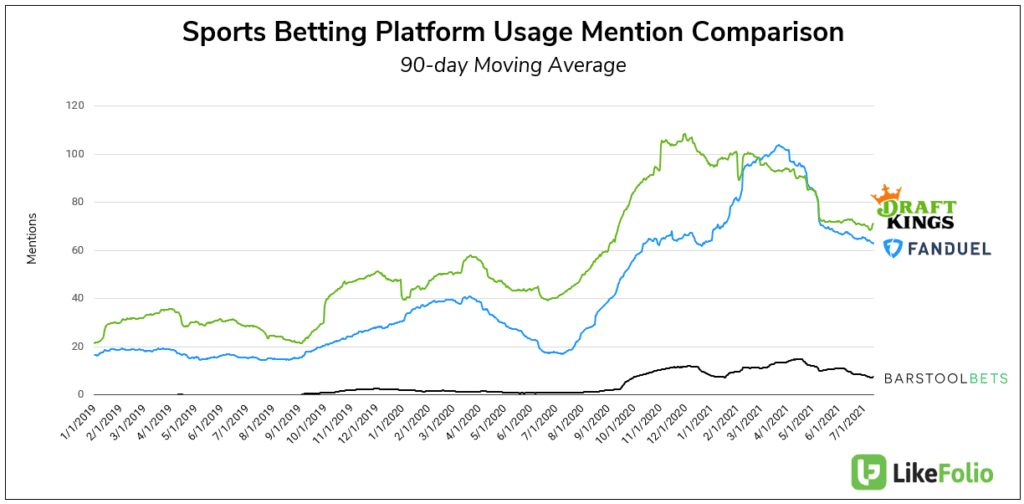

DraftKings, FanDuel, and Barstool Bets are the three major online sportsbooks we follow.

From a volume perspective, DraftKings is winning.

While FanDuel is exhibiting similar growth patterns, DraftKing sentiment is 4 points higher (63% positive vs. 59% positive). However, neither of the larger players have the level of sentiment as Penn National, at 77% positive.

We're expecting continued consumer engagement across the board as the Olympics kick off...you can even bet on Country medal counts if events aren't your thing.

We've been Bullish on DraftKings since November, when shares were trading pretty close to where they are now. Shares moved +37% to the upside through March before this recent correction.

Looking ahead, all of the players in this space are being propelled by macro tailwinds: Increased legalization, rising consumer interest in online sports betting (+20% YoY), and improved platform integrations.

Long-term, we still like PENN's positioning. It has the most diverse gambling exposure, with a mix of in-person and online betting. It also has a powerful marketing tool in its Barstool Sports media brand, which consumers love.

But right now, DraftKings is executing better vs. peers. Keep an eye on this one.