Trend Watch: Hard Seltzers The meteoric rise of alcoholic sparkling […]

Your Boss, the new hire, and Karen from HR walk into a bar…

Awkward white elephant gift exchanges. Uncomfortable conversations with co-workers. Holiday office parties are back!

A recent survey found that 57% of companies will host an in-person holiday party this year.

And they’re going all out — 70% are hiring outside caterers and two-thirds are serving alcohol. That’s more than before the pandemic.

While we can’t officially condone office party shenanigans, we definitely condone getting ahead of consumer trends.

What are people drinking this Holiday season?

Data suggests more Jack-and-Cokes than Chardonnays and Budweisers.

Why?

Wine and beer are losing steam.

Meanwhile, spirits and RTDs are gaining favor.

We’ve been keeping ‘tabs’ on consumer sentiment around Brown-Forman and Constellation Brands for clues. Both are major alcoholic beverage players—but with two very different vibes.

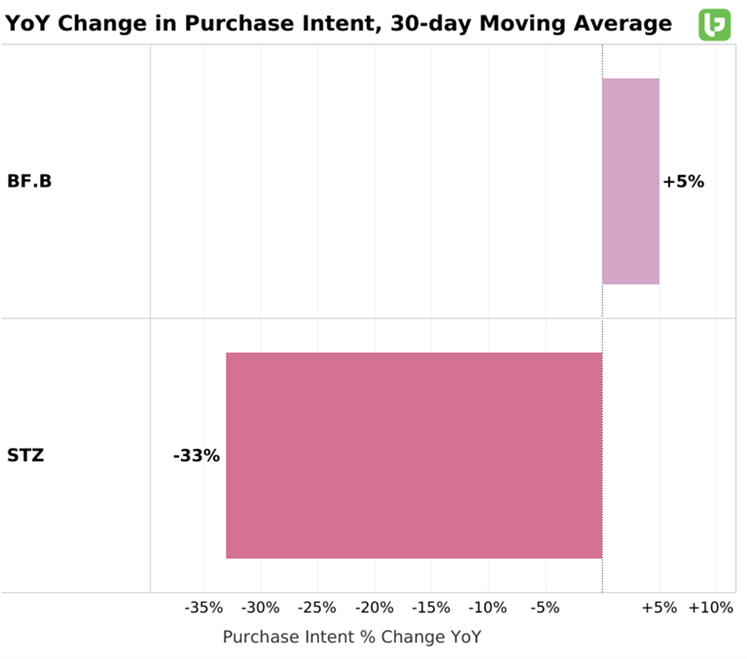

LikeFolio Purchase Intent (PI) Mentions for Brown-Forman are up slightly YoY on a 30-day average. Not bad considering it’s a tough comparison to December 2021 when restaurants and travel were reopening.

This is also consistent with the company’s recent results. Fiscal Q2 sales were up 10% to $1.1B. Since roughly half of sales come from outside the U.S., growth would’ve been stronger absent forex headwinds.

Despite the beat and raise quarter, the stock got crushed because EPS fell 4% and missed expectations. (Note: first half EPS are still up 11%.)

A potential buy opportunity? Maybe so.

Aside from forex, inflation pressures and supply chain disruption weighed on the performance. These are industrywide challenges that should improve over time.

We see Brown-Forman as a resilient company that is still growing in a tough economy. BF.B demand is solid because 1) consumers are engaging in more social events and 2) its brand portfolio is better aligned with current trends.

PI Mentions for Constellation Brands, on the other hand, are down -33% YoY. Although the company is on a different fiscal calendar, its latest quarterly results were similar. Sales were up 12%.

BF.B and STZ face the same macro headwinds and competitive pressures. So why the disparity in LF data?

It comes down to their respective drink menus.

BF.B is all liquored up. Its brand portfolio consists of 90% spirits & RTDs and 10% wine.

STZ is all about beer and wine. Its brand mix is 47% wine, 40% beer, and 13% spirits. Beer, which accounts for about 80% of sales, posted 15% growth in the Summer quarter.

But our proprietary data suggests consumers have since become bloated with the brews. PI Mentions for the core Corona Extra brand fell to a 10-year low in the September to November quarter which STZ will report in a few weeks.

STZ must overcome slowing beer interest and a lagging wine business. Not to mention a Canopy cannabis investment which contributed a $651 million loss last quarter.

Heading into the holiday season, consumer preferences are clearly shifting away from beer and wine and towards mixed drinks.

Given this trend, BF.B has the better sales mix—and is likely to serve up stronger results in the coming quarters.

So, when Greg from IT reaches for that third fistful of shrimp, chances are his other hand will be holding a Brown-Forman product.

