PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

Will Snacking Trends Finally Catch up to PepsiCo?

Will Snacking Trends Finally Catch up to PepsiCo?

It's finally happening. The world is reopening. And this means consumer behaviors are shifting.

LikeFolio data is recording normalization in 2 major consumer trends:

- Snacking

- Eating Breakfast

One external survey found that 43% of respondents admitted to snacking to cope with boredom and frustration in 2020.

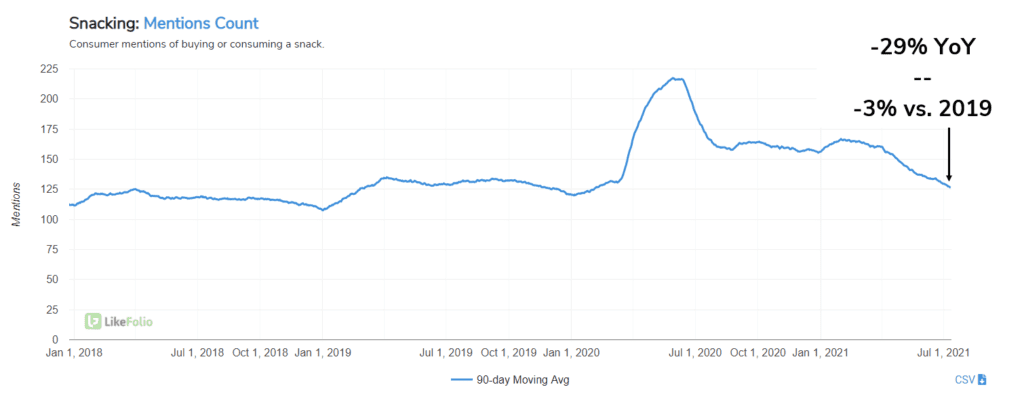

LikeFolio data shows significant snacking momentum loss: mentions of snacking are -29% lower YoY, and basically flat vs. 2019.

Consumer mentions of eating breakfast are showing a similar trajectory: -21% YoY.

On the other end of the spectrum, the top two growing wellness trends are improving digestive/gut health (+36% YoY) and improving energy (+27% YoY).

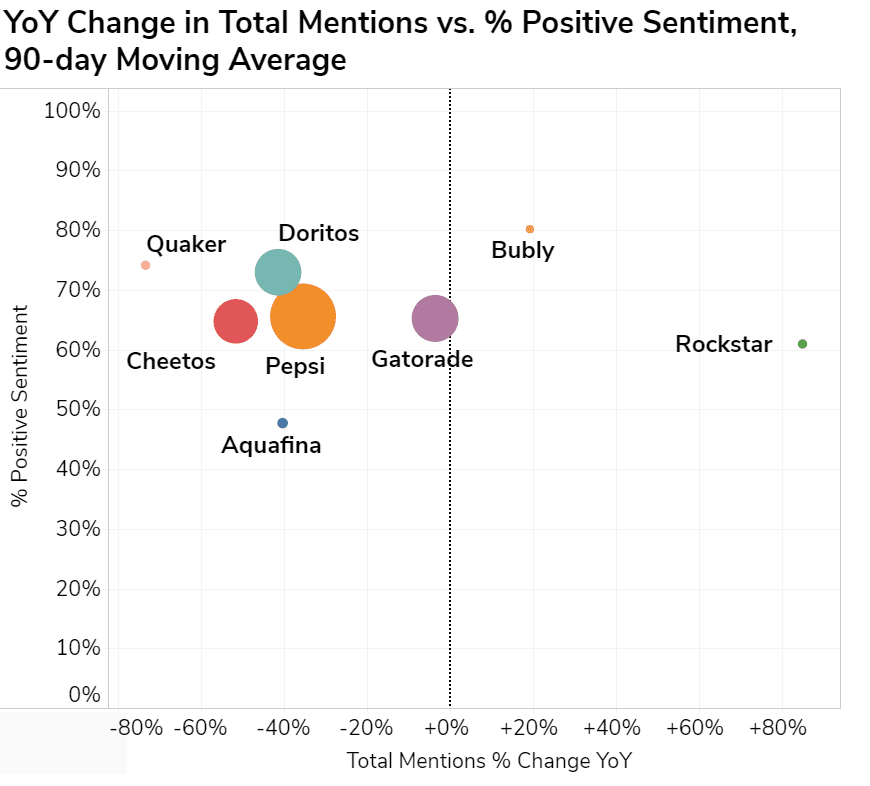

These trend shifts make sense when analyzing a brand-level view of Pepsi products.

As consumers become increasingly mindful of eating and drinking habits, Rockstar Energy and Bubly are showing relative strength.

Meanwhile, key snacking/breakfast brands like Quaker and the "Eetos" are facing some really tough YoY comps.

We are expecting some near-term weakness from previous growth segments.