Call it narcissism, or call it knowing exactly what you […]

Wayfair (W) is Losing its Edge

Wayfair (W) is Losing its Edge

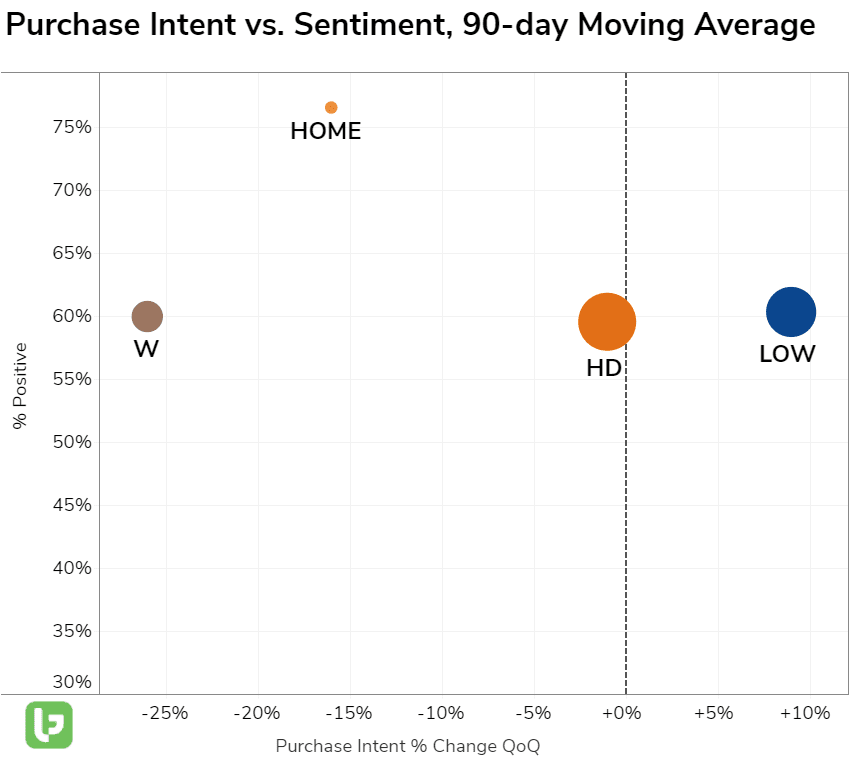

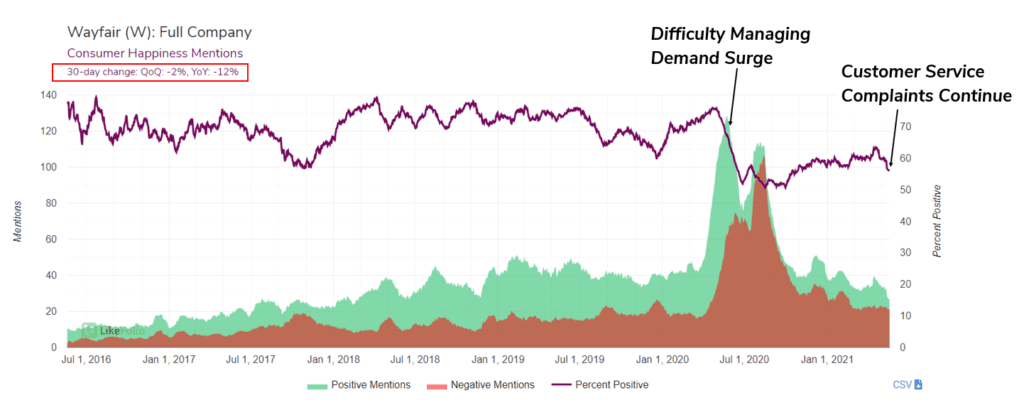

Wayfair was a COVID darling. Demand for its home-based products alongside its convenient eCommerce model sent demand rocketing in 2020. LikeFolio featured Wayfair as an oversold candidate in late March 2020 when shares were trading just above $30.That's more than a +900% gain since then. Incredible. We confidently highlighted Wayfair because consumer demand growth was booming! Now, a different narrative is emerging. Consumer demand has dropped more than -25% on a QoQ basis. The key? Demand isn't dropping -- or at least not at the same rate -- for other competitors.

Home Depot and Lowe's reported this week, and both flexed significant gains in omnichannel fulfillment, despite a muted market reaction.

- LOW: "On Lowes.com sales grew +36.5% on top of +80% growth in the first quarter of 2020, which represents a 9% sales penetration this quarter and a two-year comp of +146%. With customer demand for an integrated omnichannel shopping experience only increasing, we continue to invest in our omnichannel capabilities."

- HD: "Sales leveraging our digital platforms increased approximately +27% versus the first quarter last year, and approximately 55% of online orders were fulfilled through a store."

These traditional brick-and-mortar retailers can provide consumers with something Wayfair cannot -- in-store/same-day fulfillment. Oh how the turn tables. Aside from waning customer growth, LikeFolio data suggests Wayfair has a customer service problem.

Sentiment has decreased -12 points YoY as consumers express frustration with long delivery times and poor communication. Wayfair is very dependent on its loyal customer base. Repeat customers placed ~75% of all orders, up nearly +60% YoY. But how much grace do customers have? Now, investors have some time to consider their position. We've got a close eye on critical customer metrics in real-time during this quarter, and a negative shift in all three is palpable.