Here’s more on why…

1. Red, Red Wine

Wine & Spirits Wholesalers of America (WSWA) just released its Q3 SipSource report. Among the findings: Wine is struggling.

Wine depletions, industry speak for the number of cases distributors sell to retailers, are down -6.7% year-to-date. Sparkling wine, a hot commodity in 2021, is no longer flying off the shelves.

The wine industry has earned high praise for weathering the pandemic. But since wineries have reopened to tourists and locals, consumers seem to be losing their taste.

Can the holiday season spark a revival?

Probably not.

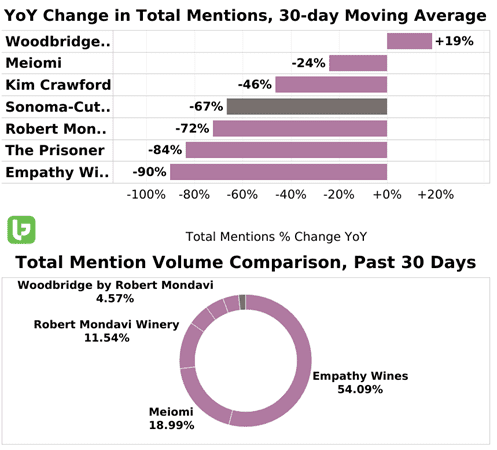

LikeFolio data around consumer wine brand mentions is a sea of red—and we aren’t referring to the Merlot.

The short-term trend across several popular wine brands is decidedly negative.

Mentions of STZ’s core Robert Mondavi brand are down sharply on a 30-day average. Demand for several other satellite wine bottles is also fading fast.

Brown-Forman’s main Sonoma-Cutrer brand is losing favor too but having less of an impact on the business since its primarily popular in the Summertime.

A rare bright spot is STZ’s Woodbridge which makes since it’s at the value end of the spectrum. Think boxed wines and re-giftable bottles.

But most of its 18 wine brands are hurting.

Overall, the industry has a wine problem.

Thankfully, the glass is half full. Spirits are doing well.

2. In Good Spirits

According to WSWA, Spirit depletions are up 3.4% year-to-date, a 1,010-basis points difference between wine depletions.

Blame Millennials. A big reason for the difference is a continued preference for cocktails over wine among Millennials.

Known as a more discerning generation, Millennials are more likely to bring a bottle of whiskey, rum, or vodka to a 2022 holiday party. And since these 25–40-year-olds form a large part of the drinking population, companies that are spirit-centric are in the best position to win.

Brown-Forman’s recent results say it all.

For the six months ended 10/31/22:

- Whiskey sales were up +13%

- Tequila sales were up +10%, and

- Wine sales were down -16%

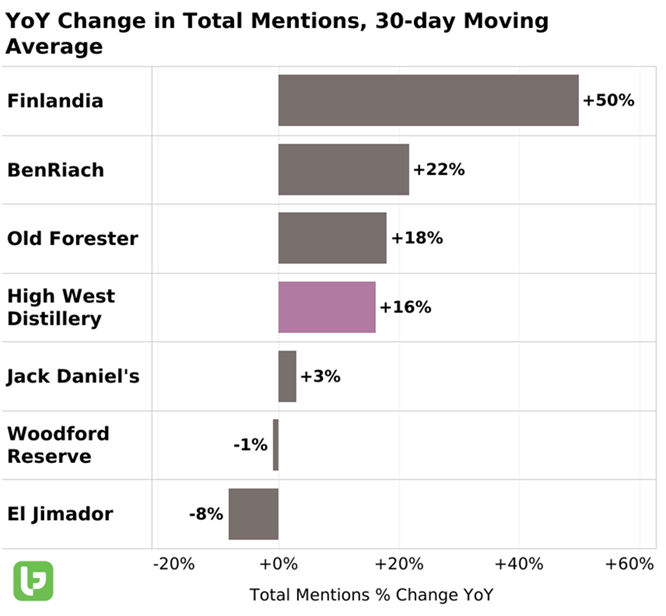

Vodka sales were down -17% which confirmed consumers are leaning more towards the ‘browns’. On the bright side, Finlandia, BF.B’s lone vodka brand, is experiencing a surge in near-term LikeFolio mentions.

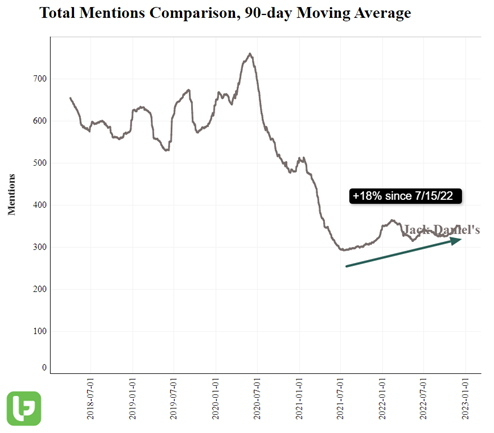

Yet it is a resurgence in Jack Daniel’s that is driving growth at Brown-Forman. Our data confirms that consumer interest in the iconic whiskey brand is recovering. Mentions are up 18% since mid-July.

The Jack Daniels family of brands is catching fire largely because of Tennessee Fire. JD Tennessee Fire sales were up 23% in the first 6 months of BF.B’s fiscal year.

Why? The product is on-trend with drinkers’ evolving interest in flavor. The same goes for JD Tennessee Honey. The extensions are helping Jack become relevant again and a must-have for bar and restaurant owners.

Premium whiskey brands are also crushing it. BF.B’s Woodford Reserve (the world’s leading super-premium American whiskey) and Old Forester sales are each up 39% YTD. This is in line with the broader premiumization trend that is holding up remarkably well.

BF.B doubled down on the premium theme by launching Jack Daniel’s Bonded and Jack Daniel’s Triple Mash earlier this year. They are the brand’s first super premium extensions in 25 years.

BF.B is also on trend in the RTD space. Consumers are craving convenience like never before and products like Jack Daniel’s cans and el Jimador New Mix RTD cans are winning. BF.B’s RTD growth is outpacing overall growth.

A lineup of popular spirits that offer:

- Flavor

- Premiumization

- Convenience

Put it together, and it’s easy to see why BF.B is winning the drink battle.

Another catalyst for spirits is the travel industry recovery.

BF.B’s Travel Retail sales are up 60% YTD.

Despite the macro and geopolitical uncertainties BF.B management said it expects “stronger growth” in the new fiscal year driven by brand strength, consumer demand, and easing supply chain constraints.

Its forecast for “high-single-digit” organic sales growth would be a slowdown from the 17% growth in fiscal 2022 but significant in a weakened economy.

Call it a recession-proof stock with a twist of growth.

Income investors will appreciate that BF.B raised its dividend last month to stretch its annual dividend hike streak to 39 years.

Rising sales with a growing dividend chaser. We’ll drink to that!

3. Hard Seltzer has Become a Hard Sell

We’d be amiss not to check in on hard seltzer. After all, it was one of the hottest beverage trends of 2021.

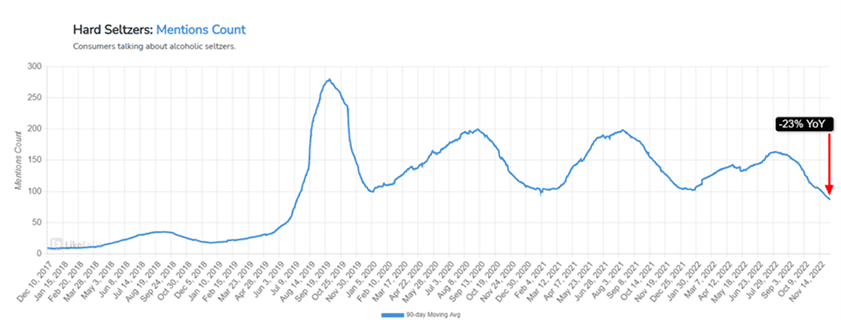

Let’s just say hard seltzers are losing their fizz. LikeFolio mentions of alcoholic seltzers are down -23% YoY and at a post-Covid low.

Consumers are moving on from what is shaping up to be a pandemic fad. Spirits and canned cocktails are taking hard seltzer’s place because they offer variety, flavor, and convenience.

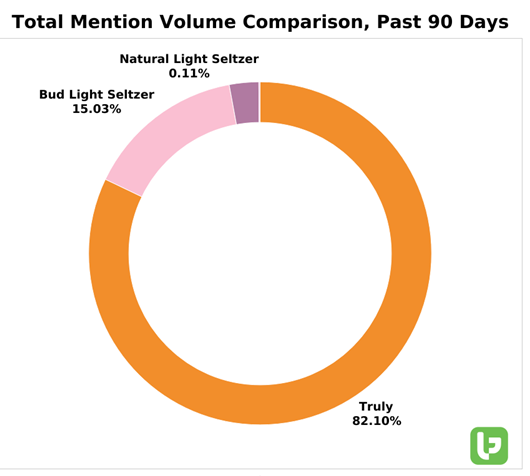

At the brand level, Boston Beer Company’s Truly is still dominating—but doing so in a weak category.

Bottom line: The beyond beer and wine movement is progressing nicely with spirits and RTD cocktails leading the way. Companies are shifting their portfolios accordingly and some are better positioned than others.

At the risk of being a homer, we like the trends we are seeing at Louisville-based Brown-Forman. We see their brands asserting industry leadership heading into the new year.